FXOpen Trader

Active Member

Fed Plans To Accelerate Monetary Tightening. Is It a Good Time To Buy US Dollars?

The currency market moves mainly on the interest rate differential between various central banks around the world. The Federal Reserve of the United States is the most influential central bank, as it sets the rates over the world’s reserve currency.

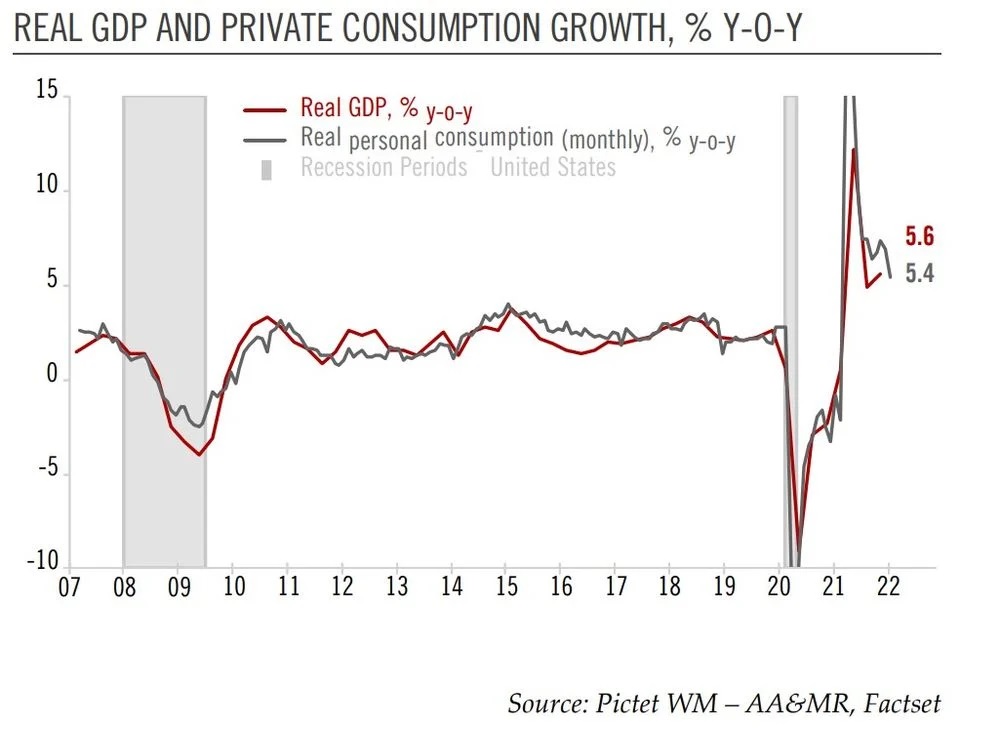

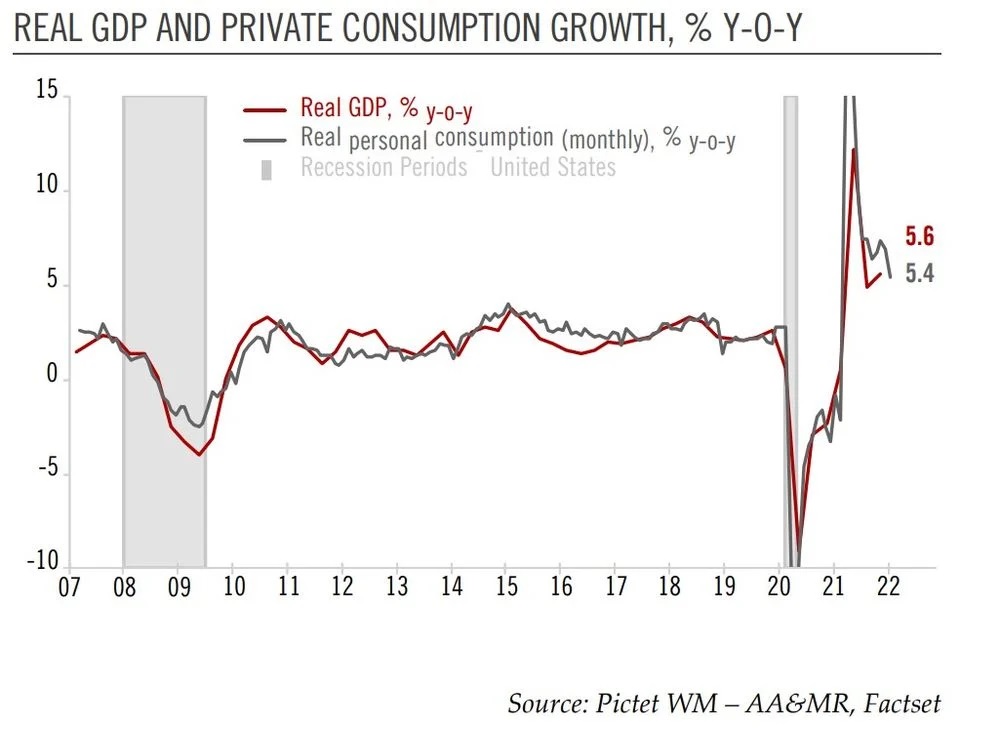

In April, the Fed began a tightening cycle. It hiked the federal funds rate by 25bp in light of rising inflation and strong economic growth. Moreover, it warned that it is ready to hike even more aggressively should the data support it.

Following the rate hike, the Fed Chair Jerome Powell suggested that the Fed is ready to hike the federal funds rate by 50bp at their next meeting in May. In light of rising rates in the US as the economy grows and inflation runs hot, is it a good time to buy US dollars?

