Vlad RF

Member

RoboForex received two prestigious global awards

Dear Clients and Partners,

RoboForex is constantly working to enhance its services so that you can operate in the financial markets as comfortably as possible. We’re delighted to inform you that two of the company’s products have been praised by the professional community, thereby adding more awards to a great many accolades earned by RoboForex.

The company won the award for "Best Mobile Trading App (Global)" at the Global Forex Awards - B2B 2022 and received the “Best Prime Trading Account (Global)” title at the Ultimate Fintech Awards 2022.

Trade with the market leader

Sincerely,

RoboForex team

Dear Clients and Partners,

RoboForex is constantly working to enhance its services so that you can operate in the financial markets as comfortably as possible. We’re delighted to inform you that two of the company’s products have been praised by the professional community, thereby adding more awards to a great many accolades earned by RoboForex.

Two global wins for RoboForex

The company won the award for "Best Mobile Trading App (Global)" at the Global Forex Awards - B2B 2022 and received the “Best Prime Trading Account (Global)” title at the Ultimate Fintech Awards 2022.

Trade with the market leader

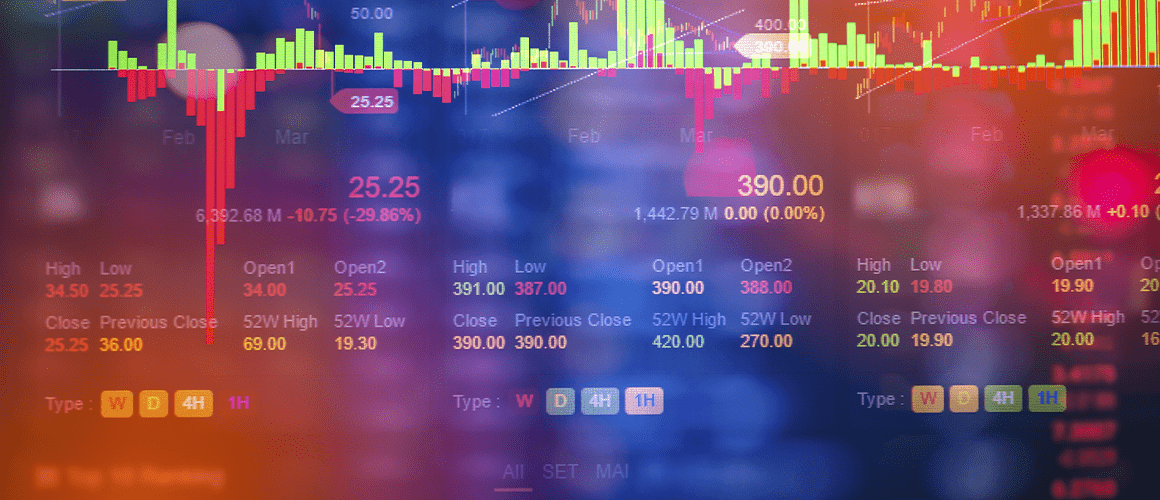

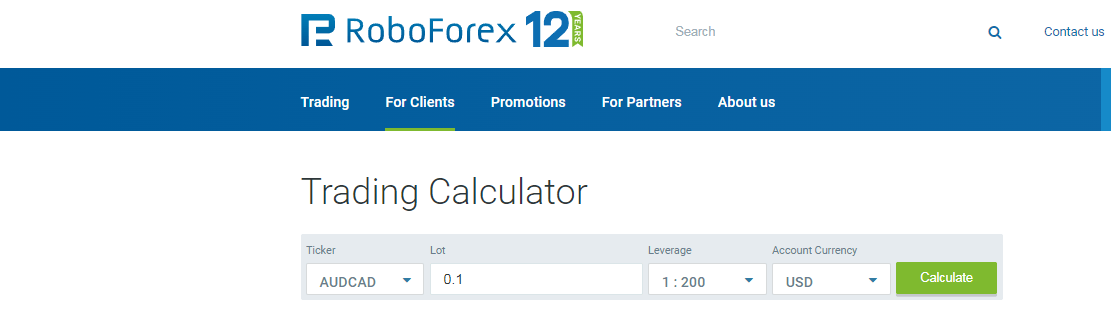

- The best conditions in the industry

With Prime accounts, you can invest with spreads from 0 pips, leverage up to 1:300, and an order execution speed from 0.1 seconds.

- Over 12,000 instruments

Stocks, Indices, Cryptocurrencies, Metals, and other popular assets are available for trading.

- Advanced mobile solutions

The R MobileTrader application developed by RoboForex has been highly appreciated by the professional community for the third year in a row.

Sincerely,

RoboForex team