FXOpen Trader

Active Member

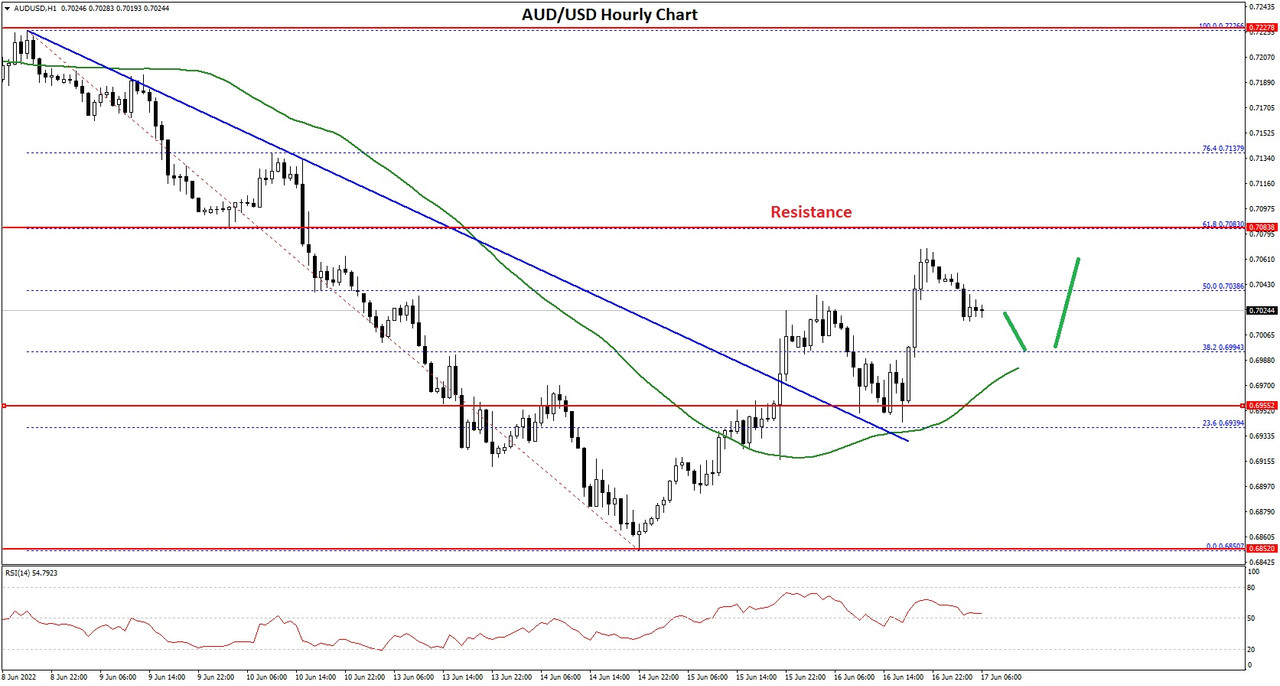

BTCUSD and XRPUSD Technical Analysis – 24th MAY 2022

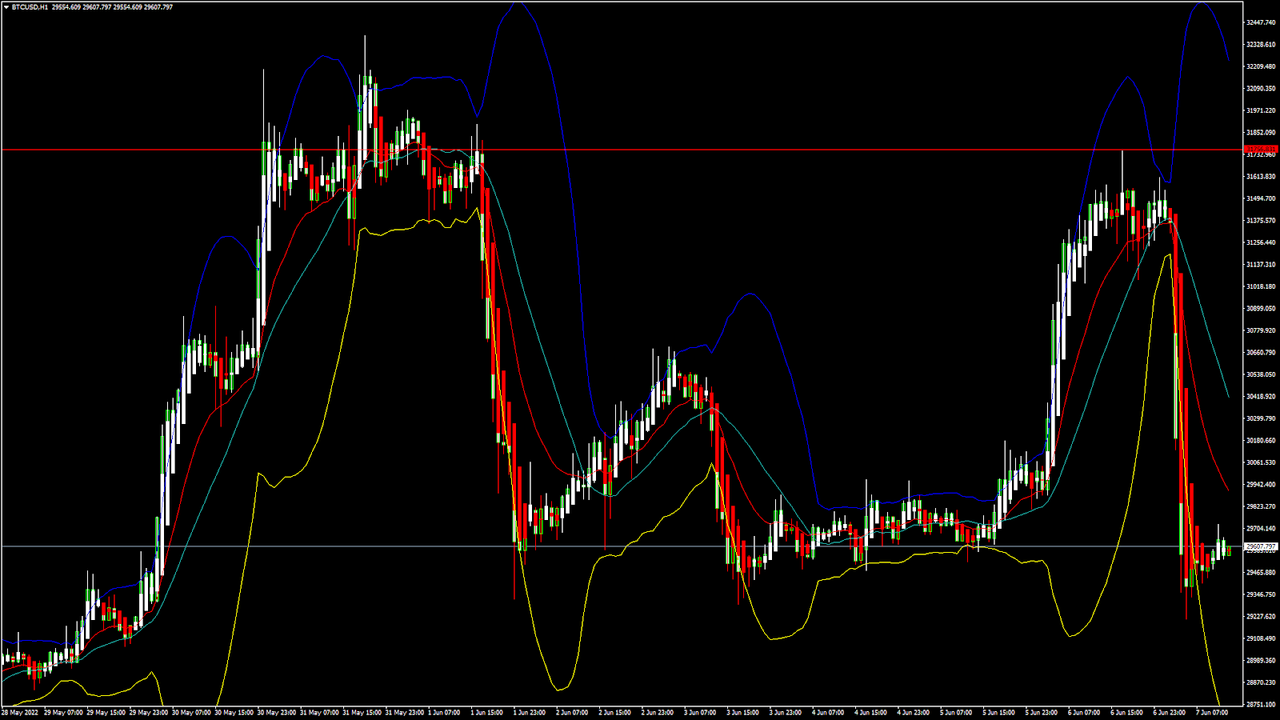

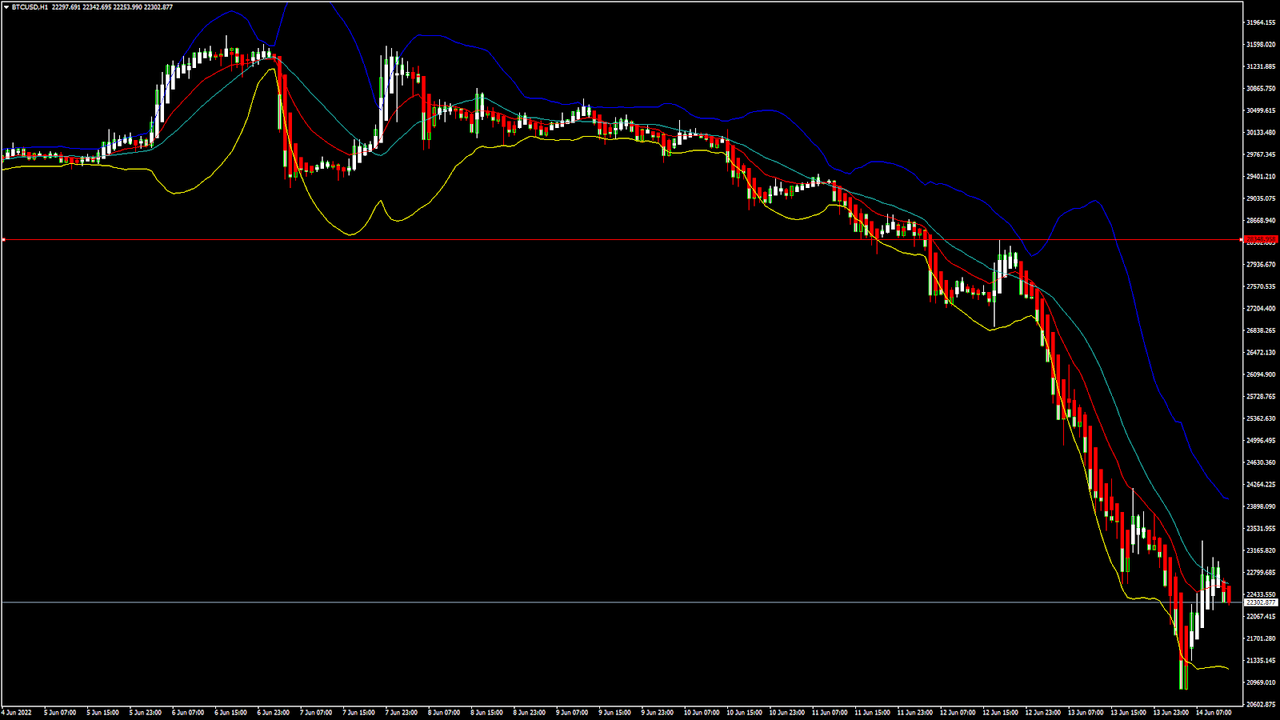

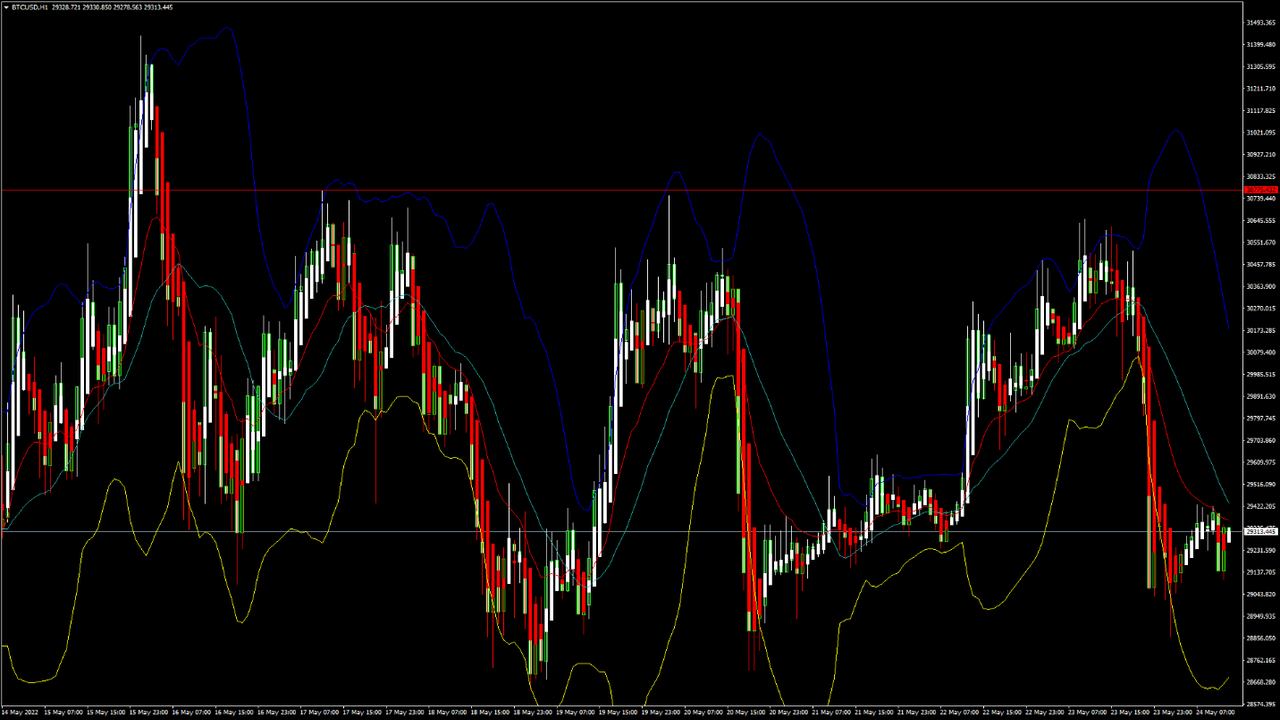

BTCUSD: Triple-Top Pattern Below $30,775

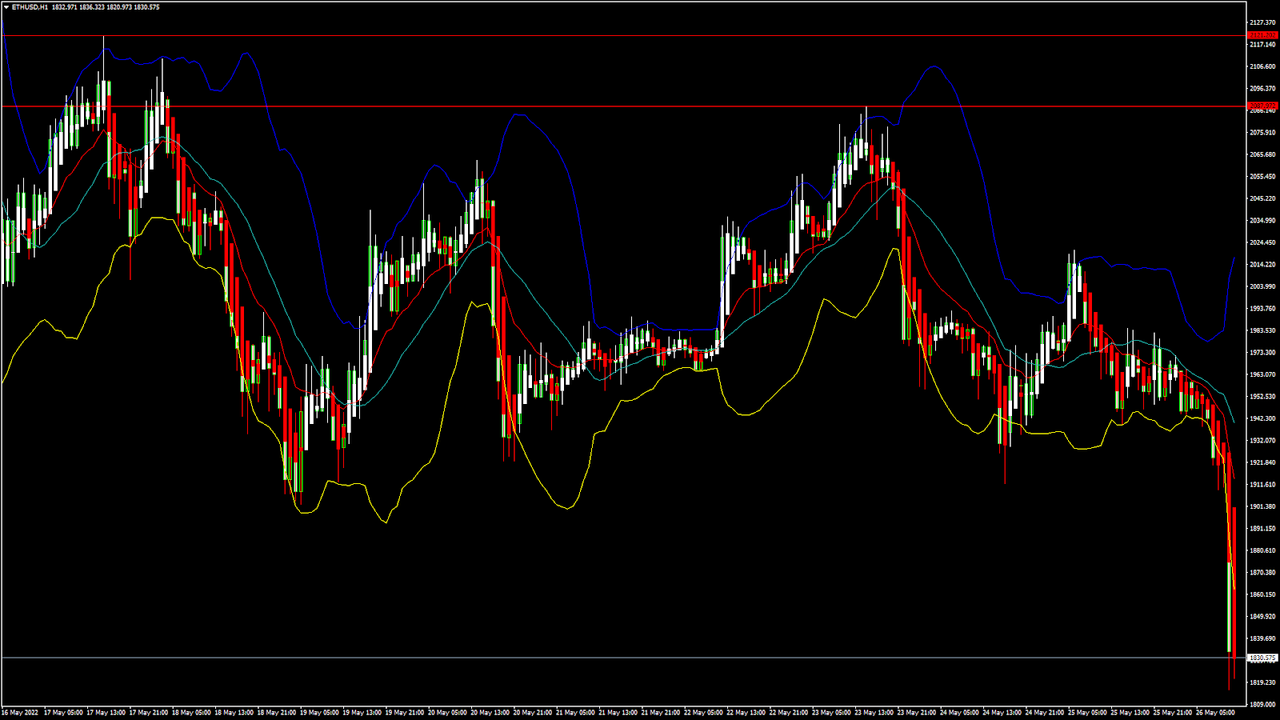

Bitcoin was not able to sustain its bullish momentum this week, and after touching a high of 30,652 on 23rd May, started to decline heavily against the US dollar; it touched a low of 28,860 today in the Asian trading session.

The drop that we saw continues, and now the prices have entered a consolidation channel above the $29,000 handle in the European trading session.

If we see some buying at these levels, the prices will continue to remain above them in the short-term range. But in the medium-term range, we are expecting a further drop due to weak global demand cues.

We can clearly see a triple-top pattern below the $30б775 handle which is a bearish reversal pattern because it signifies the end of an uptrend and a shift towards a downtrend.

Both the STOCH and STOCHRSI are indicating overbought levels which means that in the immediate short term, a decline in the prices is expected.

The relative strength index is at 40 indicating a WEAK demand for bitcoin at the current market levels.

