Vlad RF

Well-Known Member

4 Stocks for Trading in Uncertainty

Author: Eugene Savitsky

Dear Clients and Partners,

Inflation, recession, stagnation, stagflation — and other scary words that investors keep hearing in the stock market. What else? Toughening of credit and monetary policy, cutting down on the CB balance, winding up the QE programme. With such news, it becomes hard to consider buying any stocks.

When stock indices drop abruptly

Normally, the stock market experiences panic and falling of indices right in the times when no one suspects any trouble. Investors are simply buying stocks and watching their profits grow.

Negative news does not always provoke immediate reaction: understanding the scale of a future disaster needs time. However, more experienced investors assess the situation fast and start acting at once.

As a result, the quotes in the stock market start going down and speeding up because other investors have no more time to think. Hence, stock indices drop when investors take their profit, not trying to make money on the decline.

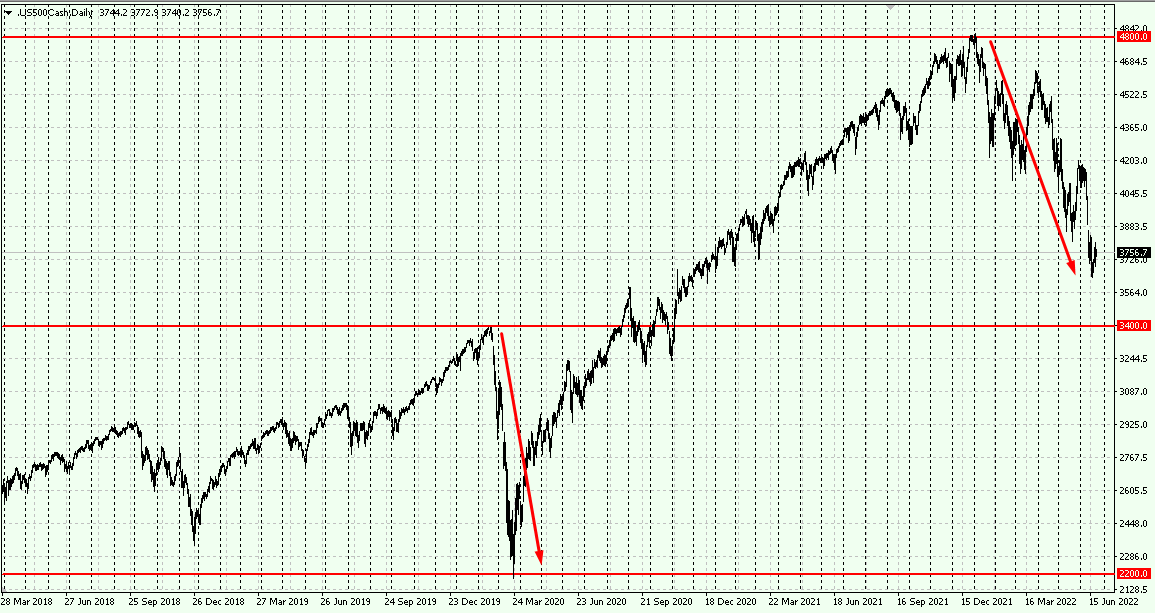

What the market sentiment is now

The poll carried out in March by Investors Intelligence demonstrates that the number of those planning to buy shares had dropped to 30%, while the number of those who want to play short had grown to 34.5%. In other words, the current market is bearish.

Over the last 12 years, this has happened 6 times, and the quotes of S&P 500 always reached some lows from where it then started to grow. Market players either opt for cash or for short positions — and this is what stimulates growth of stock prices.

There is some saved cash that can support the stock market and increase the demand for shares. And there are sellers who will have to close their positions if the prices grow, which will also lead to an increase in quotes.

Union Pacific

The shares of Union Pacific Corporation (NYSE: UNP) are trading in an uptrend. and at the first glance, there are no hints on a decline. However, upon a more thorough investigation, it can be noticed that volatility of the shares has increased. Quite often, this means the trend is coming to an end.

Upon sky-rocketing to 280 USD, the quotes quite soon returned to 240 USD and have already broken through it. This is the key level for the bulls because they have been holding it since December 2021.

The bears had made 12 attempts to break through it but always failed – until this time. Now we should expect further falling of the quotes to the support level of 220 USD. The bears are also supported by the bad news around and high market volatility.

Closing thoughts

When fundamental analysis is no help to make investment decisions, tech analysis will save us. It shows a fight between bulls and bears, and a moment will come when we will understand who will win.

In such cases, a trader should stand on the stronger side and trade in this direction. When fundamental and tech analyses agree, the probability of making a profit increases. Note that today, the stock market sentiment is negative.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Author: Eugene Savitsky

Dear Clients and Partners,

Inflation, recession, stagnation, stagflation — and other scary words that investors keep hearing in the stock market. What else? Toughening of credit and monetary policy, cutting down on the CB balance, winding up the QE programme. With such news, it becomes hard to consider buying any stocks.

When stock indices drop abruptly

Normally, the stock market experiences panic and falling of indices right in the times when no one suspects any trouble. Investors are simply buying stocks and watching their profits grow.

Negative news does not always provoke immediate reaction: understanding the scale of a future disaster needs time. However, more experienced investors assess the situation fast and start acting at once.

As a result, the quotes in the stock market start going down and speeding up because other investors have no more time to think. Hence, stock indices drop when investors take their profit, not trying to make money on the decline.

What the market sentiment is now

The poll carried out in March by Investors Intelligence demonstrates that the number of those planning to buy shares had dropped to 30%, while the number of those who want to play short had grown to 34.5%. In other words, the current market is bearish.

Over the last 12 years, this has happened 6 times, and the quotes of S&P 500 always reached some lows from where it then started to grow. Market players either opt for cash or for short positions — and this is what stimulates growth of stock prices.

There is some saved cash that can support the stock market and increase the demand for shares. And there are sellers who will have to close their positions if the prices grow, which will also lead to an increase in quotes.

Union Pacific

The shares of Union Pacific Corporation (NYSE: UNP) are trading in an uptrend. and at the first glance, there are no hints on a decline. However, upon a more thorough investigation, it can be noticed that volatility of the shares has increased. Quite often, this means the trend is coming to an end.

Upon sky-rocketing to 280 USD, the quotes quite soon returned to 240 USD and have already broken through it. This is the key level for the bulls because they have been holding it since December 2021.

The bears had made 12 attempts to break through it but always failed – until this time. Now we should expect further falling of the quotes to the support level of 220 USD. The bears are also supported by the bad news around and high market volatility.

Closing thoughts

When fundamental analysis is no help to make investment decisions, tech analysis will save us. It shows a fight between bulls and bears, and a moment will come when we will understand who will win.

In such cases, a trader should stand on the stronger side and trade in this direction. When fundamental and tech analyses agree, the probability of making a profit increases. Note that today, the stock market sentiment is negative.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team