FXOpen Trader

Active Member

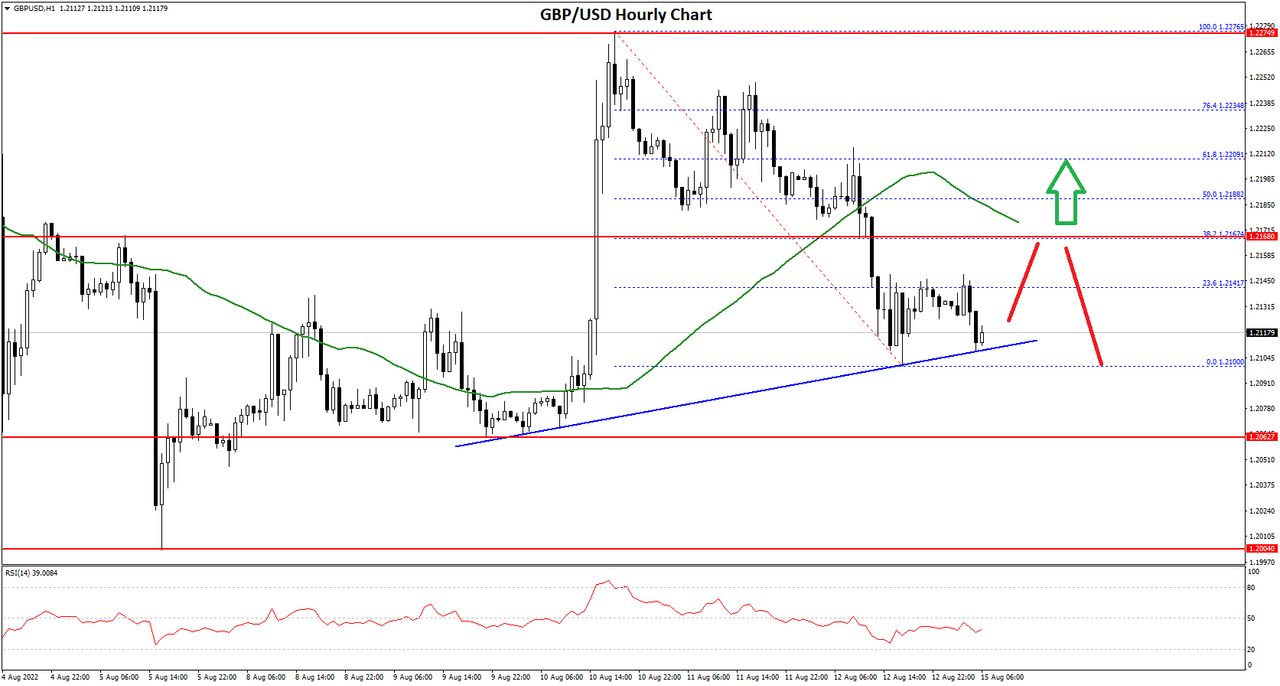

BTCUSD and XRPUSD Technical Analysis – 26th JULY 2022

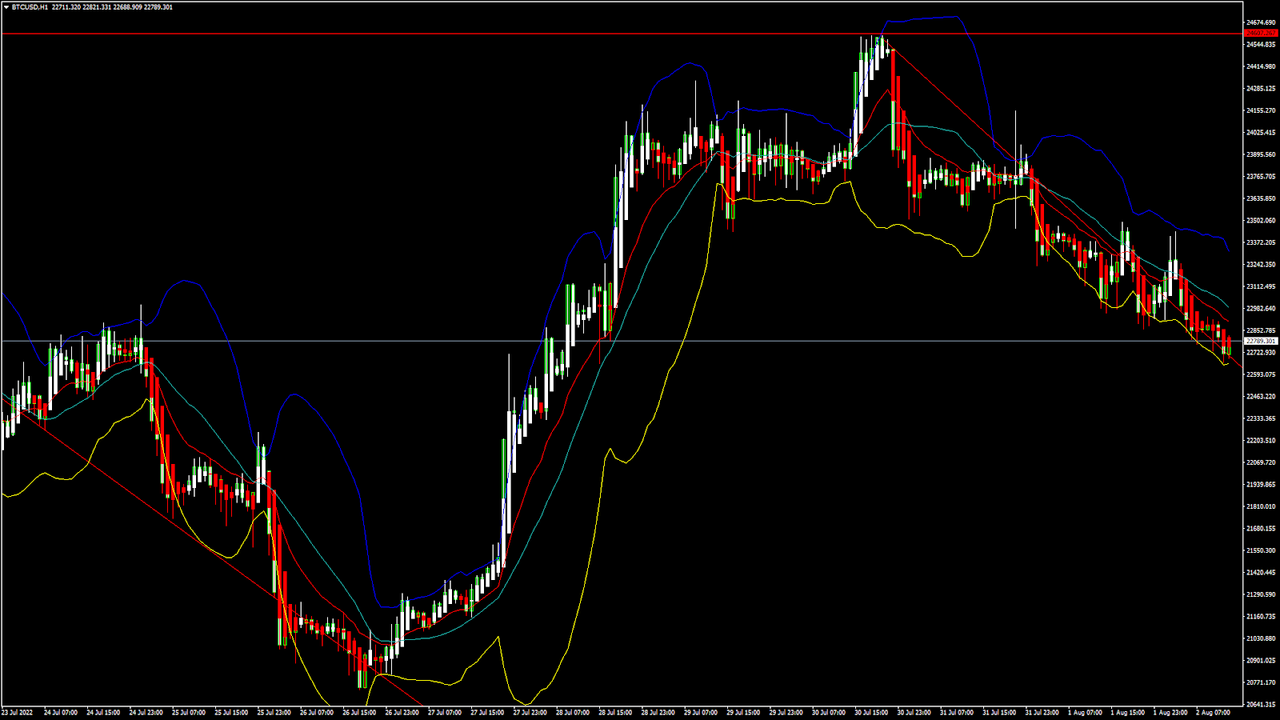

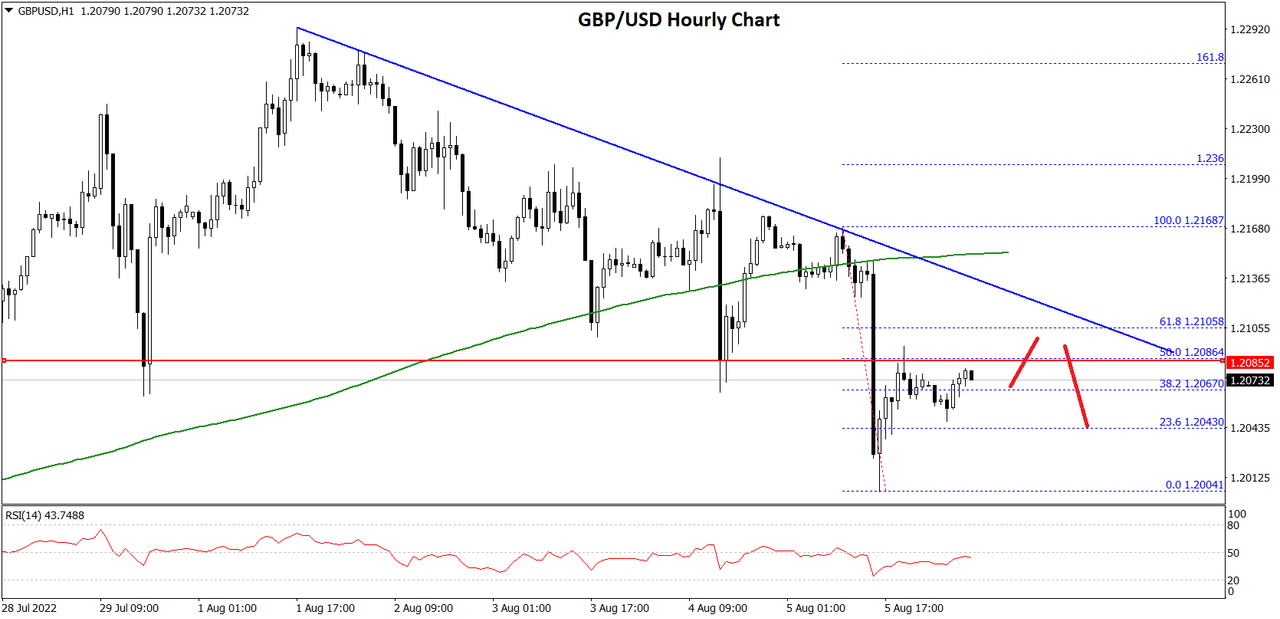

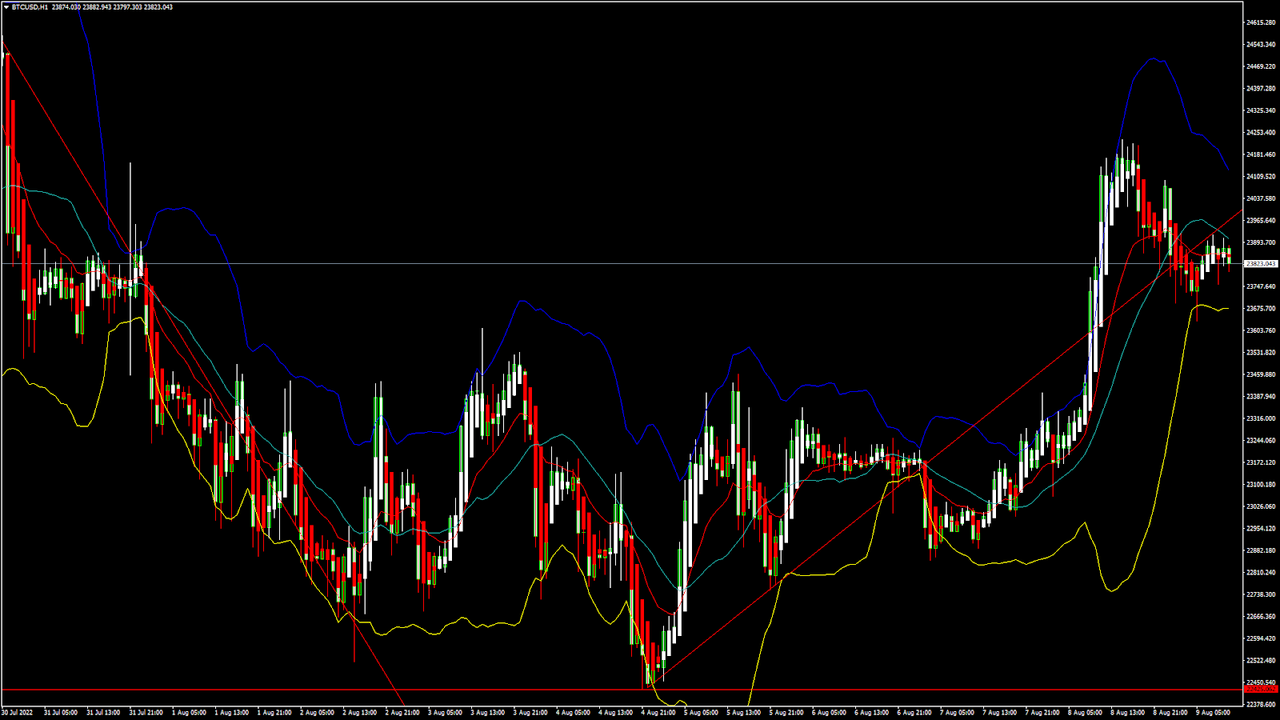

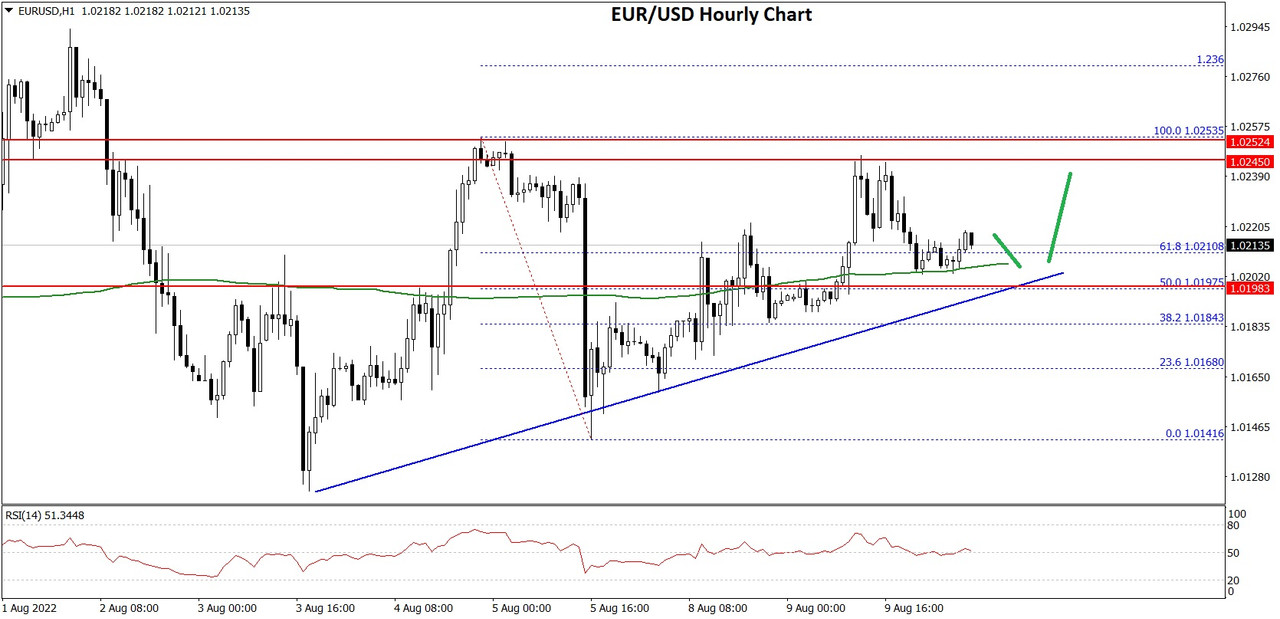

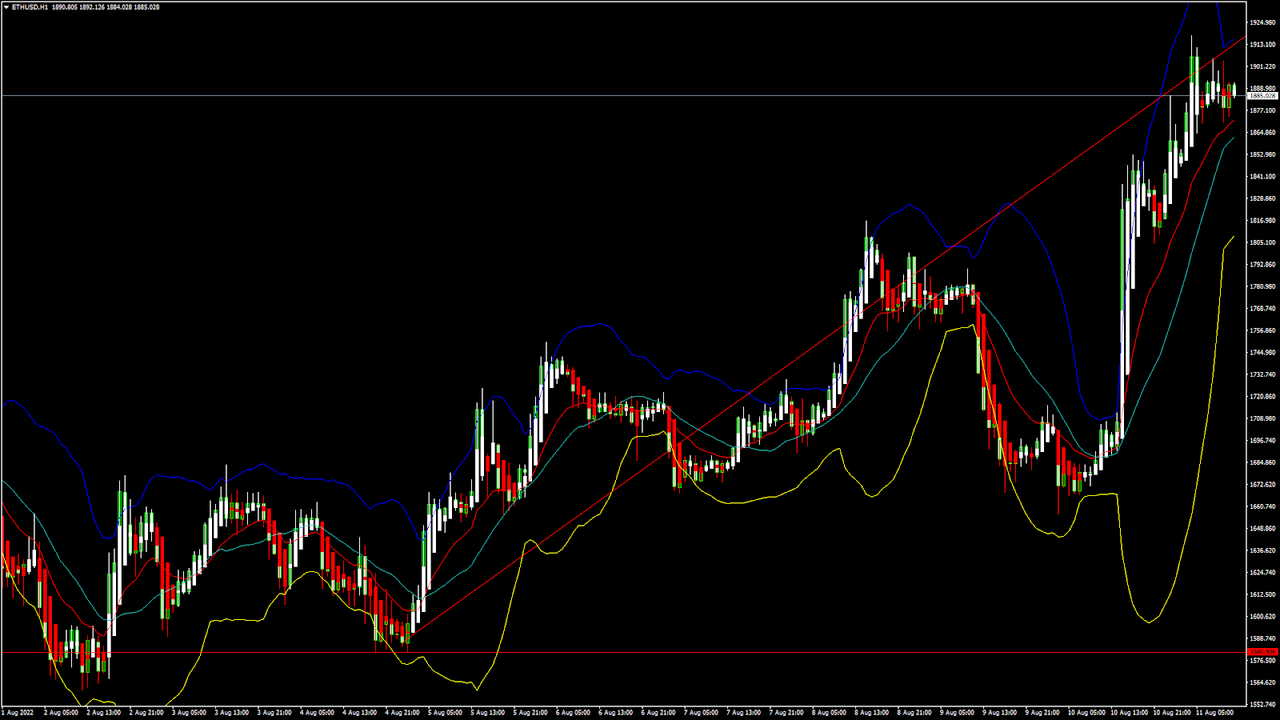

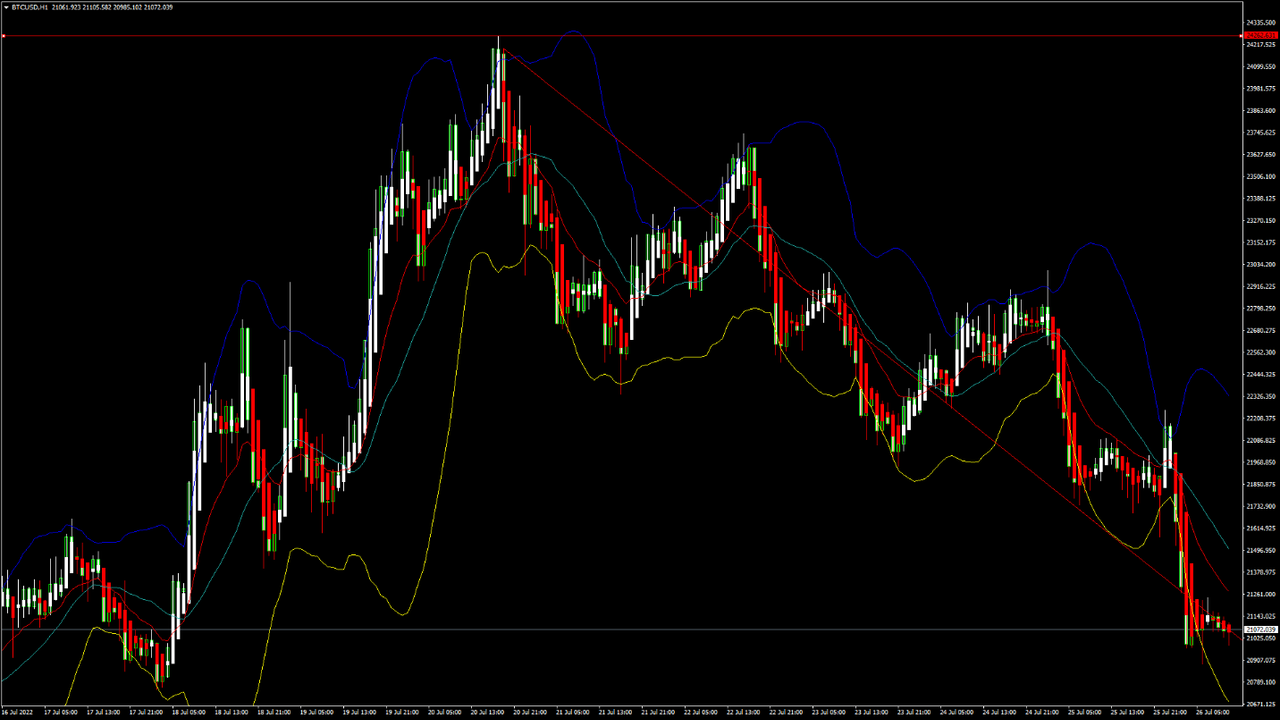

BTCUSD: Bearish Engulfing Pattern Below $24262

Bitcoin was unable to sustain its bullish momentum and after touching a high of 24195 on 20th July started to decline against the US dollar dropping below the $21500 handle in the European trading session today.

We can see that after this decline the prices have entered into a consolidation zone above the $21000 handle.

The drop in the prices of bitcoin comes just before the upcoming US Federal Reserve FOMC meeting, which is expected to raise the interest rates by 75 basis points.

We can clearly see a bearish engulfing pattern below the $24262 handle which is a bearish reversal pattern because it signifies the end of an uptrend and a shift towards a downtrend.

Bitcoin touched an intraday high of 22248 in the Asian trading session and an intraday low of 20928 in the European trading session today.

Both the STOCH and Williams percent range are indicating overbought levels which means that in the immediate short term, a decline in the prices is expected.

The relative strength index is at 29 indicating a weaker demand for bitcoin at the current market level and the continuation of the selling pressure in the markets.

Bitcoin is now moving below its 100 hourly simple moving average and 200 hourly simple moving averages.

Most of the major technical indicators are giving a strong sell signal, which means that in the immediate short term, we are expecting targets of 20500 and 20000.

The average true range is indicating less market volatility with a bearish momentum.

