Vlad RF

Member

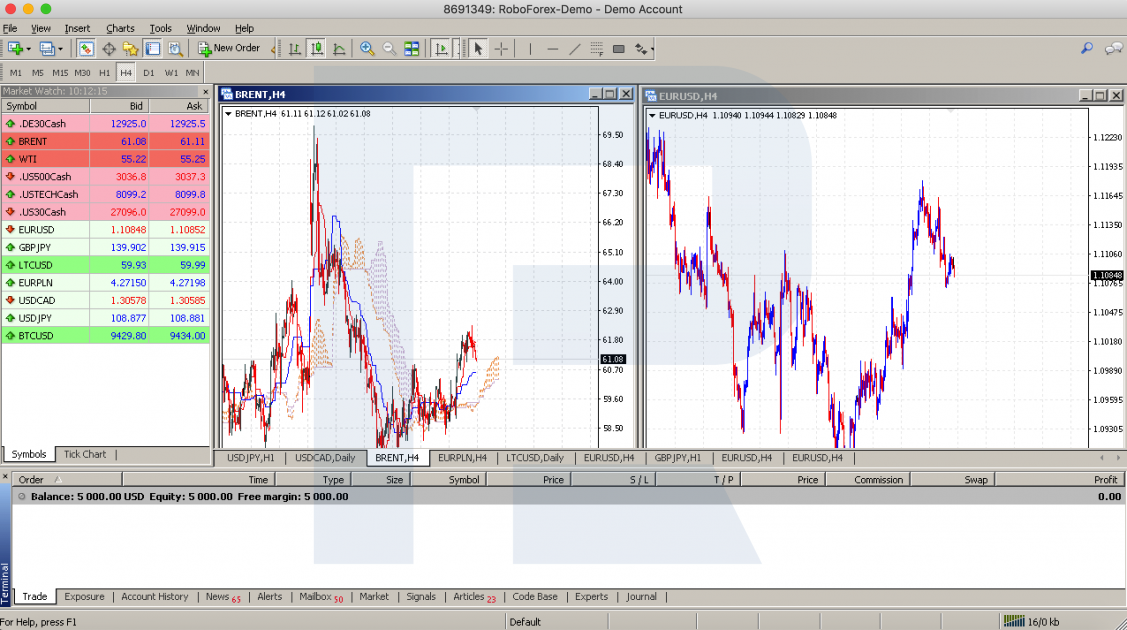

Main Order Types on MetaTrader

Author : Victor Gryazin

Dear Clients and Partners,

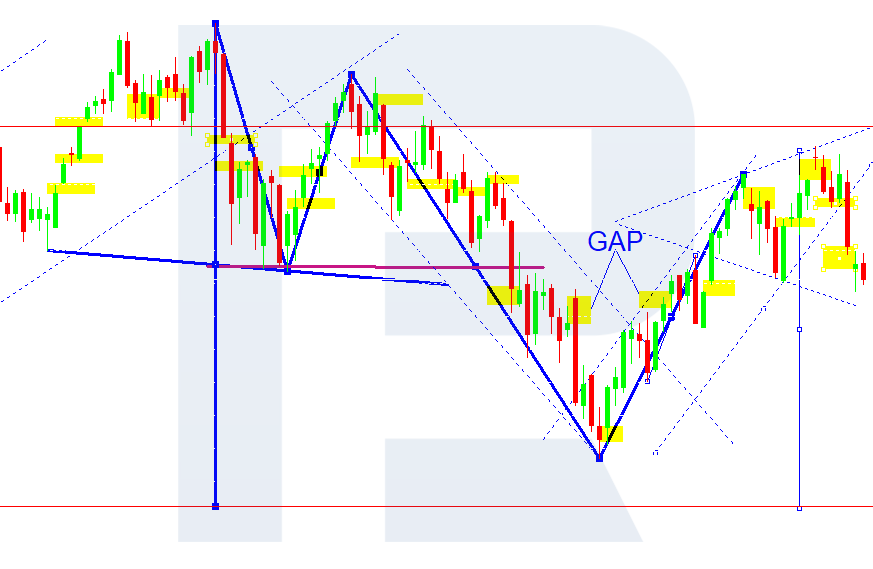

This overview is devoted to the main types of orders used on MetaTrader platforms. Orders serve to open and close positions, limit losses and take the profit.

Main order types in trading

For trading in financial markets, there are two main types of orders used:

Market order is the simplest and most understandable of all. This is an order to sell or buy the asset at the current market price immediately. The priority of the order is obligatory execution, if only there is enough liquidity in the market. Positions open (or close) at once. When volatility is high, so-called "slips" occur, which means the actual execution price differs from the Bid or Ask price at the ordering moment.

Limit order is an order to sell or buy the asset at the specified price. Limit orders will not allow making trades at a worse price than said in the order, yet it is not guaranteed that the order will be executed. In other words, the order will be executed only if there is the limit (or best) price in the market. If otherwise, the order will not be executed.

