FXOpen Trader

Active Member

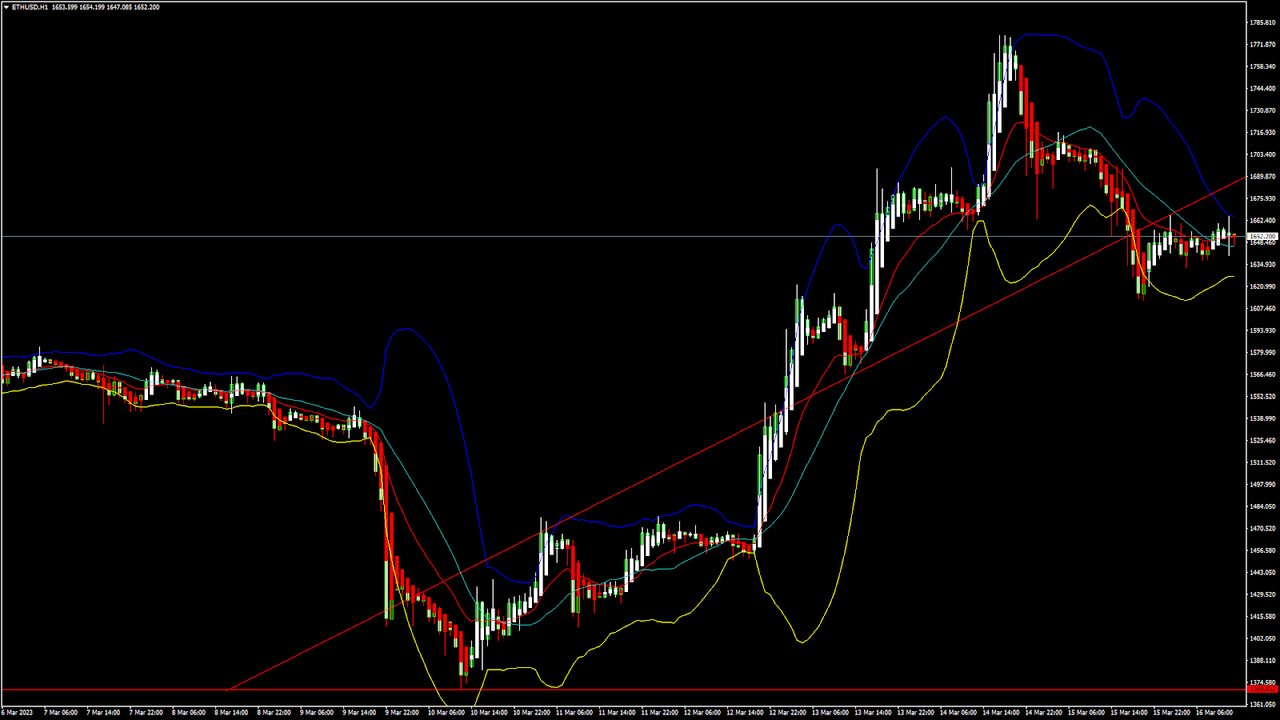

BTCUSD and XRPUSD Technical Analysis – 28th FEB 2023

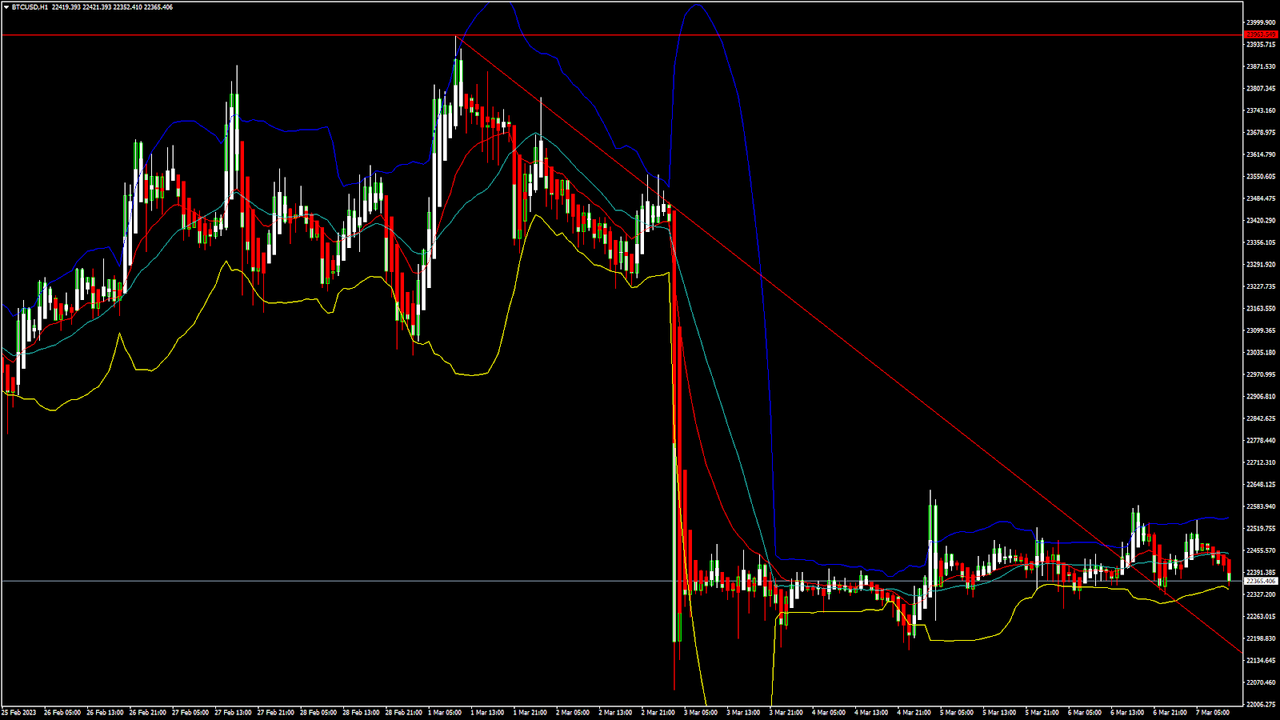

BTCUSD: Bullish Doji Star Pattern Above $22796

Bitcoin was unable to sustain its bearish momentum last week and after touching a low of $22796 on 25th Feb the prices started to correct upwards against the US dollar, touching a high of $23873 on 27th Feb.

We have seen a bearish opening of the markets this week.

We can clearly see a bullish Doji star pattern above the $22796 handle which is a bullish reversal pattern because it signifies the end of a downtrend and a shift towards an uptrend.

Bitcoin touched an intraday high of 23557 in the Asian trading session, and an intraday low of 23214 in the European trading session today.

We can see that the MACD indicator is back over zero in the weekly time frame indicating bullish trends.

The price of bitcoin is ranging near horizontal support in the weekly time frame indicating a bullish trend.

Both the STOCH and STOCHRSI are indicating Overbought levels which means that in the immediate short term, a decline in the prices is expected.

The price of bitcoin is ranging near the support of the channel in the 15-minute time frame indicating a bullish scenario.

The relative strength index is at 55.00 indicating a strong demand for bitcoin, and the continuation of the buying pressure in the markets.

Bitcoin is now moving below its 100 hourly simple moving average and below its 100 hourly exponential moving averages.

Most of the major technical indicators are giving a buy signal, which means that in the immediate short term, we are expecting targets of 24000 and 25500.

The average true range is indicating less market volatility with a bullish momentum.

Bitcoin: Bullish Reversal Seen Above $22796

The price of bitcoin is now moving into a consolidation channel below the $23500 handle which also means that now we are preparing for the next upwards move in bitcoin towards the $25000 level.

The commodity channel index indicator is giving an oversold signal which indicates a neutral tone in the markets.

Some of the technical indicators are also giving a neutral tone present in the markets.

Bitcoin has resumed its rising trend channel with a positive momentum that is building at levels above the $23110.

The immediate short-term outlook for bitcoin is strongly bullish, the medium-term outlook has turned bullish, and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $22711 which is a 14-day RSI at 50% and at $22893 which is a 3-10 day MACD oscillator stalls.

The price of BTCUSD is now facing its classic resistance level of 24948 and Fibonacci resistance level of 26119 after which the path towards 27000 will get cleared.

In the last 24hrs, BTCUSD has increased by 0.58% by 135.92$ and has a 24hr trading volume of USD 22.280 billion. We can see a decrease of 2.34% in the trading volume as compared to yesterday, which appears to be normal.