Bitcoin is now moving below its 100 and 200 hourly simple MAs.

Most of the major technical indicators are giving a SELL signal, which means that in the immediate short term, we are expecting targets of 28,000 and 27,500.

The average true range is indicating LESS market volatility with a mild bearish momentum.

Bitcoin: Bearish Reversal Seen Below $30,775

Bitcoin continues to move in a consolidation channel above the $29,000 handle in the European trading session today. We can see the formation of a demand zone above it, but the global risk scenarios may enable further decline in the prices this week.

The immediate short-term outlook for bitcoin is mildly bearish; the medium-term outlook has turned neutral; and the long-term outlook remains neutral under present market conditions.

Bitcoin continues to consolidate above its important support level of $29,000, and with increasing demand zone formation the immediate target is $30,500.

The price of BTCUSD is now facing its classic support level of 28,819 and Fibonacci support level of 29,135, after which the path towards 28,000 will get cleared.

In the last 24hrs, BTCUSD has decreased by 3.97% with a price change of 1,210$, and has a 24hr trading volume of USD 31.034 billion. We can see an Increase of 1.58% in the trading volume as compared to yesterday, which appears to be normal.

The Week Ahead

The prices of bitcoin are moving in a mildly bearish momentum, and the immediate targets are $28,000 and $27,500.

The daily RSI is printing at 37 which means that the medium range demand continues to be weak.

We are now expecting a range-bound movement between $28,000 and $32,000 next week.

The price of BTCUSD will need to remain above the important support level of $29,000 this week.

The weekly outlook is projected at $31,500 with a consolidation zone of $30,000.

Technical Indicators:

The moving averages convergence divergence (12,26): at -161 indicating a SELL

The average directional change (14-day): at 34.90 indicating a NEUTRAL level

The rate of price change: at -0.006 indicating a SELL

The commodity channel index (14-day): at 42.96 indicating a NEUTRAL level

Read Full on FXOpen Company Blog...

