Unitedpips

Member

NZD-USD Daily Analysis: Technical and Market Outlook

Introduction to NZD/USD

The NZDUSD pair, commonly referred to as the "Kiwi," represents the exchange rate between the New Zealand dollar (NZD) and the US dollar (USD). This forex pair is highly influenced by commodity prices, interest rate differentials, and economic data from both New Zealand and the United States. As a major currency pair, NZD/USD is popular among traders looking for volatility and opportunities in global forex markets. Its movements are closely tied to risk sentiment, making it sensitive to global economic trends and central bank policies.

NZD vs. USD Market Overview

The NZD/USD pair is experiencing mixed momentum due to recent economic events and market sentiment. On the New Zealand side, the ANZ Commodity Price Index recently reported changes in global export prices, though its impact on the NZD remains muted compared to Australian commodity trends. Additionally, RBNZ Governor Adrian Orr is set to speak at an economic conference, and traders will be watching closely for any monetary policy hints. Meanwhile, the USD remains supported by strong US economic indicators, with the ADP Non-Farm Employment Change report set to release tomorrow, offering insights into labor market strength. Furthermore, the US President is scheduled to address Congress, potentially influencing USD volatility. Other key US economic releases, including the ISM Services PMI and factory orders, could further shape NZDUSD movements this week. Given these developments, the Kiwi remains under pressure against the Greenback, with traders watching for potential breakouts or reversals.

