FXOpen Trader

Active Member

Solid Jobs Report Sends the US Dollar Higher

The US dollar reversed the recent losses and closed the last week higher. Responsible for the move was the July NFP report.

The market expected a positive report, but the outcome exceeded expectations. The US economy added over 940k new jobs in July. Moreover, the data for the previous month was revised higher by over 100k jobs.

All the elements in the report pointed to a strong recovery of the US economy. Besides the better headline number, the Unemployment Rate declined to 5.4% – another positive development.

Sure enough, the US economy still needs to recover about 5 million jobs lost during the pandemic. But solid reports like the one from last Friday bring the Fed closer to fulfill its employment mandate, and thus the tightening of the financial conditions may be just around the corner.

The Fed, as a central bank, has a dual mandate. It aims at price stability and maximum employment.

The price stability mandate is monitored by the changes in inflation. Inflation is already above Fed’s target, even though it is unclear how long is the period the Fed looks at averaging inflation to 2%.

What remains is improvements in the labor market – and the July NFP report shows such improvements. The bias is now that the Fed will announce the tapering of its asset purchases sooner than expected, and so the US dollar ticked higher on the news.

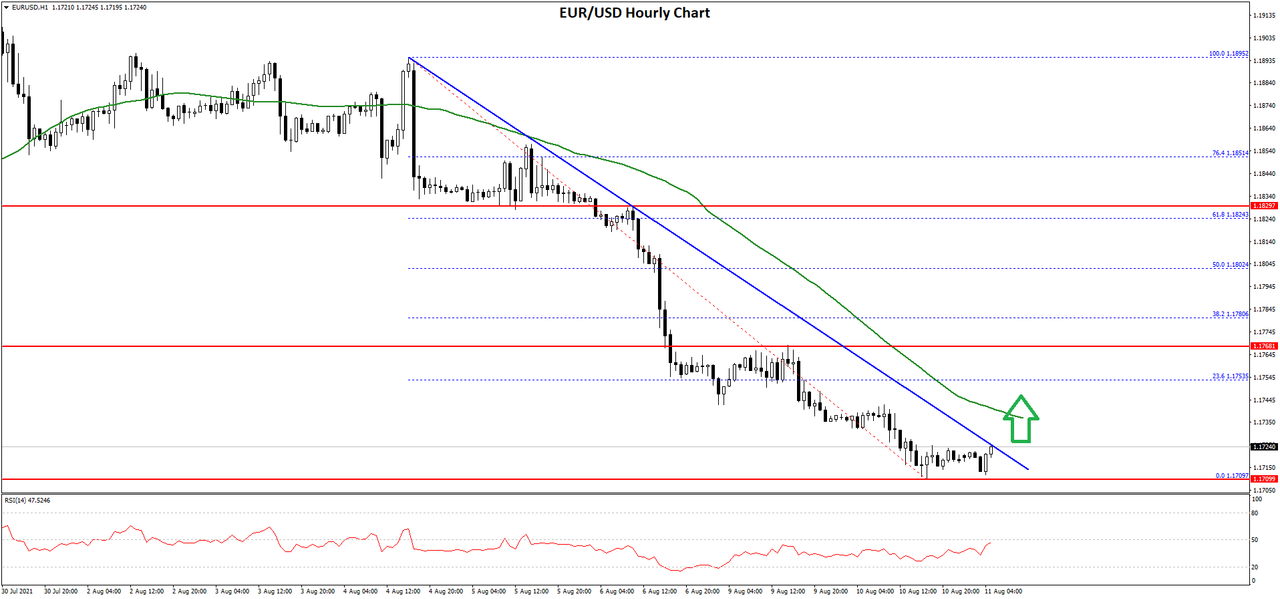