US Dollar Trades With A Mixed Tone

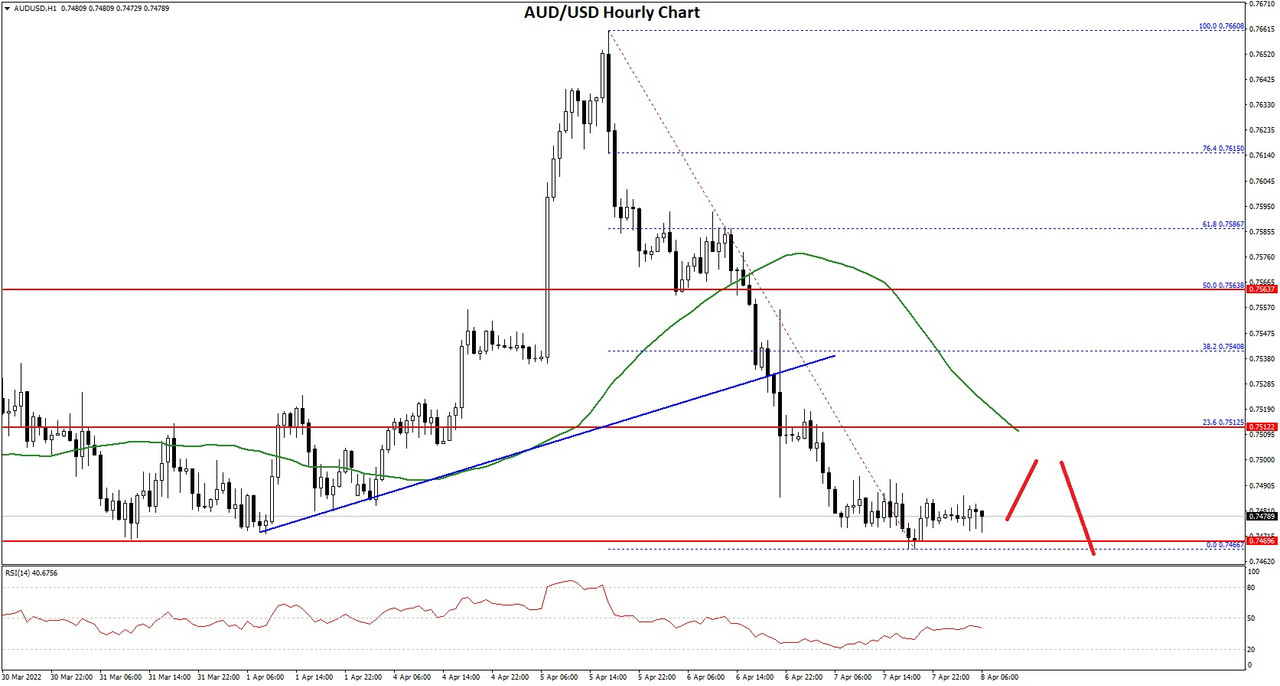

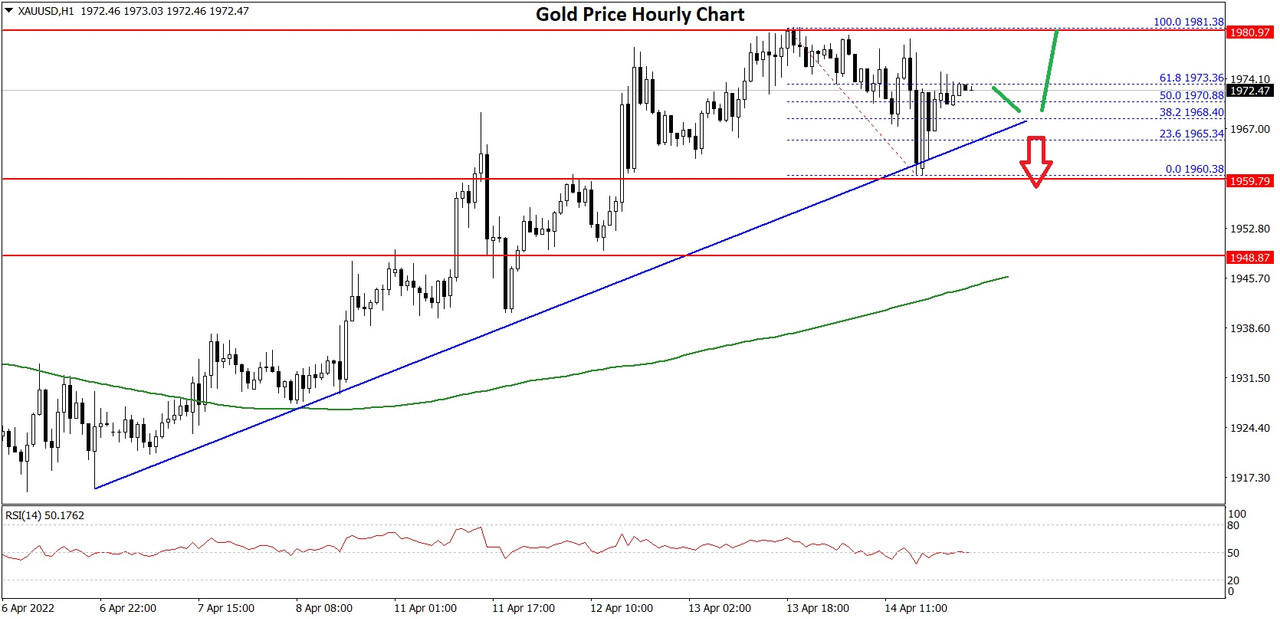

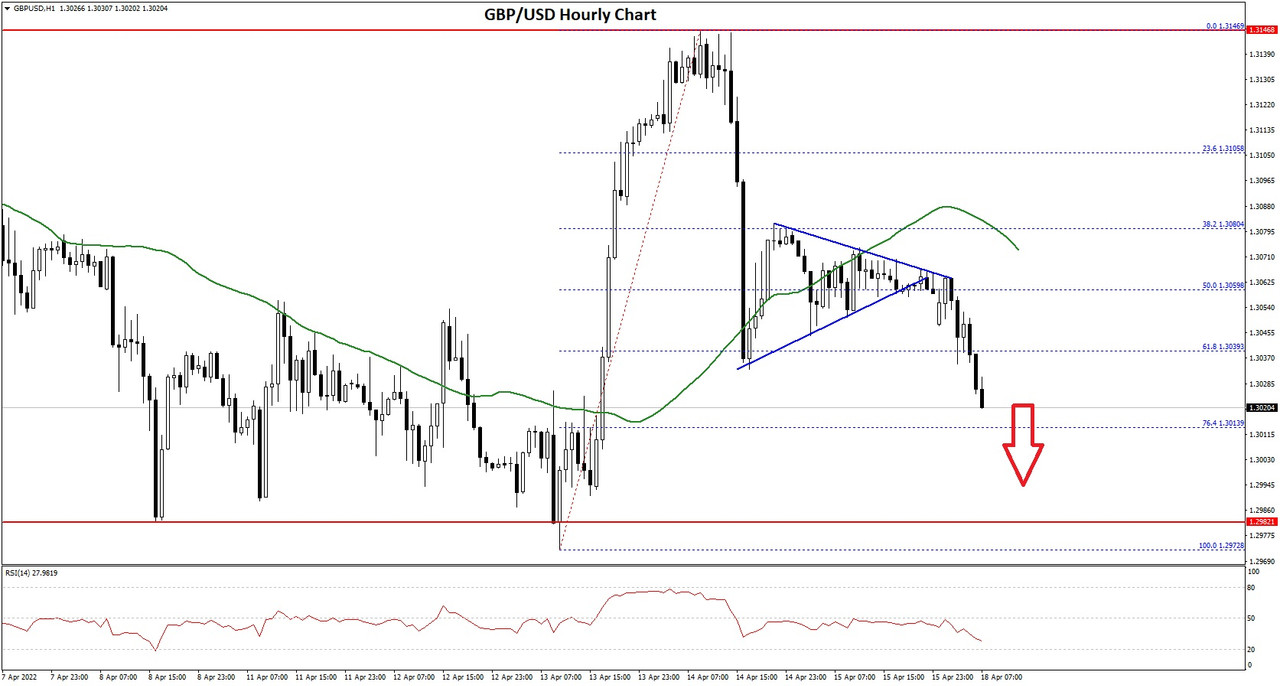

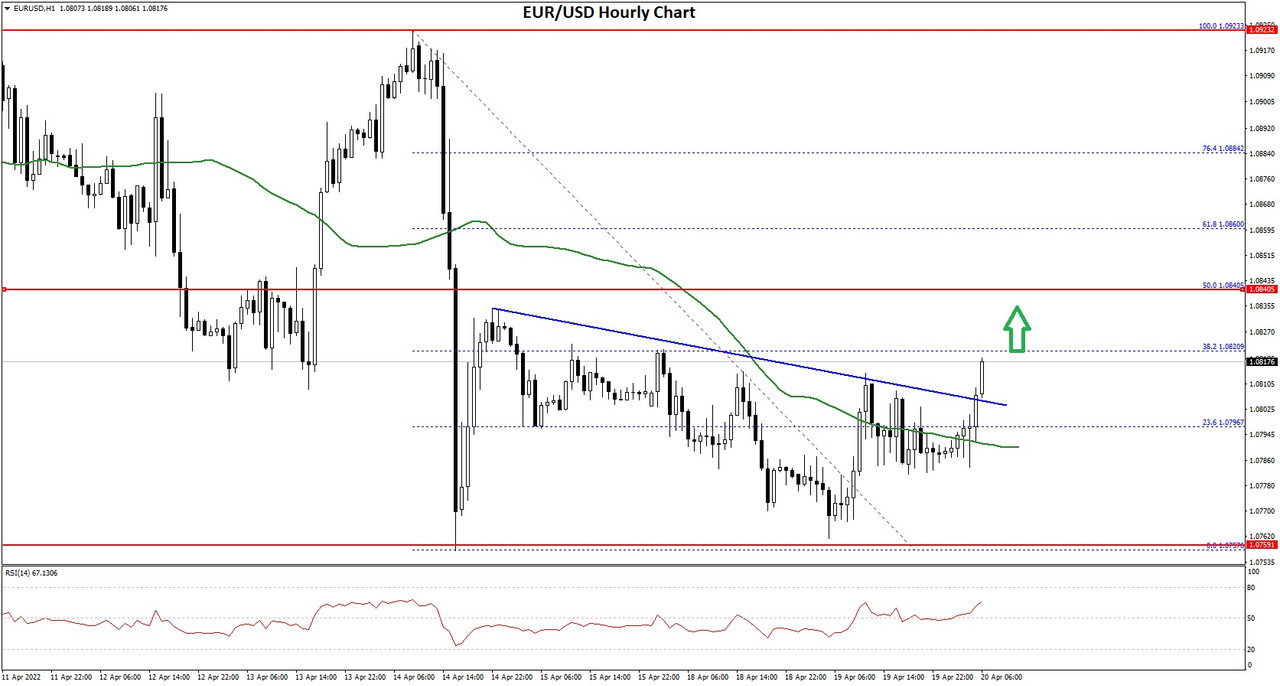

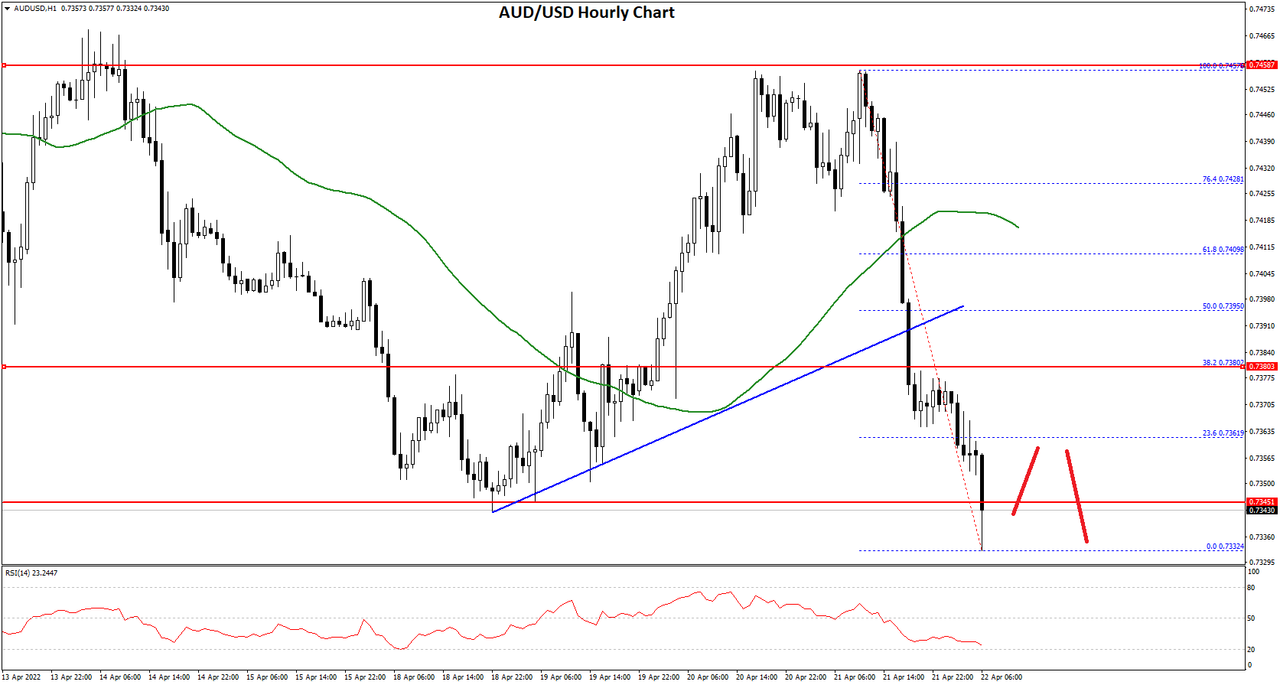

Despite the Fed’s hawkishness, the US dollar trades with a mixed tone. On the one hand, it has gained against its European peers, such as the euro and the British pound, and against the Japanese yen. On the other hand, it trades with a weak tone against the New Zealand and the Australian dollar.

Interestingly enough, the RBA and RBNZ have not raised the rates from their lower boundary. Yet, the two currencies down under are being bid against the dollar.

One explanation might be the inflation rate differential. Inflation in the US is at a four decade high, outpacing the one in Australia and New Zealand.

As such, despite the Fed’s intentions to speed up the rate hikes, the rising inflation rate is eroding the dollar’s strength. In other words, inflation is rising much higher than the Fed is hiking the rates; thus, the US dollar remains weak against its Australian and New Zealand peers.

