Vlad RF

Well-Known Member

11 Rules of Risk Management. Ultimate Guide

Dear Clients and Partners,

As it has been mentioned lots of times, working on financial markets implies high risk; in order to become a successful trader, one should minimize potential risks. This article is devoted exactly to reducing them. I would like to mention that this list of actions was suggested by one of the Stocks&Commodities authors George R. Arrington.

Let us have a look at the list of rules necessary for minimizing possible losses. I think that if you trade or have ever traded before, you have used at least some of them, perhaps unconsciously.

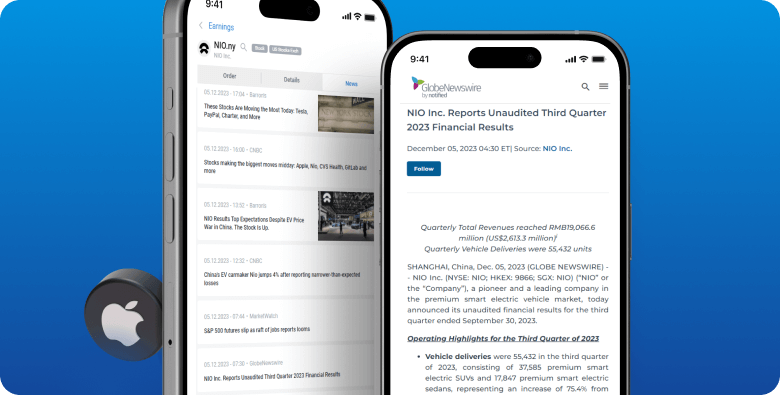

1. Before opening a trade make a thorough analysis

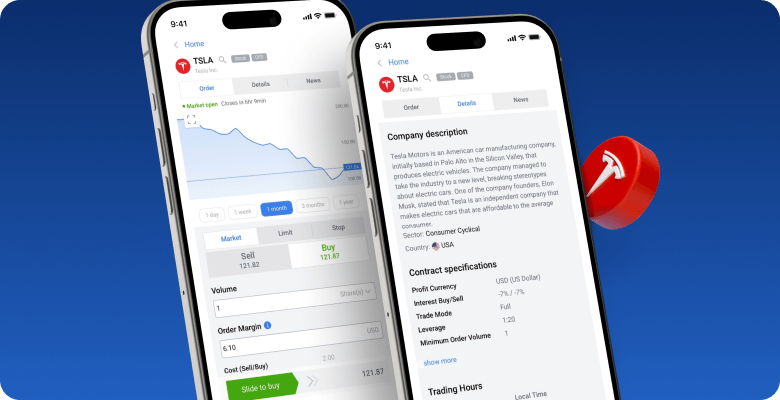

Before putting your capital in danger, you should make sure that you have full information and realize well why you want to open the trade. Aside from a detailed analysis of charts, you should form a clear idea of the amount of capital you are ready to risk in this particular trade and of the point, where you are planning to enter the position, for the trade not to become losing even if the market turns against you.

Carrying out the analysis, prepare a list of instruments with a description of reasons for opening the trades and the levels of entrance and exit (if the number of your open positions is scarce, you can keep this list in mind). Upon calculating the risks, cross out too risky ones and those with ambiguous signals. This is the way to make a preliminary selection of trades and eliminate the least efficient of them.

2. Make a trading plan

What is more: if you put effort into creating the plan, stick to it. Each and every one speaks a lot about trading plans, though the views on their efficiency differ radically. Anyway, a plan is necessary as it helps avoid spontaneous actions, performed emotionally and leading to unreasonable losses. Having a well-drafted plan and following it, you will be insured from impulsive actions and will gain confidence.

What is the plan comprised of? It is basically a list of your everyday operations in accordance with your trading style. You have to make an investigation and create a method fitting you in all details, then write it down.

What is more, you should describe acceptable risk for every position and for all trades together, as well as your approximate goals, justifying the losses. If you embed a 2% risk into a trade and receive 1% on exit, you compromise your position at once, because sooner or later your losses will eat up your profit, and the trade will become losing. If during trading you deplete your loss limits, it would be wise to make a pause, exit the market and think about what has happened.

One more important hing: if at a certain moment you realize that the meaning of market events escapes you, do not follow the plan blindly, close all positions and wait for the situation to stabilize and become clearer. Also, do not open trades on the basis of someone’s view or advice, act independently after a thorough analysis of the situation.

