FXOpen Trader

Active Member

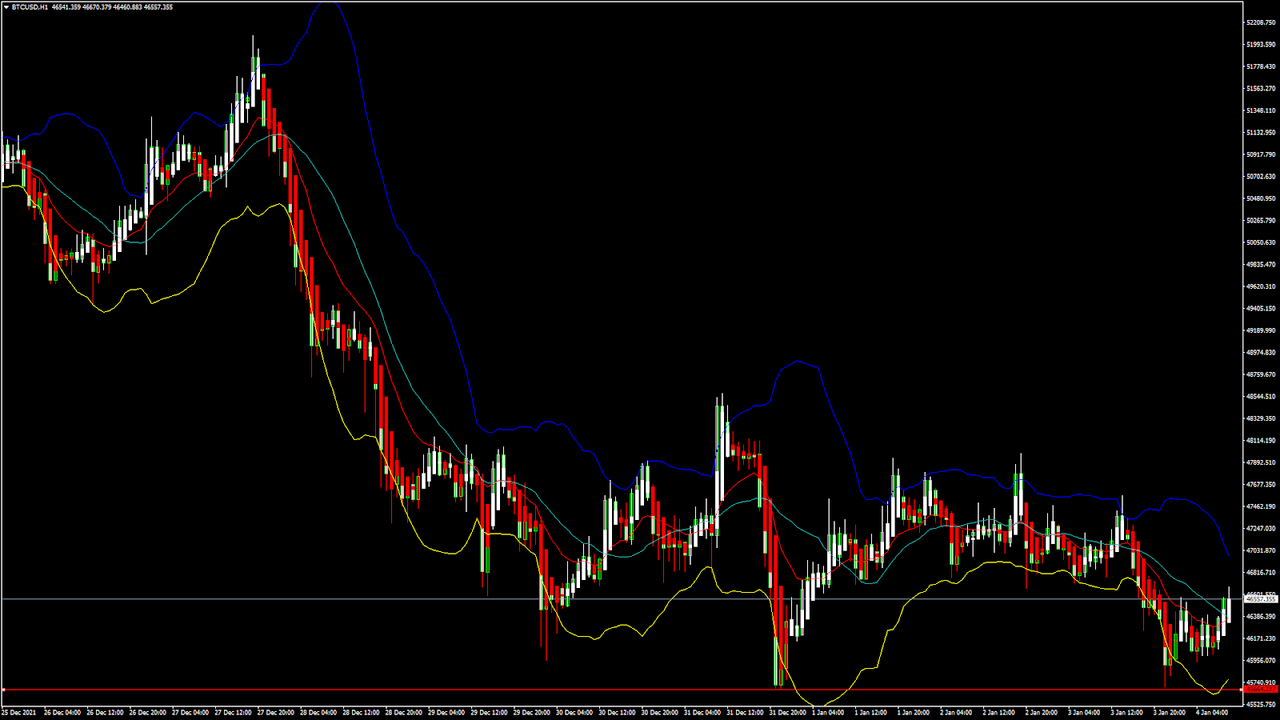

BTCUSD and XRPUSD Technical Analysis – 04th JAN 2022

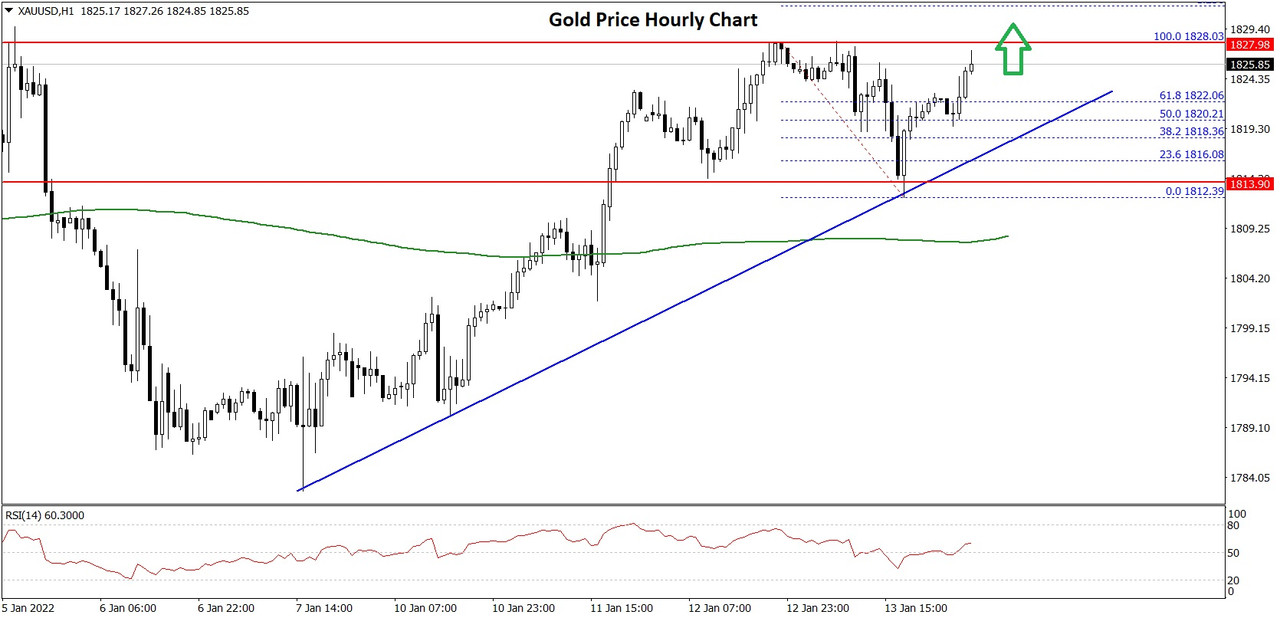

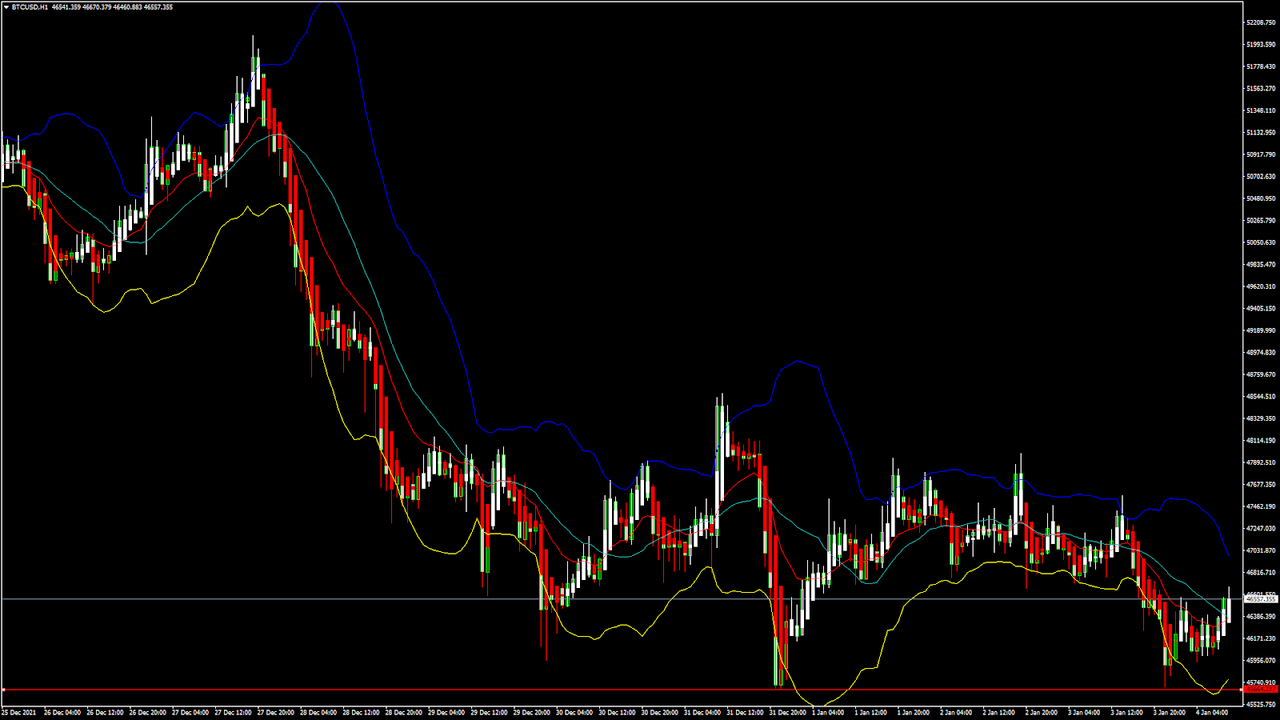

BTCUSD: Double Bottom Pattern Above $45,000

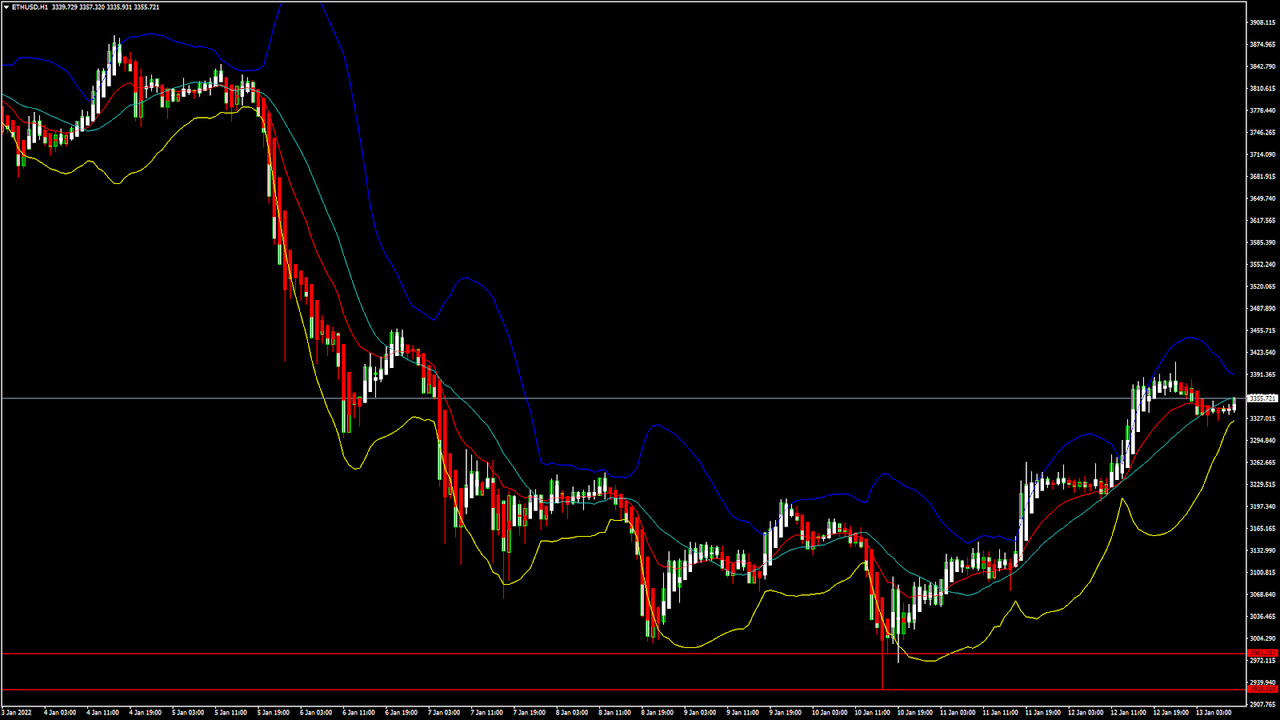

Bitcoin started this week on a bearish tone, and the price continued to slide touching a low of $45,725 on 3rd January, after which we can see some fresh buying in bitcoin markets globally.

Some pullback action can be observed in the European trading session today, and the prices of BTCUSD are ranging above the $46,000 handle.

We can clearly see a double bottom pattern above $45,000, which signifies the end of a downtrend and a shift towards an uptrend.

Both Stoch and StochRSI are indicating an OVERBOUGHT level, meaning that in the immediate short-term, a decline in the prices is expected.