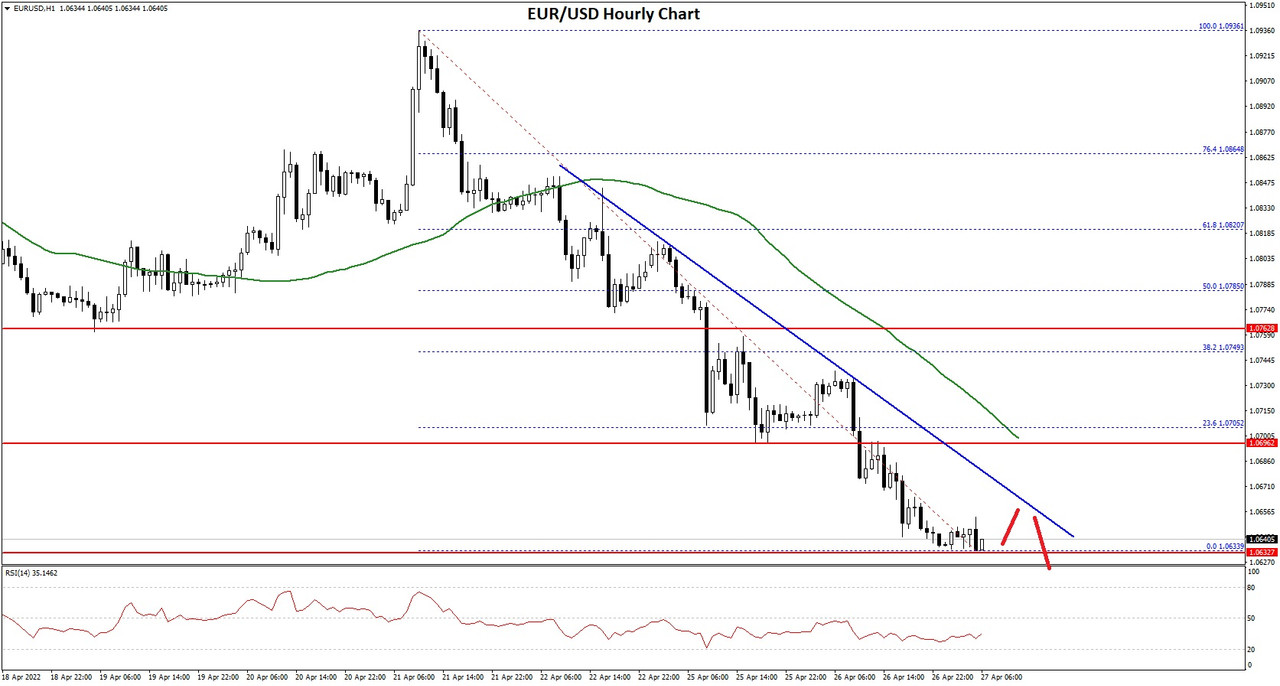

The conflict in Europe scared investors away from the common currency. While not declining as many have thought, the euro remains weak as investors keep selling any rally.

All in all, the US dollar remains bid against the JPY and European currencies while offered against the Australian and New Zealand dollars. Traders will find out more details about the Fed’s plans on Wednesday when the previous meeting’s minutes are scheduled for release.

Read Full on FXOpen Company Blog...

The currency market moves mainly on the interest rate differential between various central banks around the world. The Federal Reserve of the United States is the most influential central bank, as it sets the rates over the world’s reserve currency.

In April, the Fed began a tightening cycle. It hiked the federal funds rate by 25bp in light of rising inflation and strong economic growth. Moreover, it warned that it is ready to hike even more aggressively should the data support it.

Following the rate hike, the Fed Chair Jerome Powell suggested that the Fed is ready to hike the federal funds rate by 50bp at their next meeting in May. In light of rising rates in the US as the economy grows and inflation runs hot, is it a good time to buy US dollars?

US Dollar Trades With A Mixed Tone

Despite the Fed’s hawkishness, the US dollar trades with a mixed tone. On the one hand, it has gained against its European peers, such as the euro and the British pound, and against the Japanese yen. On the other hand, it trades with a weak tone against the New Zealand and the Australian dollar.

Interestingly enough, the RBA and RBNZ have not raised the rates from their lower boundary. Yet, the two currencies down under are being bid against the dollar.

One explanation might be the inflation rate differential. Inflation in the US is at a four decade high, outpacing the one in Australia and New Zealand.

As such, despite the Fed’s intentions to speed up the rate hikes, the rising inflation rate is eroding the dollar’s strength. In other words, inflation is rising much higher than the Fed is hiking the rates; thus, the US dollar remains weak against its Australian and New Zealand peers.

The conflict in Europe scared investors away from the common currency. While not declining as many have thought, the euro remains weak as investors keep selling any rally.

All in all, the US dollar remains bid against the JPY and European currencies while offered against the Australian and New Zealand dollars. Traders will find out more details about the Fed’s plans on Wednesday when the previous meeting’s minutes are scheduled for release.

Read Full on FXOpen Company Blog...