Decisive Week Ahead for the ECB and the Euro

The first week of the month ended up with the Non-Farm Payrolls (NFP) in the United States showing a strong rebound of the US labor market. The NFP report revealed that the job market added double the number of jobs that the economists forecasted. As such, the perspective of a faster than expected recovery is not an illusion anymore but a fact.

On top of that, the White House announced that the US will have a vaccine available for every adult by the end of April this year. This puts the US economy in front when it comes to the economic recovery after the pandemic, as the vaccines appear to be effective and the rest of the world lags in its vaccination efforts.

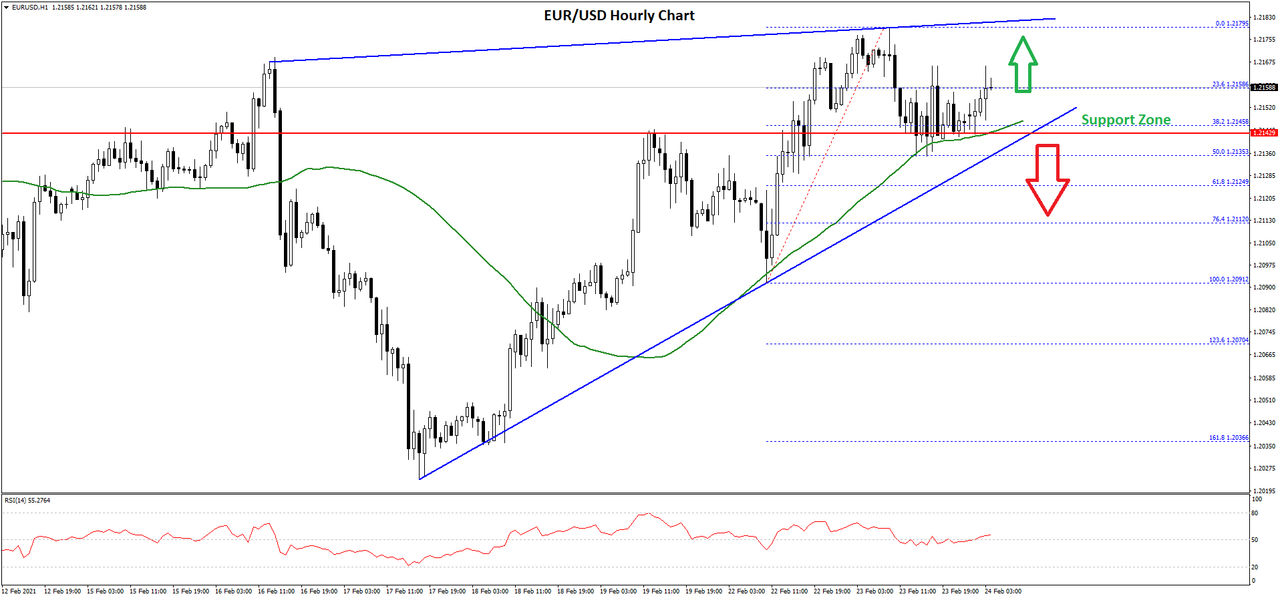

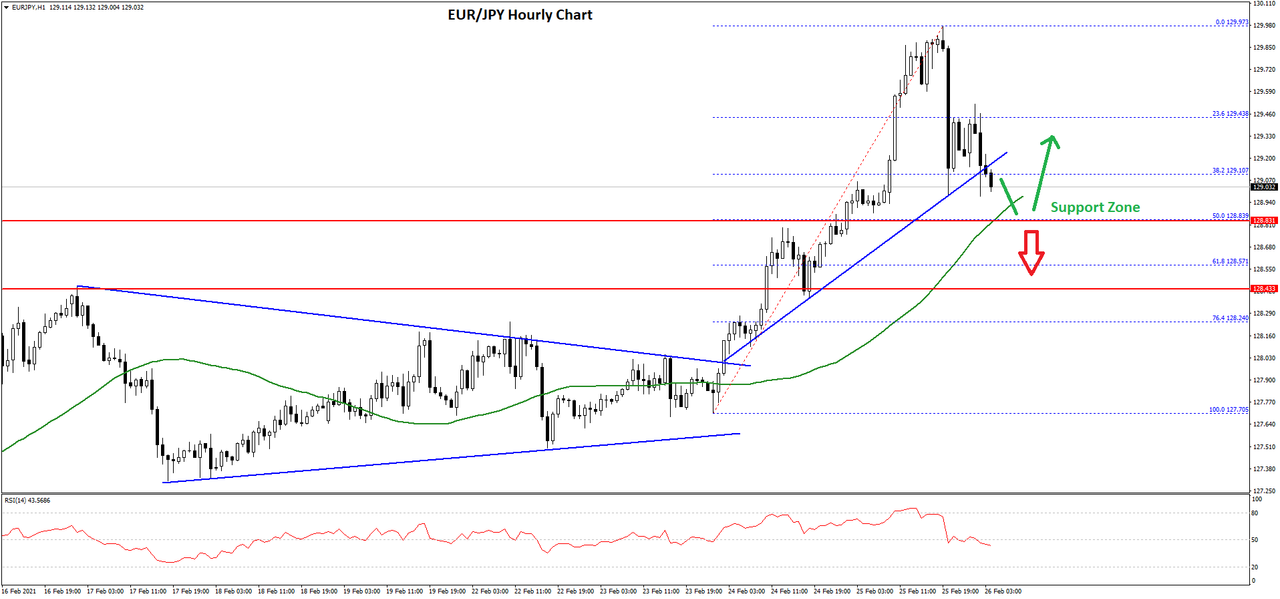

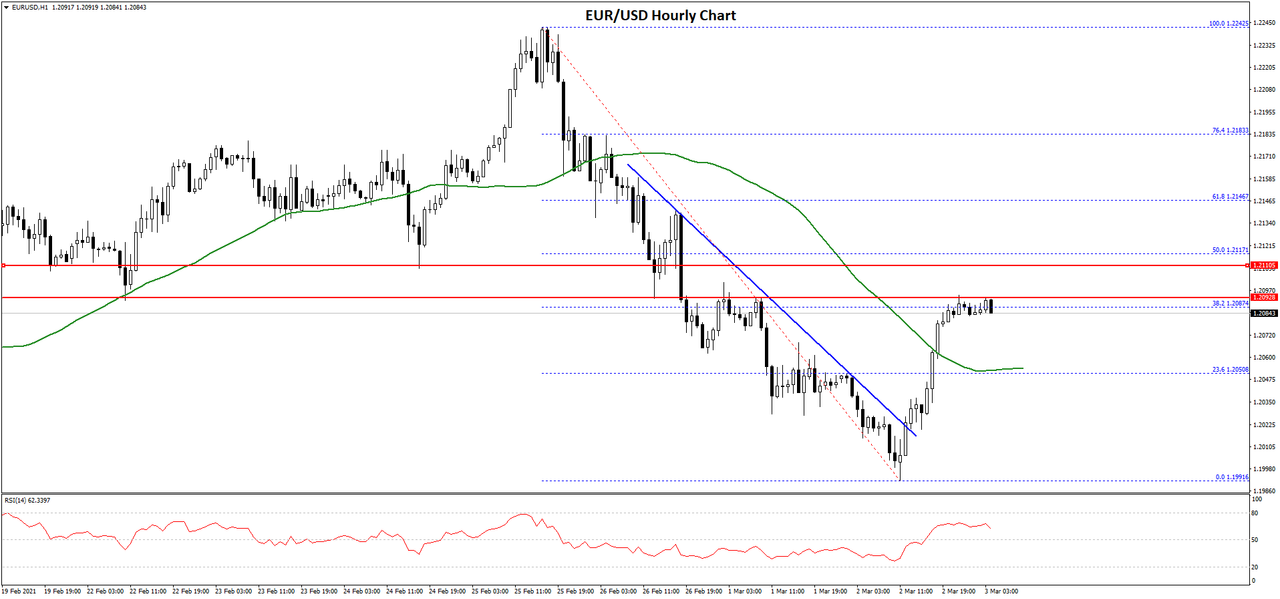

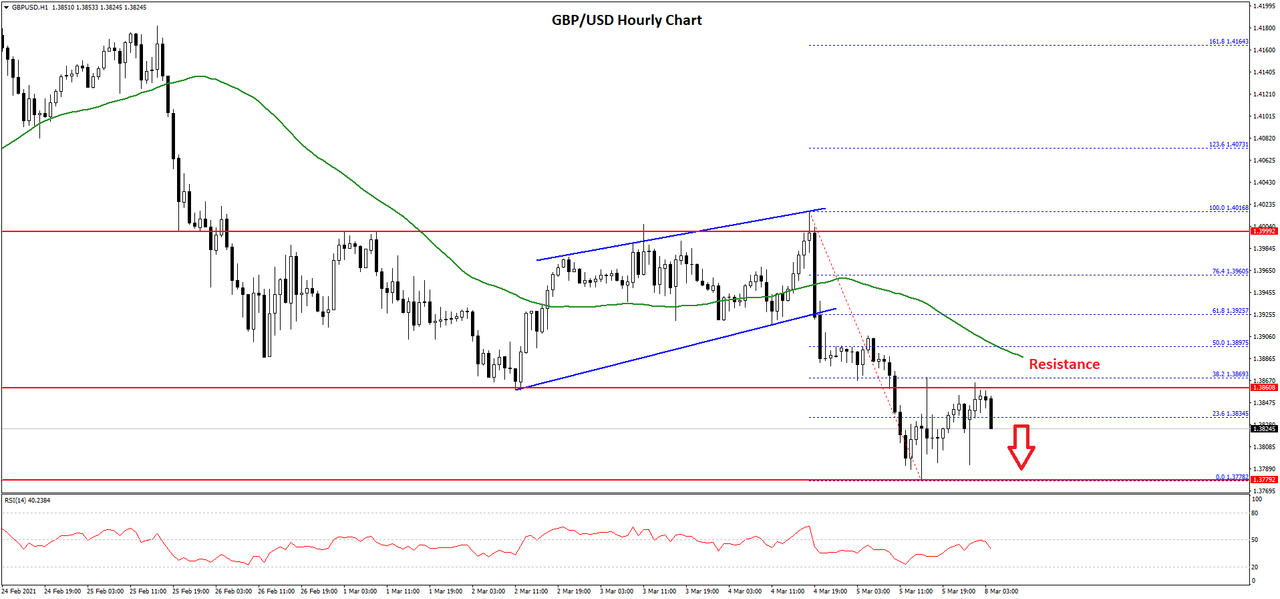

Unsurprisingly, the US dollar gained across the board. The USDJPY closed the week above 108, the EURUSD pair fell to 1.19, and even the AUDUSD dropped three big figures from its 0.80 highs.

While the previous week was exciting, as all NFP weeks are, the week ahead is even more interesting. The name of the game this week is what the European Central Bank (ECB) will do at its Thursday meeting.

ECB in Focus This Week

The euro area economies did not perform so well as the United States economy did. Just the opposite. In Europe, the COVID-19 pandemic hit the economies multiple times, with two or three pandemic waves resulting in more deaths than expected. As a consequence, most of the economies were closed for most of last year and in 2021 as well.

So, when the US is thinking of the economic growth ahead, Europe barely deals with the pandemic. The European Commission failed to secure vaccines for its population, and the speed of administering the existing ones is much slower than anything we have seen in other countries (e.g., United States, United Kingdom, Israel). Like it or not, the difference will be seen in the economic performances in the period ahead, and Europe is poised to lag its rivals.