With global cryptocurrency markets staging mixed trading signals we will have to wait before entering into any buying positions in bitcoin.

The relative strength index is at 52 indicating a NEUTRAL market and a move towards a market consolidation phase.

Bitcoin is now moving below its 100 hourly simple and exponential moving averages.

The average true range is indicating a lesser market volatility which means that markets are due to enter into a consolidation phase.

Bitcoin: Bullish Reversal Above $45,000 Confirmed

Bitcoin is forming a bullish trend pattern which means that the prices can start moving upwards due to the buying pressure that is coming into the global cryptocurrency markets.

The moving averages are giving a NEUTRAL signal; however, we have detected a MA 20 crossover pattern which is an indication for the bullish reversal of the markets. This bullish trend is mild and will have to wait till we can see a STRONG BUY signal from the moving averages.

All of the major technical indicators are giving a STRONG BUY signal, which means that in the immediate short-term we are expecting targets of $47,000 and $48,000.

The price of BTCUSD is now facing its classic resistance level of $46,639 and Fibonacci resistance level of $46,731, after which the path towards $47,000 will get cleared.

In the last 24hrs, BTCUSD has gone DOWN by -1.01% with a price change of 477$, and has a 24hr trading volume of USD 34.438 billion. We can see an Increase of 19.26% in the trading volume as compared to yesterday. This increase is due to the increased buying pressure seen after the recent decline in bitcoin.