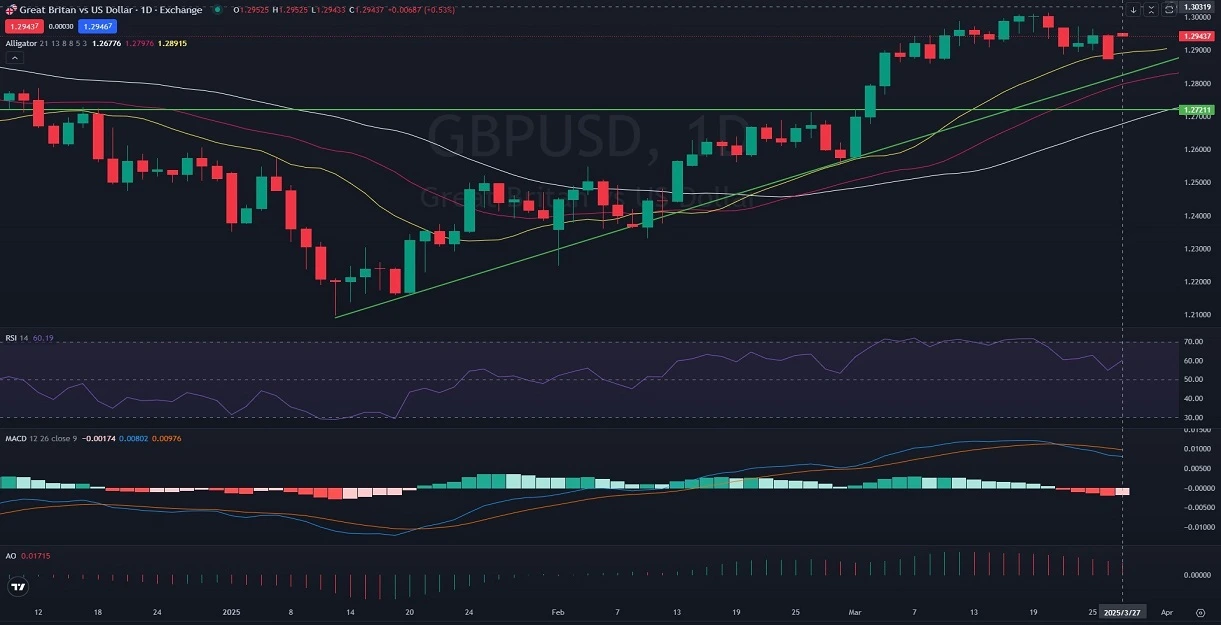

NZD/USD Technical Analysis

On the daily chart, NZDUSD is currently testing the middle Bollinger Band resistance level. A successful breakout above this level could see the pair climb toward the upper Bollinger Band, but a key horizontal resistance zone lies ahead, which may slow bullish momentum. The recent price action suggests a retracement following the recent downtrend, with price attempting to reclaim lost ground. From an indicator perspective, the MACD is showing signs of weakness, with the histogram indicating a potential bearish crossover. The Relative Strength Index (RSI) is hovering around 47, suggesting neither overbought nor oversold conditions, meaning the pair could move in either direction based on fundamental catalysts. Additionally, the Awesome Oscillator (AO) is in negative territory, signaling continued downside risk. A break above the resistance zone could trigger further gains, but failure to sustain momentum may lead to another test of lower support levels.

Final Words on NZD vs USD

Given the current market setup, NZD-USD remains at a critical juncture. If bullish momentum builds and the pair can break key resistance zones, an upward move toward the next resistance level is possible. However, downside risks persist, especially if upcoming US economic data strengthens the USD further. Traders should monitor key technical levels, economic events, and central bank signals to gauge the pair’s next move. Caution is advised as market volatility may increase ahead of upcoming economic releases. Proper risk management strategies, including stop-loss and take-profit levels, are crucial in navigating the current market conditions.

03.05.2025

Introduction to NZD/USD

The NZDUSD pair, commonly referred to as the "Kiwi," represents the exchange rate between the New Zealand dollar (NZD) and the US dollar (USD). This forex pair is highly influenced by commodity prices, interest rate differentials, and economic data from both New Zealand and the United States. As a major currency pair, NZD/USD is popular among traders looking for volatility and opportunities in global forex markets. Its movements are closely tied to risk sentiment, making it sensitive to global economic trends and central bank policies.

NZD vs. USD Market Overview

The NZD/USD pair is experiencing mixed momentum due to recent economic events and market sentiment. On the New Zealand side, the ANZ Commodity Price Index recently reported changes in global export prices, though its impact on the NZD remains muted compared to Australian commodity trends. Additionally, RBNZ Governor Adrian Orr is set to speak at an economic conference, and traders will be watching closely for any monetary policy hints. Meanwhile, the USD remains supported by strong US economic indicators, with the ADP Non-Farm Employment Change report set to release tomorrow, offering insights into labor market strength. Furthermore, the US President is scheduled to address Congress, potentially influencing USD volatility. Other key US economic releases, including the ISM Services PMI and factory orders, could further shape NZDUSD movements this week. Given these developments, the Kiwi remains under pressure against the Greenback, with traders watching for potential breakouts or reversals.

NZD/USD Technical Analysis

On the daily chart, NZDUSD is currently testing the middle Bollinger Band resistance level. A successful breakout above this level could see the pair climb toward the upper Bollinger Band, but a key horizontal resistance zone lies ahead, which may slow bullish momentum. The recent price action suggests a retracement following the recent downtrend, with price attempting to reclaim lost ground. From an indicator perspective, the MACD is showing signs of weakness, with the histogram indicating a potential bearish crossover. The Relative Strength Index (RSI) is hovering around 47, suggesting neither overbought nor oversold conditions, meaning the pair could move in either direction based on fundamental catalysts. Additionally, the Awesome Oscillator (AO) is in negative territory, signaling continued downside risk. A break above the resistance zone could trigger further gains, but failure to sustain momentum may lead to another test of lower support levels.

Final Words on NZD vs USD

Given the current market setup, NZD-USD remains at a critical juncture. If bullish momentum builds and the pair can break key resistance zones, an upward move toward the next resistance level is possible. However, downside risks persist, especially if upcoming US economic data strengthens the USD further. Traders should monitor key technical levels, economic events, and central bank signals to gauge the pair’s next move. Caution is advised as market volatility may increase ahead of upcoming economic releases. Proper risk management strategies, including stop-loss and take-profit levels, are crucial in navigating the current market conditions.

03.05.2025