RFXSIGNALS

Member

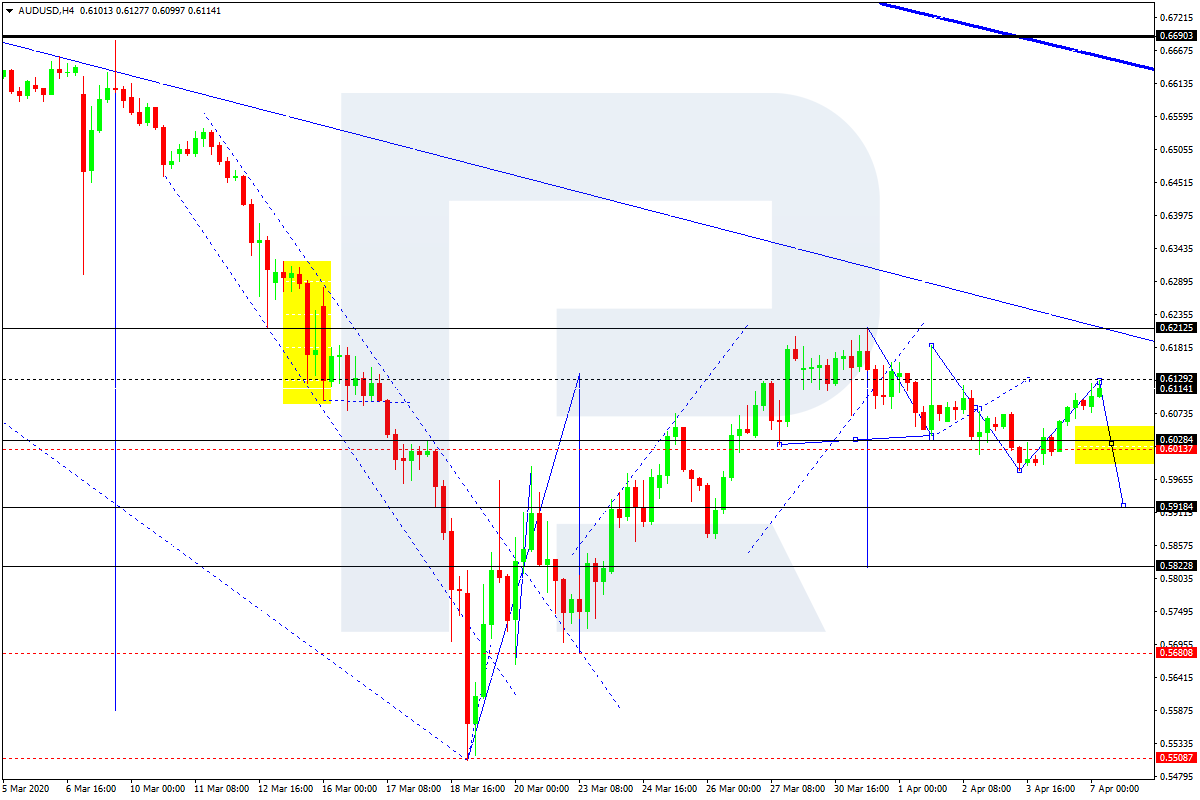

The Australian Dollar raised a little. Overview for 07.04.2020 FROM RFXSIGNALS

07.04.2020

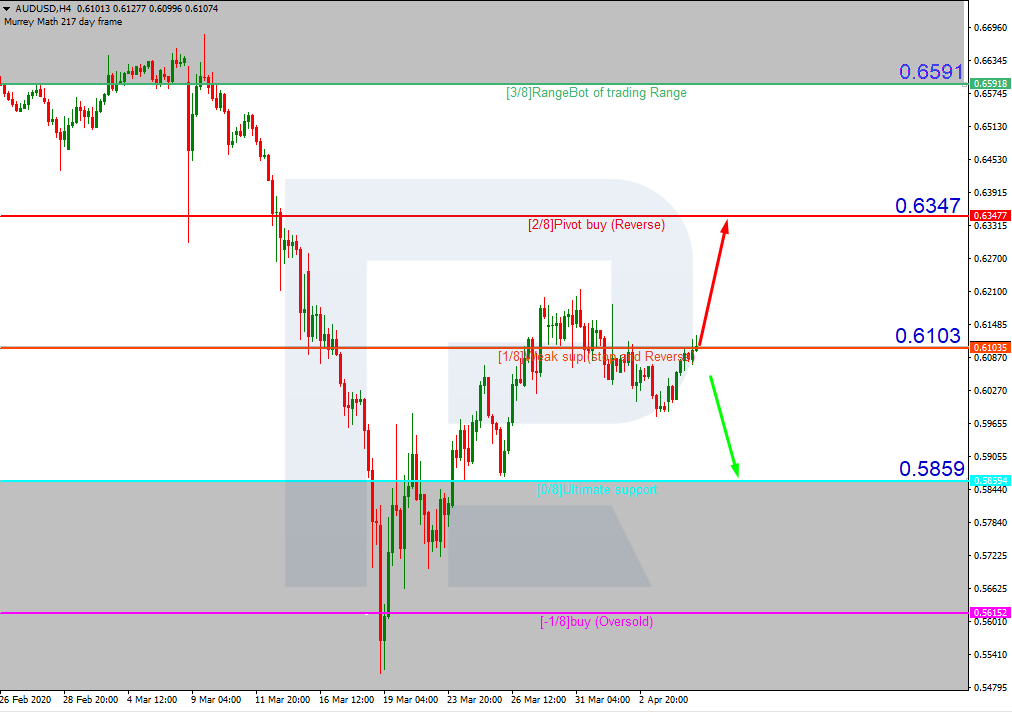

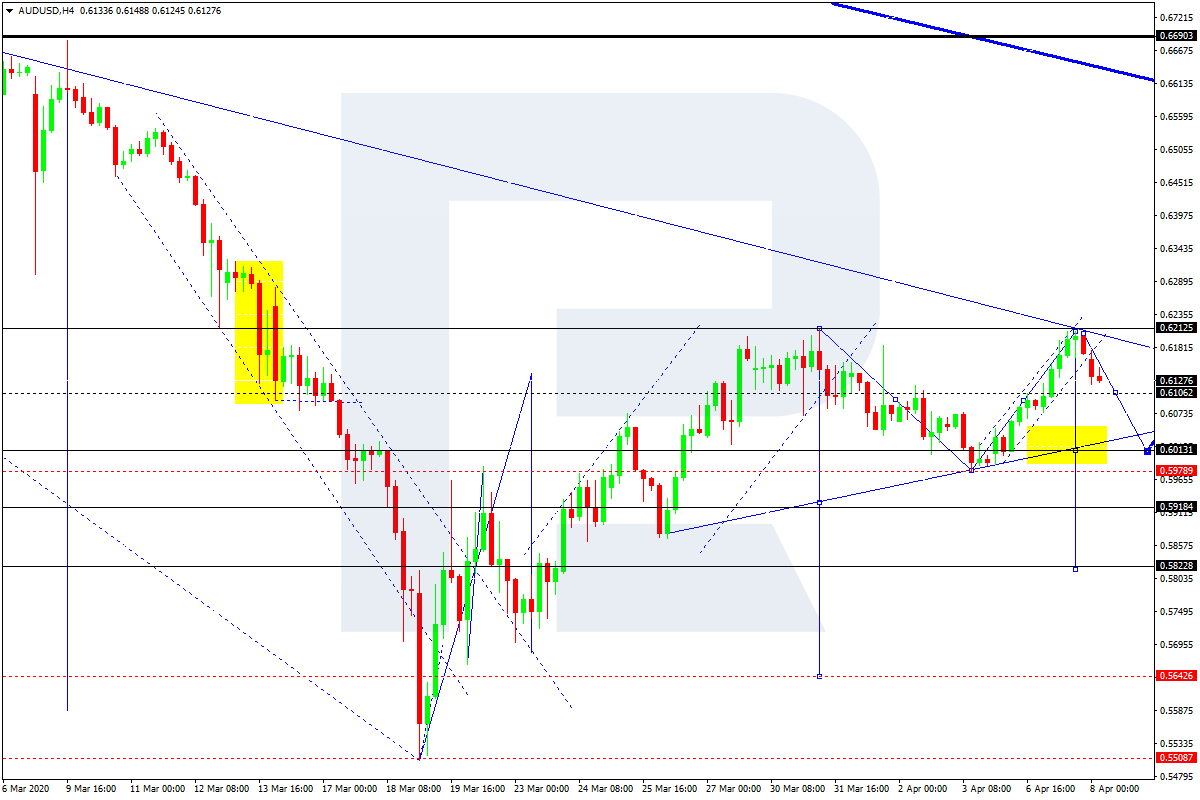

On Tuesday, AUDUSD is keeping the positive momentum started yesterday.

The Aussie has been strengthening against the USD for the second trading session in a row. The current quote for the instrument is 0.6163.

A scheduled meeting of the Reserve Bank of Australia ended without any surprises. The benchmark rate remained at the lowest level 0.25%, just as expected. Other basic parameters of the regulator’s monetary policy also remained intact.

The RBA reaffirmed the yield on 3-year Australian government bonds of 25 bps. It’s very important for maintaining financial stability in the country’s economy.

In the comments, the regulator said that fiscal programs together with coordinated monetary influence might help “smooth” the economic contraction. External risks include the coronavirus pandemic but global economies are expected to recover as soon as the outbreak is contained. In the second quarter of 2020, most global economies, including Australia, will see a significant slump accompanied by the decline of the labor market and the dramatic increase in the unemployment rate.

However, if the market conditions get better, the Reserve Bank of Australia will have to buy fewer bonds

07.04.2020

On Tuesday, AUDUSD is keeping the positive momentum started yesterday.

The Aussie has been strengthening against the USD for the second trading session in a row. The current quote for the instrument is 0.6163.

A scheduled meeting of the Reserve Bank of Australia ended without any surprises. The benchmark rate remained at the lowest level 0.25%, just as expected. Other basic parameters of the regulator’s monetary policy also remained intact.

The RBA reaffirmed the yield on 3-year Australian government bonds of 25 bps. It’s very important for maintaining financial stability in the country’s economy.

In the comments, the regulator said that fiscal programs together with coordinated monetary influence might help “smooth” the economic contraction. External risks include the coronavirus pandemic but global economies are expected to recover as soon as the outbreak is contained. In the second quarter of 2020, most global economies, including Australia, will see a significant slump accompanied by the decline of the labor market and the dramatic increase in the unemployment rate.

However, if the market conditions get better, the Reserve Bank of Australia will have to buy fewer bonds