Solid ECN

Member

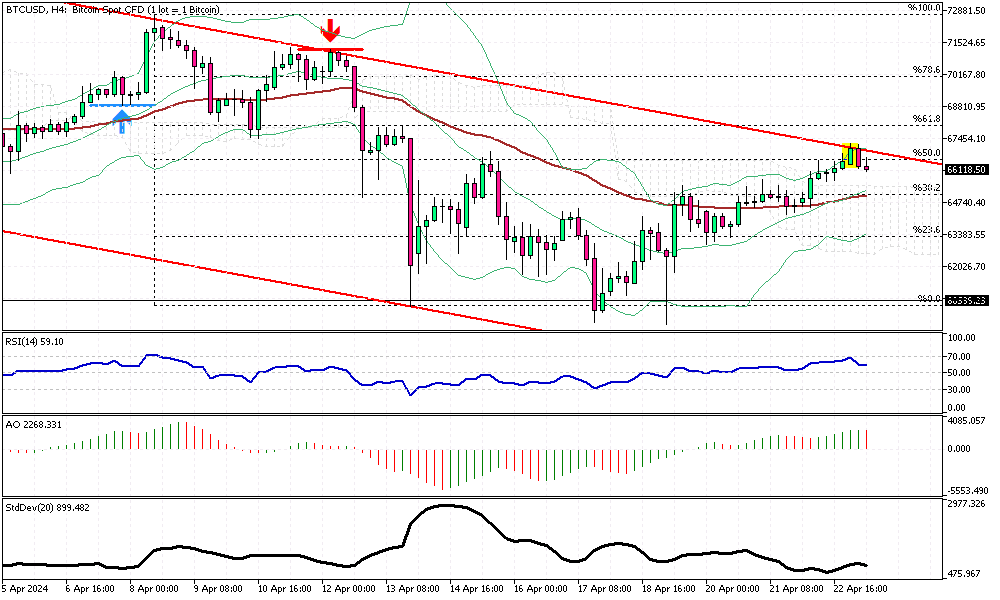

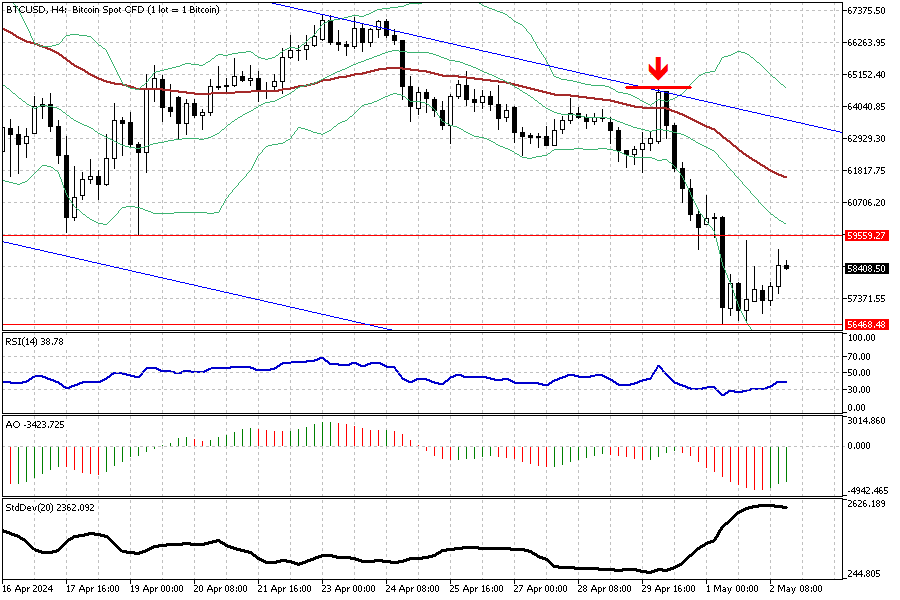

Understanding Bitcoin’s Recent Price Recovery

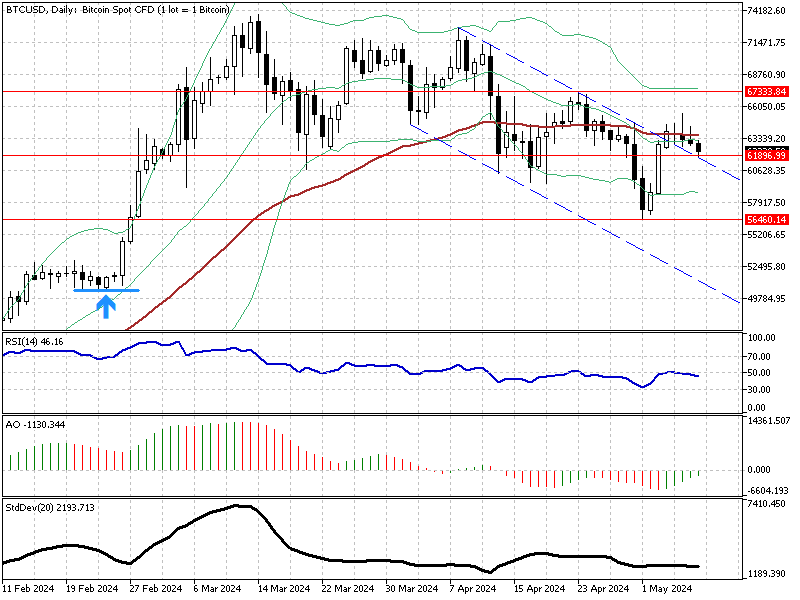

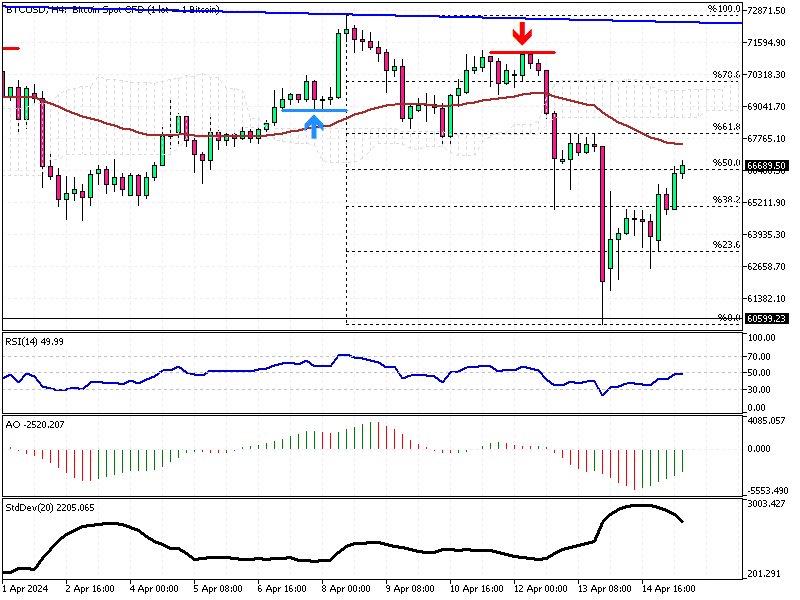

Bitcoin's price has rebounded from the $60,600 resistance, coinciding with the lows of April 5 and 20. This recovery was anticipated as the RSI indicator was previously in the oversold territory. As of this writing, the indicator is showing bullish signs, having flipped above the 50 level.

Consequently, the BTCUSD pair remains bullish, although it is currently trading below the Ichimoku cloud. The next bullish target is likely the upper band of the flag around $72,000. However, the bulls face the EMA 50 as a barrier, suggesting that there might be a consolidation phase or a minor pullback to the 38.2% Fibonacci support level before the uptrend resumes. This is particularly plausible considering the standard deviation indicator is losing momentum.

A critical factor keeping the market bullish is the $60,600 mark. Should the Bitcoin price dip below this level, the bullish scenario would need to be reevaluated.

Consequently, the BTCUSD pair remains bullish, although it is currently trading below the Ichimoku cloud. The next bullish target is likely the upper band of the flag around $72,000. However, the bulls face the EMA 50 as a barrier, suggesting that there might be a consolidation phase or a minor pullback to the 38.2% Fibonacci support level before the uptrend resumes. This is particularly plausible considering the standard deviation indicator is losing momentum.

A critical factor keeping the market bullish is the $60,600 mark. Should the Bitcoin price dip below this level, the bullish scenario would need to be reevaluated.