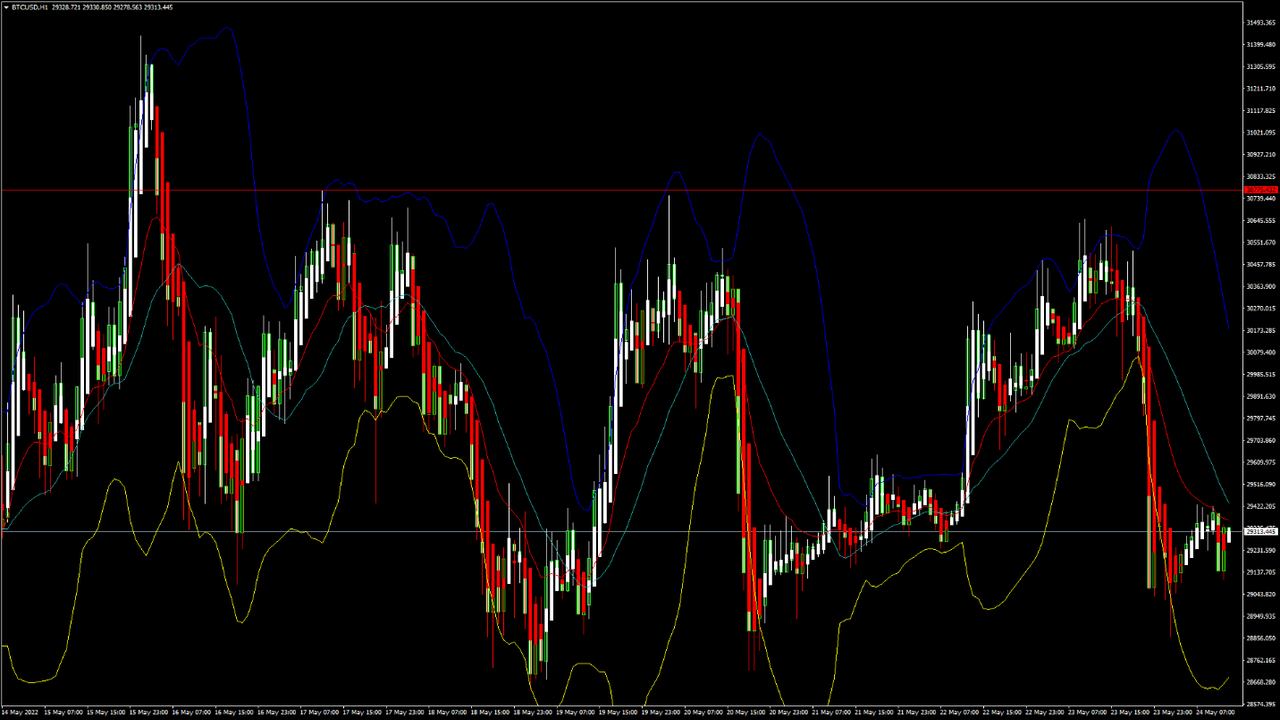

BTCUSD: Triple-Top Pattern Below $30,775

Bitcoin was not able to sustain its bullish momentum this week, and after touching a high of 30,652 on 23rd May, started to decline heavily against the US dollar; it touched a low of 28,860 today in the Asian trading session.

The drop that we saw continues, and now the prices have entered a consolidation channel above the $29,000 handle in the European trading session.

If we see some buying at these levels, the prices will continue to remain above them in the short-term range. But in the medium-term range, we are expecting a further drop due to weak global demand cues.

We can clearly see a triple-top pattern below the $30б775 handle which is a bearish reversal pattern because it signifies the end of an uptrend and a shift towards a downtrend.

Both the STOCH and STOCHRSI are indicating overbought levels which means that in the immediate short term, a decline in the prices is expected.

The relative strength index is at 40 indicating a WEAK demand for bitcoin at the current market levels.

Bitcoin is now moving below its 100 and 200 hourly simple MAs.

Most of the major technical indicators are giving a SELL signal, which means that in the immediate short term, we are expecting targets of 28,000 and 27,500.

The average true range is indicating LESS market volatility with a mild bearish momentum.

- Bitcoin: bearish reversal seen below $30,775

- The Williams percent range is indicating an OVERBOUGHT level

- The price is now trading just above its pivot level of $29,229

- All of the MAs are giving a STRONG SELL market signal

Bitcoin: Bearish Reversal Seen Below $30,775

Bitcoin continues to move in a consolidation channel above the $29,000 handle in the European trading session today. We can see the formation of a demand zone above it, but the global risk scenarios may enable further decline in the prices this week.

The immediate short-term outlook for bitcoin is mildly bearish; the medium-term outlook has turned neutral; and the long-term outlook remains neutral under present market conditions.

Bitcoin continues to consolidate above its important support level of $29,000, and with increasing demand zone formation the immediate target is $30,500.

The price of BTCUSD is now facing its classic support level of 28,819 and Fibonacci support level of 29,135, after which the path towards 28,000 will get cleared.

In the last 24hrs, BTCUSD has decreased by 3.97% with a price change of 1,210$, and has a 24hr trading volume of USD 31.034 billion. We can see an Increase of 1.58% in the trading volume as compared to yesterday, which appears to be normal.

The Week Ahead

The prices of bitcoin are moving in a mildly bearish momentum, and the immediate targets are $28,000 and $27,500.

The daily RSI is printing at 37 which means that the medium range demand continues to be weak.

We are now expecting a range-bound movement between $28,000 and $32,000 next week.

The price of BTCUSD will need to remain above the important support level of $29,000 this week.

The weekly outlook is projected at $31,500 with a consolidation zone of $30,000.

Technical Indicators:

The moving averages convergence divergence (12,26): at -161 indicating a SELL

The average directional change (14-day): at 34.90 indicating a NEUTRAL level

The rate of price change: at -0.006 indicating a SELL

The commodity channel index (14-day): at 42.96 indicating a NEUTRAL level

Read Full on FXOpen Company Blog...