3. Diversify your assets

Let us recall one more method, well-known bur not always used – diversification. It allows to decrease risks significantly, acting in two directions:

4. Do not put all your savings on your trading account

It is recommended to use only part of your capital for trading. As the saying goes, do not put all your eggs in one basket. What is more, if a trade looks especially appealing, still do not be tempted to open it for the whole deposit, as the market may turn against you any moment. Make sure you have enough money on your account to keep the trades open easily. It is best to have some reserve on a separate account in order to restore the margin quickly in case of an undesirable price movement. Some traders purposefully open several accounts for trading or deposit the main account for such a sum that will let them open just one or two trades to avoid the temptation of putting all money in trading.

Read more at R Blog - RoboForex

Sincerely,

The RoboForex Team

Dear Clients and Partners,

As it has been mentioned lots of times, working on financial markets implies high risk; in order to become a successful trader, one should minimize potential risks. This article is devoted exactly to reducing them. I would like to mention that this list of actions was suggested by one of the Stocks&Commodities authors George R. Arrington.

Let us have a look at the list of rules necessary for minimizing possible losses. I think that if you trade or have ever traded before, you have used at least some of them, perhaps unconsciously.

1. Before opening a trade make a thorough analysis

Before putting your capital in danger, you should make sure that you have full information and realize well why you want to open the trade. Aside from a detailed analysis of charts, you should form a clear idea of the amount of capital you are ready to risk in this particular trade and of the point, where you are planning to enter the position, for the trade not to become losing even if the market turns against you.

Carrying out the analysis, prepare a list of instruments with a description of reasons for opening the trades and the levels of entrance and exit (if the number of your open positions is scarce, you can keep this list in mind). Upon calculating the risks, cross out too risky ones and those with ambiguous signals. This is the way to make a preliminary selection of trades and eliminate the least efficient of them.

2. Make a trading plan

What is more: if you put effort into creating the plan, stick to it. Each and every one speaks a lot about trading plans, though the views on their efficiency differ radically. Anyway, a plan is necessary as it helps avoid spontaneous actions, performed emotionally and leading to unreasonable losses. Having a well-drafted plan and following it, you will be insured from impulsive actions and will gain confidence.

What is the plan comprised of? It is basically a list of your everyday operations in accordance with your trading style. You have to make an investigation and create a method fitting you in all details, then write it down.

What is more, you should describe acceptable risk for every position and for all trades together, as well as your approximate goals, justifying the losses. If you embed a 2% risk into a trade and receive 1% on exit, you compromise your position at once, because sooner or later your losses will eat up your profit, and the trade will become losing. If during trading you deplete your loss limits, it would be wise to make a pause, exit the market and think about what has happened.

One more important hing: if at a certain moment you realize that the meaning of market events escapes you, do not follow the plan blindly, close all positions and wait for the situation to stabilize and become clearer. Also, do not open trades on the basis of someone’s view or advice, act independently after a thorough analysis of the situation.

3. Diversify your assets

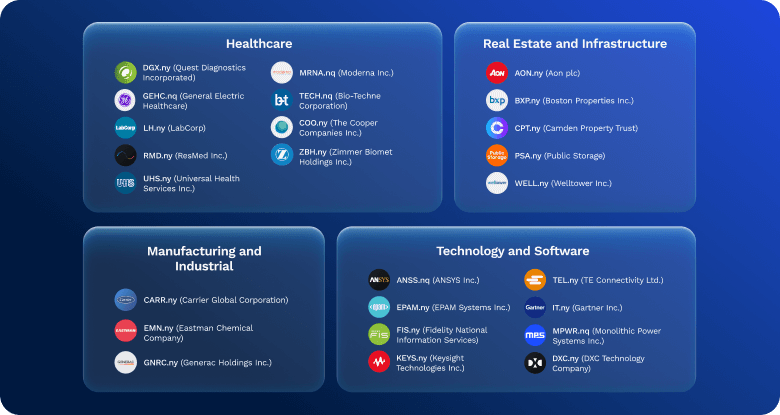

Let us recall one more method, well-known bur not always used – diversification. It allows to decrease risks significantly, acting in two directions:

- regulating risks by the volume of opening trades;

- spreading risks between various instruments.

4. Do not put all your savings on your trading account

It is recommended to use only part of your capital for trading. As the saying goes, do not put all your eggs in one basket. What is more, if a trade looks especially appealing, still do not be tempted to open it for the whole deposit, as the market may turn against you any moment. Make sure you have enough money on your account to keep the trades open easily. It is best to have some reserve on a separate account in order to restore the margin quickly in case of an undesirable price movement. Some traders purposefully open several accounts for trading or deposit the main account for such a sum that will let them open just one or two trades to avoid the temptation of putting all money in trading.

Read more at R Blog - RoboForex

Sincerely,

The RoboForex Team