The Week Ahead

We can see that the price of bitcoin is now almost 53% up against the lows formed in November 2022.

The consolidation in the levels of bitcoin also indicates that the global investor sentiment continues to improve and will lead to the higher price of bitcoin in the month of March 2023.

The daily RSI is printing at 50.79 which indicates a neutral demand for bitcoin and the continuation of the bullish phase present in the markets in the short-term range.

We can see the formation of a bullish trend line from $22796 towards the $23989 level.

The price of BTCUSD is now facing its resistance zone located at $24030 at which the price crosses 9-day moving average and $24095 which is a 14-3 day raw stochastic at 70%

The weekly outlook is projected at $24500 with a consolidation zone of $24000.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.

BTCUSD: Bullish Doji Star Pattern Above $22796

Bitcoin was unable to sustain its bearish momentum last week and after touching a low of $22796 on 25th Feb the prices started to correct upwards against the US dollar, touching a high of $23873 on 27th Feb.

We have seen a bearish opening of the markets this week.

We can clearly see a bullish Doji star pattern above the $22796 handle which is a bullish reversal pattern because it signifies the end of a downtrend and a shift towards an uptrend.

Bitcoin touched an intraday high of 23557 in the Asian trading session, and an intraday low of 23214 in the European trading session today.

We can see that the MACD indicator is back over zero in the weekly time frame indicating bullish trends.

The price of bitcoin is ranging near horizontal support in the weekly time frame indicating a bullish trend.

Both the STOCH and STOCHRSI are indicating Overbought levels which means that in the immediate short term, a decline in the prices is expected.

The price of bitcoin is ranging near the support of the channel in the 15-minute time frame indicating a bullish scenario.

The relative strength index is at 55.00 indicating a strong demand for bitcoin, and the continuation of the buying pressure in the markets.

Bitcoin is now moving below its 100 hourly simple moving average and below its 100 hourly exponential moving averages.

Most of the major technical indicators are giving a buy signal, which means that in the immediate short term, we are expecting targets of 24000 and 25500.

The average true range is indicating less market volatility with a bullish momentum.

- Bitcoin: bullish reversal seen above $22796.

- The Williams percent range is giving an overbought signal.

- The price is now trading just below its pivot level of $23729.

- The short-term range is mildly BULLISH.

Bitcoin: Bullish Reversal Seen Above $22796

The price of bitcoin is now moving into a consolidation channel below the $23500 handle which also means that now we are preparing for the next upwards move in bitcoin towards the $25000 level.

The commodity channel index indicator is giving an oversold signal which indicates a neutral tone in the markets.

Some of the technical indicators are also giving a neutral tone present in the markets.

Bitcoin has resumed its rising trend channel with a positive momentum that is building at levels above the $23110.

The immediate short-term outlook for bitcoin is strongly bullish, the medium-term outlook has turned bullish, and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $22711 which is a 14-day RSI at 50% and at $22893 which is a 3-10 day MACD oscillator stalls.

The price of BTCUSD is now facing its classic resistance level of 24948 and Fibonacci resistance level of 26119 after which the path towards 27000 will get cleared.

In the last 24hrs, BTCUSD has increased by 0.58% by 135.92$ and has a 24hr trading volume of USD 22.280 billion. We can see a decrease of 2.34% in the trading volume as compared to yesterday, which appears to be normal.

The Week Ahead

We can see that the price of bitcoin is now almost 53% up against the lows formed in November 2022.

The consolidation in the levels of bitcoin also indicates that the global investor sentiment continues to improve and will lead to the higher price of bitcoin in the month of March 2023.

The daily RSI is printing at 50.79 which indicates a neutral demand for bitcoin and the continuation of the bullish phase present in the markets in the short-term range.

We can see the formation of a bullish trend line from $22796 towards the $23989 level.

The price of BTCUSD is now facing its resistance zone located at $24030 at which the price crosses 9-day moving average and $24095 which is a 14-3 day raw stochastic at 70%

The weekly outlook is projected at $24500 with a consolidation zone of $24000.

VIEW FULL ANALYSIS VISIT - FXOpen Blog...

Disclaimer: This Forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as Financial Advice.