Bitcoin: Bearish Reversal Seen Below $24262

The price of bitcoin continues to decline below the $22000 handle, and we are now testing the important support level of $20000 in the European trading session.

The global sentiments have changed in the wake of the US Fed interest rate decision and its impact on the cryptocurrency markets worldwide.

We can see the formation of a falling trend channel, and now we are facing the immediate targets of $20500 and $20100.

Bitcoin was unable to clear its resistance zone located at $25000, and we can see a progression of the bearish bias in the markets.

The ultimate oscillator is indicating a neutral market, and the prices can also stage an upwards correction from these levels if the bearish trend gets exhausted.

The immediate short-term outlook for bitcoin is bearish; the medium-term outlook has turned neutral; and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $20000, and the prices continue to remain above these levels for any potential bullish reversal in the markets.

The price of BTCUSD is now facing its classic support level of 20902, and Fibonacci resistance levels of 21034, after which the path towards 20000 will get cleared.

In the last 24hrs, BTCUSD has declined by 4.19% by 922 and has a 24hr trading volume of USD 37.899 billion. We can see an increase of 33.97% in the trading volume as compared to yesterday, which is due to the selling seen by the short-term investors.

The Week Ahead

The price of bitcoin is moving in a mildly bearish momentum, and the immediate targets are $20500 and $20000

The daily RSI is printing at 44 which means that the medium range demand continues to remain weak.

The trendline formation is seen from the $24000 level towards the $21000, indicating that if this bearish trend line gets exhausted, we may see an upwards correction in the prices.

Bitcoin prices may continue to remain in a range-bound movement between the $20000 and $22000 levels this week.

The price of BTCUSD will need to remain above the important support levels of $20000 this week.

The weekly outlook is projected at $21500 with a consolidation zone of $20500.

Technical Indicators:

The average directional change (14 days): at 43.57 indicating a NEUTRAL

The rate of price change: at -3.78 indicating a SELL

The relative strength index (14): at 29.67 indicating a SELL

The commodity channel index (14 days): at -59.39 indicating a SELL

Read Full on FXOpen Company Blog.../B]

BTCUSD: Bearish Engulfing Pattern Below $24262

Bitcoin was unable to sustain its bullish momentum and after touching a high of 24195 on 20th July started to decline against the US dollar dropping below the $21500 handle in the European trading session today.

We can see that after this decline the prices have entered into a consolidation zone above the $21000 handle.

The drop in the prices of bitcoin comes just before the upcoming US Federal Reserve FOMC meeting, which is expected to raise the interest rates by 75 basis points.

We can clearly see a bearish engulfing pattern below the $24262 handle which is a bearish reversal pattern because it signifies the end of an uptrend and a shift towards a downtrend.

Bitcoin touched an intraday high of 22248 in the Asian trading session and an intraday low of 20928 in the European trading session today.

Both the STOCH and Williams percent range are indicating overbought levels which means that in the immediate short term, a decline in the prices is expected.

The relative strength index is at 29 indicating a weaker demand for bitcoin at the current market level and the continuation of the selling pressure in the markets.

Bitcoin is now moving below its 100 hourly simple moving average and 200 hourly simple moving averages.

Most of the major technical indicators are giving a strong sell signal, which means that in the immediate short term, we are expecting targets of 20500 and 20000.

The average true range is indicating less market volatility with a bearish momentum.

