FXOpen Trader

Active Member

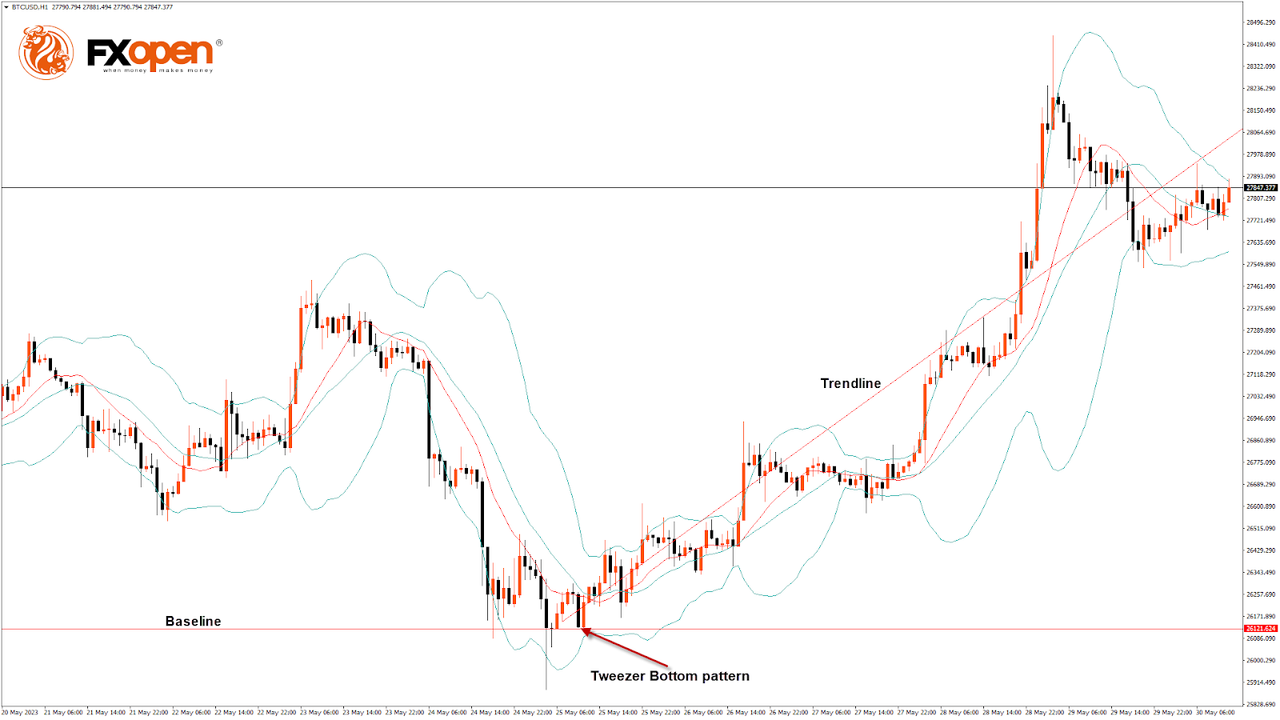

BTCUSD Analysis: Tweezer Bottom Pattern above $26,121

Bitcoin price continues its bullish momentum from last week after touching a low of $26,121 on May 25, with strong upsides located in the range of $28,500 and $29,000.

On the hourly chart:

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Bitcoin price continues its bullish momentum from last week after touching a low of $26,121 on May 25, with strong upsides located in the range of $28,500 and $29,000.

On the hourly chart:

- We can clearly see a tweezer bottom pattern above the $26,121 handle, which indicates a bullish trend.

- Both the STOCH and STOCHRSI indicate overbought market conditions, which means that in the immediate short term, a decline in the price may occur.

- The MACD crosses UP its moving average.

- The relative strength index is at 56.95, indicating a strong demand for Bitcoin and the continuation of the buying pressure in the market.

- Most of the major technical indicators give a bullish signal, which means that in the immediate short term, the expected targets are $28,000 and $28,500.

- Bitcoin price is now moving above its 100-hour simple moving average and 100-hour exponential moving average.

- The average true range indicates low market volatility with mild bullish momentum.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.