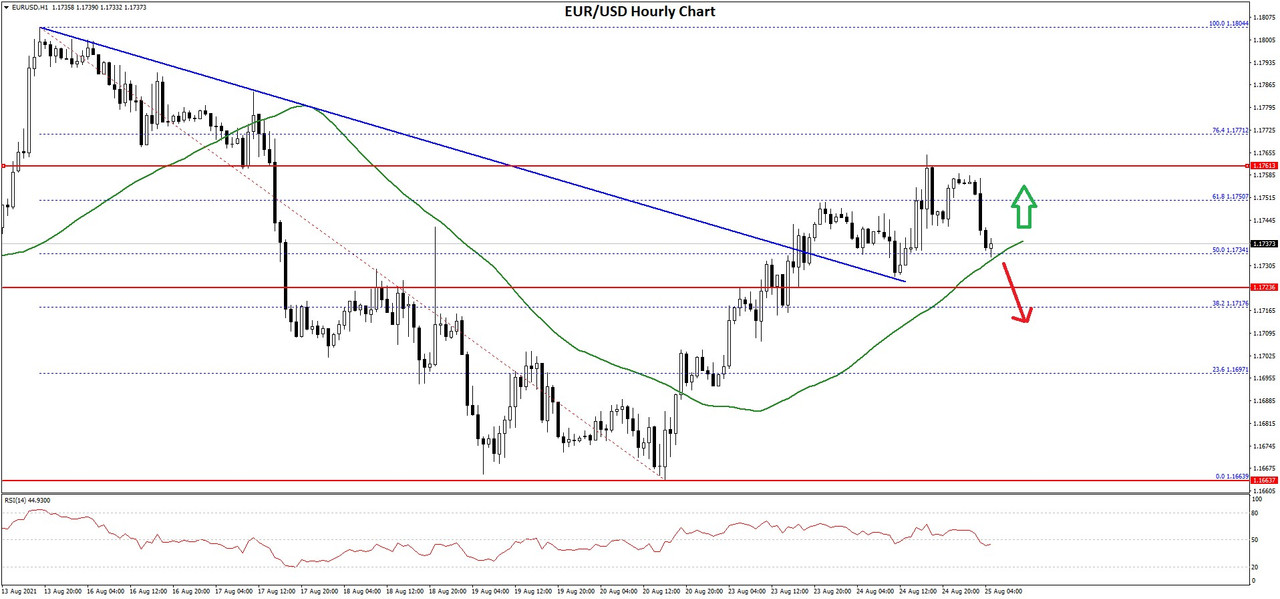

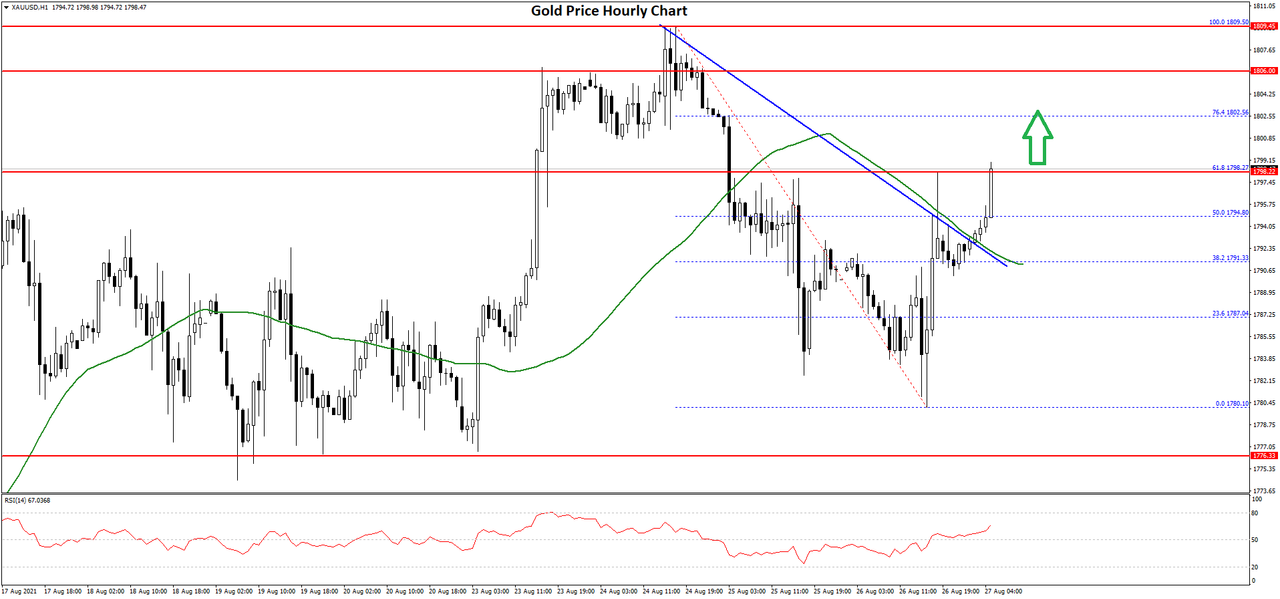

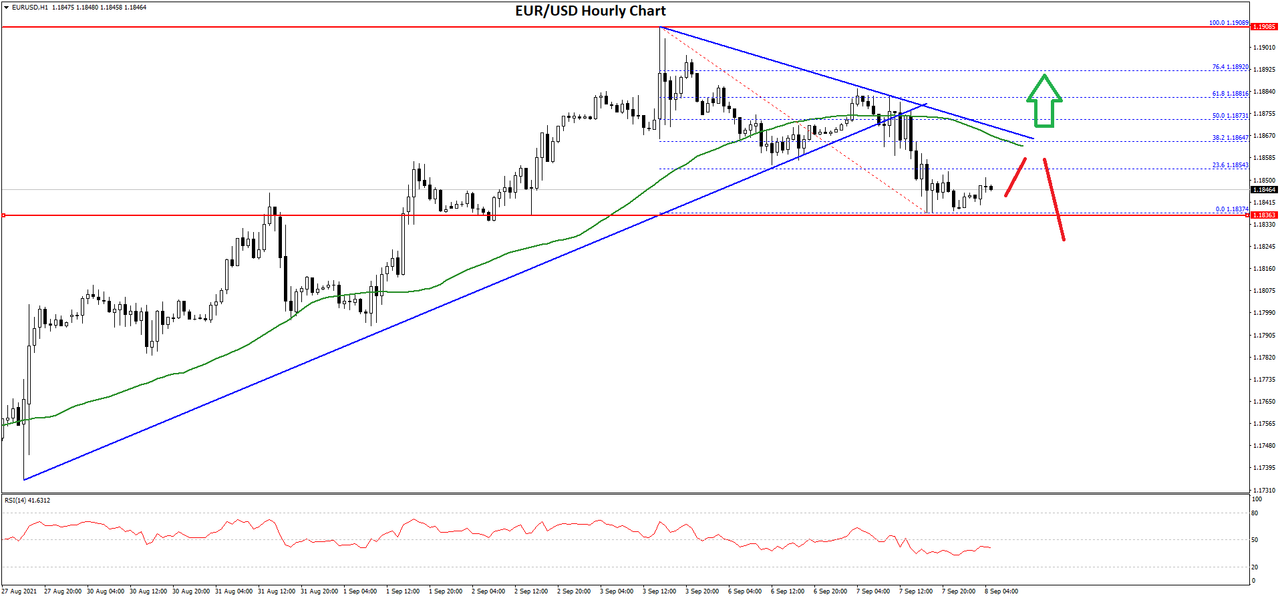

The Technical Picture Also Favors a Stronger Dollar

From a technical analysis perspective, the US dollar may be at the end of a cycle. The Dollar index formed a double top at the 100 level, but it recently found both horizontal and dynamic support in the 90 area.

A quick look at the rising trend reveals the fact that the Dollar index has kept the series of higher lows intact, just like it is supposed to do in a rising trend. Hence, as long as the index holds above 89, the bias remains bullish.

Moving forward, traders will look for clues about what the Fed will do next. Is the July NFP report strong enough to trigger earlier tapering? If yes, the US dollar’s rally should continue unabated.

FXOpen Blog

The US dollar reversed the recent losses and closed the last week higher. Responsible for the move was the July NFP report.

The market expected a positive report, but the outcome exceeded expectations. The US economy added over 940k new jobs in July. Moreover, the data for the previous month was revised higher by over 100k jobs.

All the elements in the report pointed to a strong recovery of the US economy. Besides the better headline number, the Unemployment Rate declined to 5.4% – another positive development.

Sure enough, the US economy still needs to recover about 5 million jobs lost during the pandemic. But solid reports like the one from last Friday bring the Fed closer to fulfill its employment mandate, and thus the tightening of the financial conditions may be just around the corner.

The Fed, as a central bank, has a dual mandate. It aims at price stability and maximum employment.

The price stability mandate is monitored by the changes in inflation. Inflation is already above Fed’s target, even though it is unclear how long is the period the Fed looks at averaging inflation to 2%.

What remains is improvements in the labor market – and the July NFP report shows such improvements. The bias is now that the Fed will announce the tapering of its asset purchases sooner than expected, and so the US dollar ticked higher on the news.

The Technical Picture Also Favors a Stronger Dollar

From a technical analysis perspective, the US dollar may be at the end of a cycle. The Dollar index formed a double top at the 100 level, but it recently found both horizontal and dynamic support in the 90 area.

A quick look at the rising trend reveals the fact that the Dollar index has kept the series of higher lows intact, just like it is supposed to do in a rising trend. Hence, as long as the index holds above 89, the bias remains bullish.

Moving forward, traders will look for clues about what the Fed will do next. Is the July NFP report strong enough to trigger earlier tapering? If yes, the US dollar’s rally should continue unabated.

FXOpen Blog