Solid ECN

Member

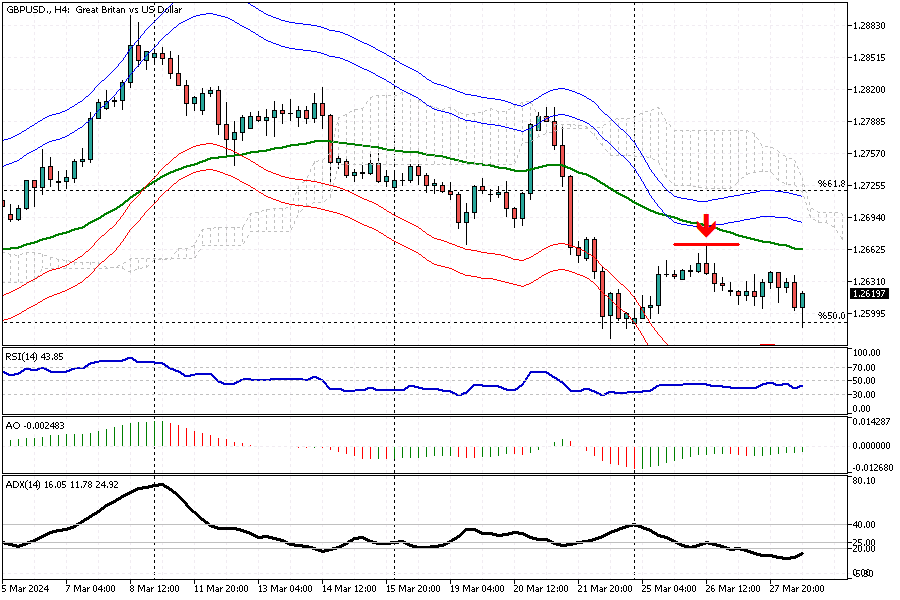

Analyzing GBPUSD's Bullish Sentiments Amid Recent Downtrend

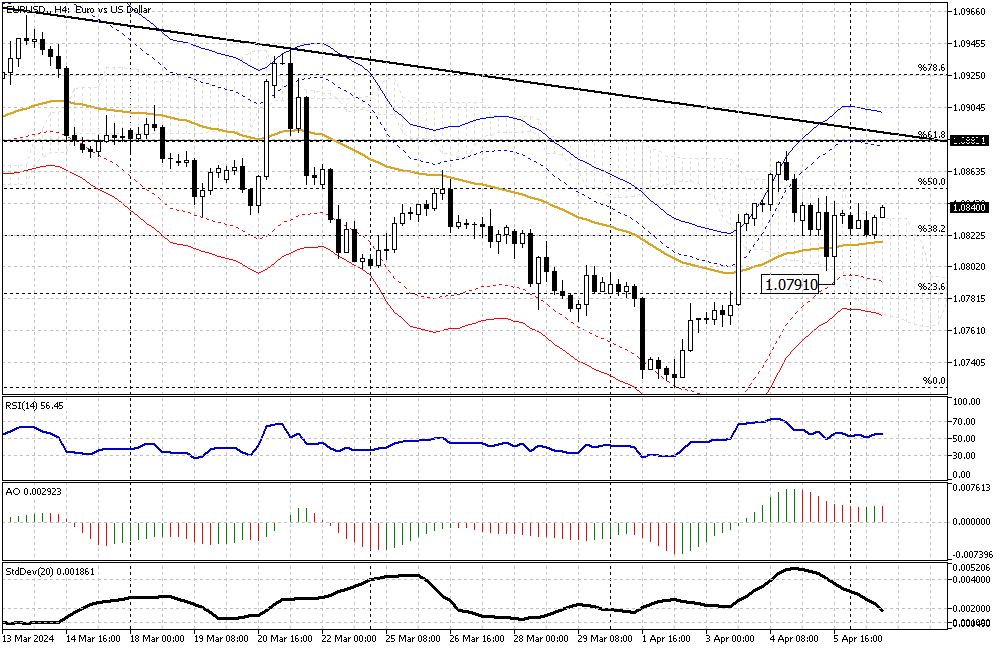

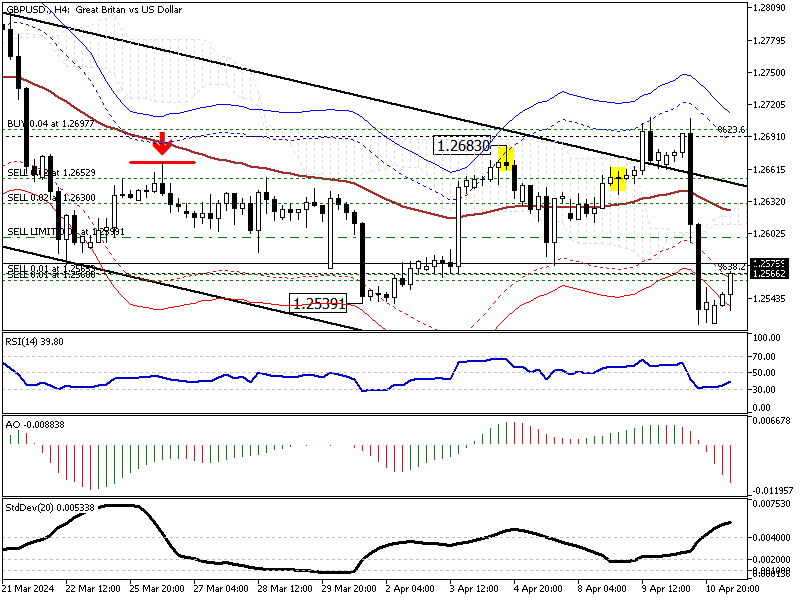

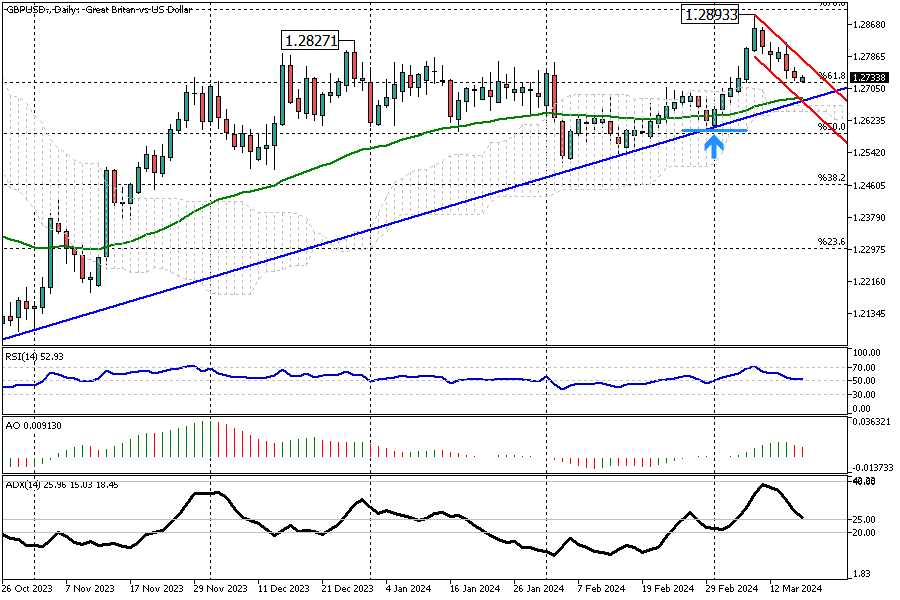

Solid ECN – Pound Sterling demonstrated its resilience at the start of the Monday trading session. It opened with a slight gap against the U.S. Dollar but quickly recovered. It is currently holding strong at around 1.273.

The pair trades above the bullish trend line, as indicated in blue on the GBPUSD chart. Therefore, the primary trend remains bullish. However, the price has fallen from the 1.289 high and is now experiencing a downtrend within the bearish channel, marked in red.

The data from the chart suggests that the current downward momentum may represent a consolidation phase, setting the stage for a potential bullish comeback. The EMA 50, aligning with the trend line and the resistance level supported by the Ichimoku cloud, could provide a solid support for buyers to initiate this optimistic turn of events.

Please note that the price must break out of the bearish channel for the uptrend to resume. In this scenario, the rise could continue and target the high from February as its first significant milestone.

The pair trades above the bullish trend line, as indicated in blue on the GBPUSD chart. Therefore, the primary trend remains bullish. However, the price has fallen from the 1.289 high and is now experiencing a downtrend within the bearish channel, marked in red.

The data from the chart suggests that the current downward momentum may represent a consolidation phase, setting the stage for a potential bullish comeback. The EMA 50, aligning with the trend line and the resistance level supported by the Ichimoku cloud, could provide a solid support for buyers to initiate this optimistic turn of events.

Please note that the price must break out of the bearish channel for the uptrend to resume. In this scenario, the rise could continue and target the high from February as its first significant milestone.