The Week Ahead

We can see that bitcoin has started its upside correction after the decline and continues to trade above $46,500.

The recent decline we saw from the high of $68,984 reached on 10th November, 2021, happened due to the profit taking and the market liquidation by big investors and the global hedge funds.

The downside wave correction now seems to be finally over and we are ready for an upswing move towards the $50,000 handle in January 2022.

The short-term outlook is positive; the medium to long-term outlook remains BULLISH for bitcoin with targets of $55,000 to $60,000 in 2022.

BTC Gains in 2021

In 2021, we saw a 66% gain in bitcoin, which was lower than Ethereum’s 421% jump.

In contrast, we saw a marginal decline in the value of gold without any gains, whereas the US S&P 500 saw gains of 31% during the same period.

Bitcoin still remains the topmost cryptocurrency of the world with a total market capitalization of 881.48 billion USD.

Technical Indicators:

Commodity channel index (14-day): at 161.63 indicating a BUY

Average directional change (14-day): at 36.94 indicating a BUY

Rate of price change: at 0.399 indicating a BUY

Bull/bear power (13-day): at 316.27 indicating a BUY

Read Full on FXOpen Company Blog...

BTCUSD: Double Bottom Pattern Above $45,000

Bitcoin started this week on a bearish tone, and the price continued to slide touching a low of $45,725 on 3rd January, after which we can see some fresh buying in bitcoin markets globally.

Some pullback action can be observed in the European trading session today, and the prices of BTCUSD are ranging above the $46,000 handle.

We can clearly see a double bottom pattern above $45,000, which signifies the end of a downtrend and a shift towards an uptrend.

Both Stoch and StochRSI are indicating an OVERBOUGHT level, meaning that in the immediate short-term, a decline in the prices is expected.

With global cryptocurrency markets staging mixed trading signals we will have to wait before entering into any buying positions in bitcoin.

The relative strength index is at 52 indicating a NEUTRAL market and a move towards a market consolidation phase.

Bitcoin is now moving below its 100 hourly simple and exponential moving averages.

The average true range is indicating a lesser market volatility which means that markets are due to enter into a consolidation phase.

- Bitcoin trend reversal is seen above $45,000

- Williams percent range is indicating an OVERBOUGHT level

- The price is now trading just above its pivot levels of $46,489

- All moving averages are giving a NEUTRAL market signal

Bitcoin: Bullish Reversal Above $45,000 Confirmed

Bitcoin is forming a bullish trend pattern which means that the prices can start moving upwards due to the buying pressure that is coming into the global cryptocurrency markets.

The moving averages are giving a NEUTRAL signal; however, we have detected a MA 20 crossover pattern which is an indication for the bullish reversal of the markets. This bullish trend is mild and will have to wait till we can see a STRONG BUY signal from the moving averages.

All of the major technical indicators are giving a STRONG BUY signal, which means that in the immediate short-term we are expecting targets of $47,000 and $48,000.

The price of BTCUSD is now facing its classic resistance level of $46,639 and Fibonacci resistance level of $46,731, after which the path towards $47,000 will get cleared.

In the last 24hrs, BTCUSD has gone DOWN by -1.01% with a price change of 477$, and has a 24hr trading volume of USD 34.438 billion. We can see an Increase of 19.26% in the trading volume as compared to yesterday. This increase is due to the increased buying pressure seen after the recent decline in bitcoin.

The Week Ahead

We can see that bitcoin has started its upside correction after the decline and continues to trade above $46,500.

The recent decline we saw from the high of $68,984 reached on 10th November, 2021, happened due to the profit taking and the market liquidation by big investors and the global hedge funds.

The downside wave correction now seems to be finally over and we are ready for an upswing move towards the $50,000 handle in January 2022.

The short-term outlook is positive; the medium to long-term outlook remains BULLISH for bitcoin with targets of $55,000 to $60,000 in 2022.

BTC Gains in 2021

In 2021, we saw a 66% gain in bitcoin, which was lower than Ethereum’s 421% jump.

In contrast, we saw a marginal decline in the value of gold without any gains, whereas the US S&P 500 saw gains of 31% during the same period.

Bitcoin still remains the topmost cryptocurrency of the world with a total market capitalization of 881.48 billion USD.

Technical Indicators:

Commodity channel index (14-day): at 161.63 indicating a BUY

Average directional change (14-day): at 36.94 indicating a BUY

Rate of price change: at 0.399 indicating a BUY

Bull/bear power (13-day): at 316.27 indicating a BUY

Read Full on FXOpen Company Blog...