- Bitcoin: bearish reversal seen below $24262

- STOCHRSI is indicating an overbought level

- The price is now trading just above its pivot level of $21077

- All of the moving averages are giving a strong sell market signal

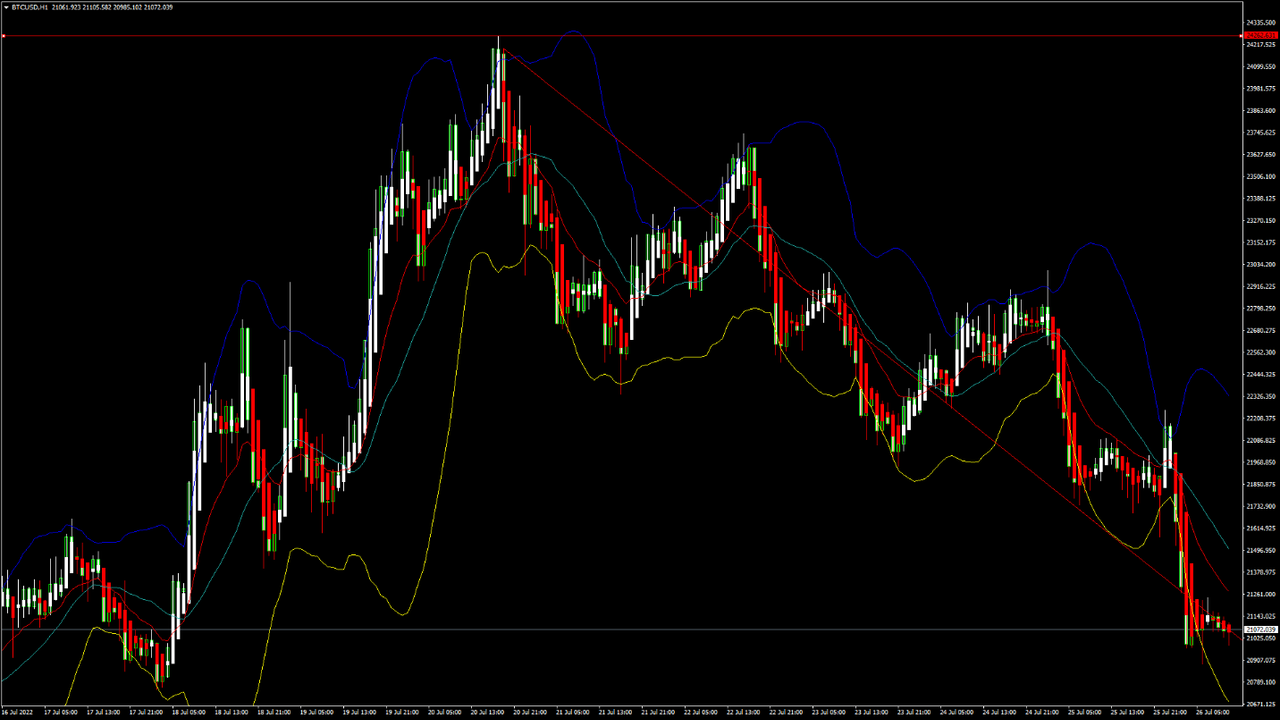

Bitcoin: Bearish Reversal Seen Below $24262

The price of bitcoin continues to decline below the $22000 handle, and we are now testing the important support level of $20000 in the European trading session.

The global sentiments have changed in the wake of the US Fed interest rate decision and its impact on the cryptocurrency markets worldwide.

We can see the formation of a falling trend channel, and now we are facing the immediate targets of $20500 and $20100.

Bitcoin was unable to clear its resistance zone located at $25000, and we can see a progression of the bearish bias in the markets.

The ultimate oscillator is indicating a neutral market, and the prices can also stage an upwards correction from these levels if the bearish trend gets exhausted.

The immediate short-term outlook for bitcoin is bearish; the medium-term outlook has turned neutral; and the long-term outlook remains neutral under present market conditions.

Bitcoin’s support zone is located at $20000, and the prices continue to remain above these levels for any potential bullish reversal in the markets.

The price of BTCUSD is now facing its classic support level of 20902, and Fibonacci resistance levels of 21034, after which the path towards 20000 will get cleared.

In the last 24hrs, BTCUSD has declined by 4.19% by 922 and has a 24hr trading volume of USD 37.899 billion. We can see an increase of 33.97% in the trading volume as compared to yesterday, which is due to the selling seen by the short-term investors.

The Week Ahead

The price of bitcoin is moving in a mildly bearish momentum, and the immediate targets are $20500 and $20000

The daily RSI is printing at 44 which means that the medium range demand continues to remain weak.

The trendline formation is seen from the $24000 level towards the $21000, indicating that if this bearish trend line gets exhausted, we may see an upwards correction in the prices.

Bitcoin prices may continue to remain in a range-bound movement between the $20000 and $22000 levels this week.

The price of BTCUSD will need to remain above the important support levels of $20000 this week.

The weekly outlook is projected at $21500 with a consolidation zone of $20500.

Technical Indicators:

The average directional change (14 days): at 43.57 indicating a NEUTRAL

The rate of price change: at -3.78 indicating a SELL

The relative strength index (14): at 29.67 indicating a SELL

The commodity channel index (14 days): at -59.39 indicating a SELL

Read Full on FXOpen Company Blog.../B]