Based on these two orders, there have been creates several order types on MetaTrader platforms. On other platforms, things might work differently.

Opening orders

Buy Limit

This is a limit order to buy the asset at a price no worse than the specified one. Also, this order can be used when you need to limit the price of a not most liquid asset you are buying.

For example, when Brent oil price is $80, while the trader wants it cheaper — at $70 — they can place a pending Buy Limit order at the desirable price level. The position will open as soon as the Ask price reaches the specified level.

Sell Limit

This is a limit order to sell the asset at a price no lower than the one set in the order. This type can be used when you need to limit the selling price of a non-liquid asset.

For example, if gold now costs $1,800, and the trader wants to sell it when the price reaches $2,000, they can place a Sell Limit order at this level. As soon as the Bid price reaches the desired level, a selling position will open.

Closing orders

After a position is open, the trader needs to specify its closing conditions. As a rule, there are two options: Take Profit for a price going as forecast and Stop Loss for a price going against the trader.

Take Profit

Take Profit is a pending order that closes the position without trader's participation. A placed order automatically closes a gaining position as soon as the price reaches the specified level.

For example, the trader buys Brent oil at $70 and expects it to grow to $100 in the nearest future, where they will close the position with a profit. Hence, they can place a Take Profit at $100, and the position will close automatically, as soon as the quotations reach the level.

Margin Call and Stop Out

There are also such important phenomena as Margin Call and Stop Out.

Margin Call

This is a notification by which the broker informs the trader that due to the current losses in all open positions the money on the account is not enough to sustain those positions. The trader then needs either to deposit their account or close some of the positions, otherwise a Stop Out might follow.

Stop Out

Stop Out means forced closing of losing positions by the broker at the current market price when the ratio of the trader's capital to margin reaches a critical level (set by the broker). After the positions close, the trader's deposit will get corrected according to the losses they suffered. Losing positions will keep closing until the said ratio exceeds the Stop Out level.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team

Author : Victor Gryazin

Dear Clients and Partners,

This overview is devoted to the main types of orders used on MetaTrader platforms. Orders serve to open and close positions, limit losses and take the profit.

Main order types in trading

For trading in financial markets, there are two main types of orders used:

Market order is the simplest and most understandable of all. This is an order to sell or buy the asset at the current market price immediately. The priority of the order is obligatory execution, if only there is enough liquidity in the market. Positions open (or close) at once. When volatility is high, so-called "slips" occur, which means the actual execution price differs from the Bid or Ask price at the ordering moment.

Limit order is an order to sell or buy the asset at the specified price. Limit orders will not allow making trades at a worse price than said in the order, yet it is not guaranteed that the order will be executed. In other words, the order will be executed only if there is the limit (or best) price in the market. If otherwise, the order will not be executed.

Based on these two orders, there have been creates several order types on MetaTrader platforms. On other platforms, things might work differently.

Opening orders

Buy Limit

This is a limit order to buy the asset at a price no worse than the specified one. Also, this order can be used when you need to limit the price of a not most liquid asset you are buying.

For example, when Brent oil price is $80, while the trader wants it cheaper — at $70 — they can place a pending Buy Limit order at the desirable price level. The position will open as soon as the Ask price reaches the specified level.

Sell Limit

This is a limit order to sell the asset at a price no lower than the one set in the order. This type can be used when you need to limit the selling price of a non-liquid asset.

For example, if gold now costs $1,800, and the trader wants to sell it when the price reaches $2,000, they can place a Sell Limit order at this level. As soon as the Bid price reaches the desired level, a selling position will open.

Closing orders

After a position is open, the trader needs to specify its closing conditions. As a rule, there are two options: Take Profit for a price going as forecast and Stop Loss for a price going against the trader.

Take Profit

Take Profit is a pending order that closes the position without trader's participation. A placed order automatically closes a gaining position as soon as the price reaches the specified level.

For example, the trader buys Brent oil at $70 and expects it to grow to $100 in the nearest future, where they will close the position with a profit. Hence, they can place a Take Profit at $100, and the position will close automatically, as soon as the quotations reach the level.

Margin Call and Stop Out

There are also such important phenomena as Margin Call and Stop Out.

Margin Call

This is a notification by which the broker informs the trader that due to the current losses in all open positions the money on the account is not enough to sustain those positions. The trader then needs either to deposit their account or close some of the positions, otherwise a Stop Out might follow.

Stop Out

Stop Out means forced closing of losing positions by the broker at the current market price when the ratio of the trader's capital to margin reaches a critical level (set by the broker). After the positions close, the trader's deposit will get corrected according to the losses they suffered. Losing positions will keep closing until the said ratio exceeds the Stop Out level.

Read more at R Blog - RoboForex

Sincerely,

RoboForex team