Solid ECN

Member

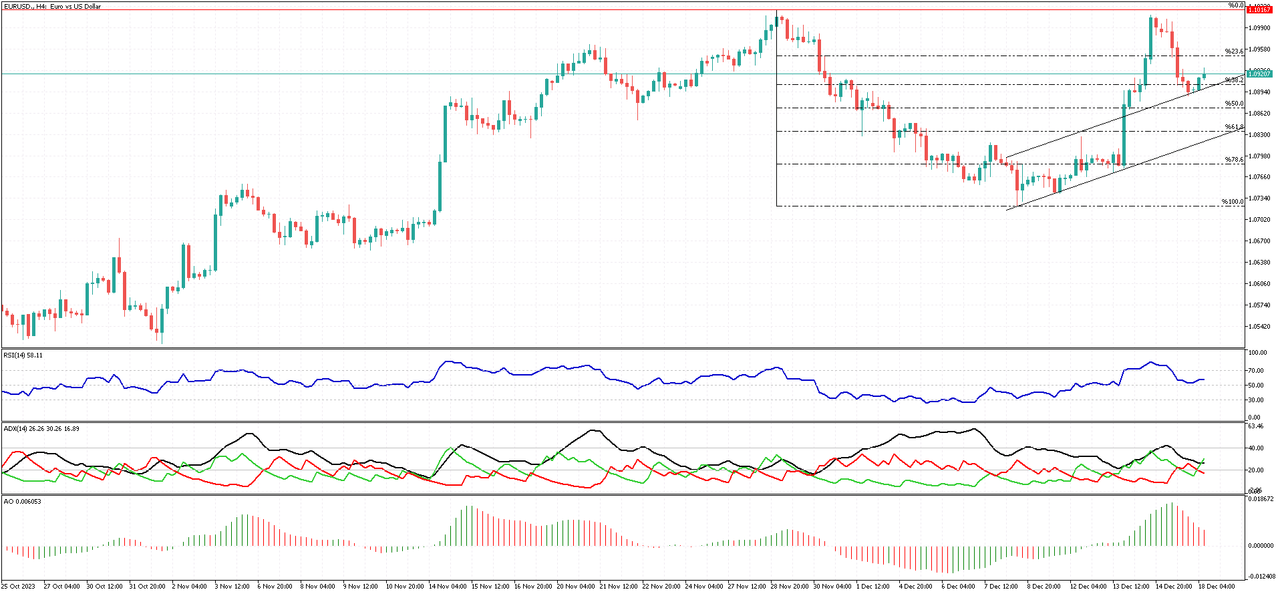

Euro Drops to Lowest in a Year as Investors Favor USD

As the US jobs report came out better than expected, investors turned their attention to the USD. This made the euro drop more, reaching its lowest level since November. The common currency was already under pressure because of the ECB policymakers’ comments. They said that they were not likely to raise interest rates soon, especially after the Euro Area’s inflation rate fell to the lowest in more than two years in November.

At the same time, Francois Villeroy de Galhau, who is an ECB member and the head of the Bank of France, said to a French publication that prices were falling faster than expected. This increased the chance of a rate cut in 2024.

As the US jobs report came out better than expected, investors turned their attention to the USD. This made the euro drop more, reaching its lowest level since November. The common currency was already under pressure because of the ECB policymakers’ comments. They said that they were not likely to raise interest rates soon, especially after the Euro Area’s inflation rate fell to the lowest in more than two years in November.

At the same time, Francois Villeroy de Galhau, who is an ECB member and the head of the Bank of France, said to a French publication that prices were falling faster than expected. This increased the chance of a rate cut in 2024.