Vlad RF

Member

Gold forecast: XAUUSD is trading above 2,500 USD; the market awaits the Fed’s minutes

XAUUSD price continued its surge on Tuesday, reaching a new annual and all-time high of 2,532 USD. Today, the market’s focus is on the release of the Federal Reserve minutes. Find out more in our XAUUSD analysis for today, 21 August 2024.

XAUUSD fundamental analysis

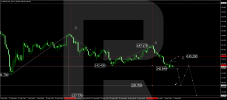

XAUUSD quotes are experiencing a strong uptrend, regularly reaching all-time highs. A triangle price pattern has formed on the H4 chart, which could signal a continuation of the XAUUSD price growth, with an approximate target at 2,600 USD per troy ounce

XAUUSD analysis shows that gold continues to rise steadily, reaching a new all-time high of 2,532 USD. The market is focused on the release of the Federal Reserve’s July meeting minutes, which may affect the XAUUSD forecast further.

Read more at RoboForex Website

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team

XAUUSD price continued its surge on Tuesday, reaching a new annual and all-time high of 2,532 USD. Today, the market’s focus is on the release of the Federal Reserve minutes. Find out more in our XAUUSD analysis for today, 21 August 2024.

XAUUSD fundamental analysis

XAUUSD quotes are experiencing a strong uptrend, regularly reaching all-time highs. A triangle price pattern has formed on the H4 chart, which could signal a continuation of the XAUUSD price growth, with an approximate target at 2,600 USD per troy ounce

XAUUSD analysis shows that gold continues to rise steadily, reaching a new all-time high of 2,532 USD. The market is focused on the release of the Federal Reserve’s July meeting minutes, which may affect the XAUUSD forecast further.

Read more at RoboForex Website

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.

Sincerely,

The RoboForex Team