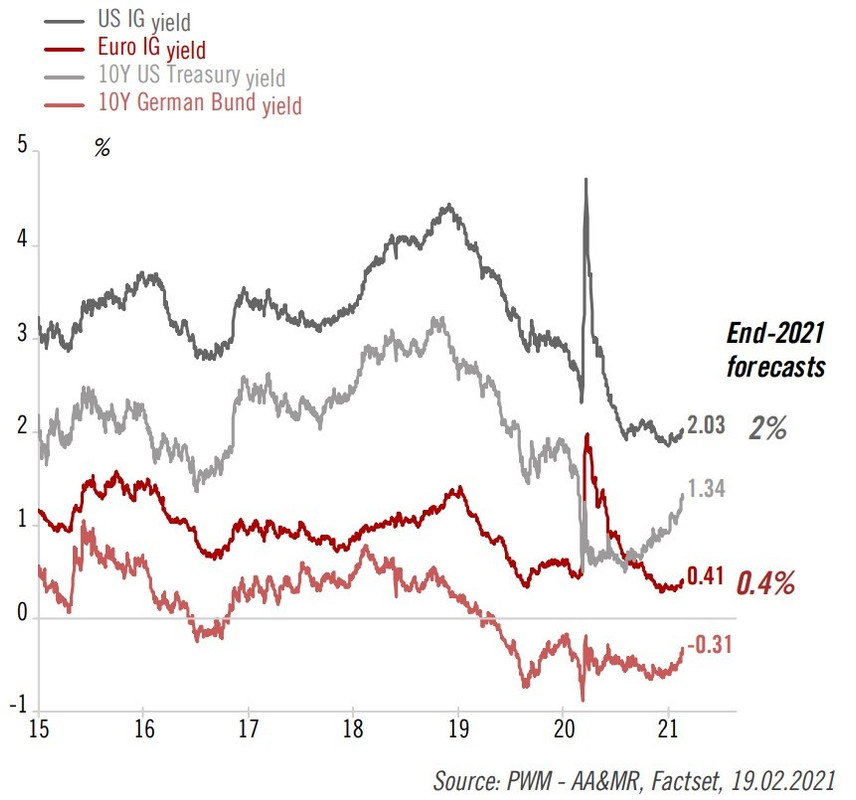

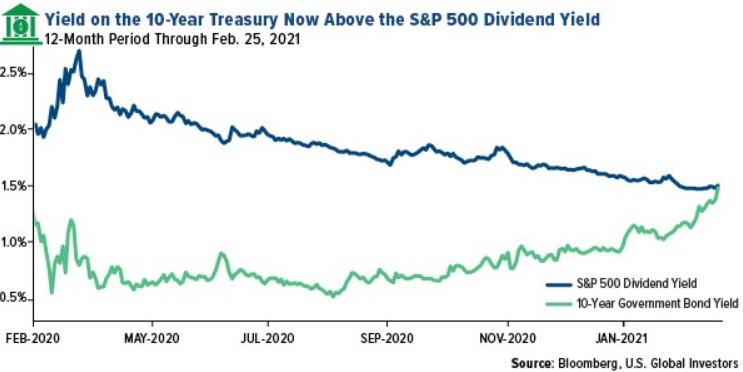

More problematic for the ECB is the tightening of long-term yields in the United States. The move higher in the US yields, which are the benchmark for risk-free rates in the world, triggered a similar move in other jurisdictions – e.g., the Bund yields in Germany are on the rise too.

Higher yields signal economic recovery. While in the US, higher yields are a logical market reaction to the improved economic picture and the fast vaccination rate, in Europe, higher yields bring a challenge. When yields are rising, financial conditions tighten. This is a problem for the ECB, as it does not want tightening conditions while the economy continues to underperform.

Hence, Thursday’s ECB meeting is crucial for the ECB and the euro. On the one hand, the ECB must act to wind down the unwanted tightening. On the other hand, the EURUSD exchange rate keeps trading in a tight correlation with the equity markets in the United States. Should the ECB expand the asset-buying program (i.e., PEPP), the EURUSD may fall much lower than the current levels.

FXOpen Blog