ZigZag Fibonacci Forex Trading Strategy

Many professional and retail traders swear by the magic of Fibonacci ratios. But what is it really? And does it really work?

The Fibonacci numbers are a set of integers characterized by having the current number being a sum of the preceding two numbers. On the other hand, Fibonacci ratios are a set of ratios that are derived from the Fibonacci number sequence.

So, what is so special about the Fibonacci ratios? At around 200 B.C., Leonardo of Pisa, also known as Fibonacci, discovered the Fibonacci sequence and its corresponding ratios while observing nature. He observed that these ratios recur in nature, whether be it in the veins of a leaf, the shape of a shell, a shape of a snowflake, or even the structure of the human limbs. It seemed so magical, people got captivated by the idea of such perfect proportions.

In trading however, Fibonacci ratios seem to be out of place. How could these ratios be applied in the market when price seem to move randomly, or is it? One of the most popular traders who use Fibonacci ratios is Joe DiNapoli. In fact, Fibonacci ratios seem to be one of the core ideas behind Joe’s DiNapoli Levels. Many traders did follow Joe’s footsteps, and for good reason.

If you’d look at historical charts, time and time again, price does seem to respect the Fibonacci ratios on the DiNapoli Levels. Price does tend to bounce off the levels of a Fibonacci ratio when measured from a previous swing point to the next.

In the past, complex computations were used by Joe and his students in order to come up with the DiNapoli Levels. Today however, we already have the Fibonacci retracement tool on most popular trading platforms as a built-in feature. Many traders who have mastered the use of this tool have greatly benefited from it.

Still, one problem has persisted among many traders who are new to using the Fibonacci retracement tool. “Which swing points do I use to measure the Fibonacci levels?” This is what we are going to address and hopefully simplify with this strategy.

Trading Strategy Concept

The reason why many traders new to using the Fibonacci retracement tool find it hard to effectively use it is because they are having trouble identifying swing points that are significant enough to be considered. This is where the ZigZag indicator comes in. The ZigZag indicator is a great tool to use to identify swing points. If you’d back test it, it does seem to effectively pinpoint relevant swing points. So, we will be using these swing points as a basis for measuring our Fibonacci retracement tool, and we will be waiting for price to react at around 50% of the Fibonacci retracement tool.

Indicators:

- ZigZag

- zigzagarrows

Currency Pair: any

Trading Session: any

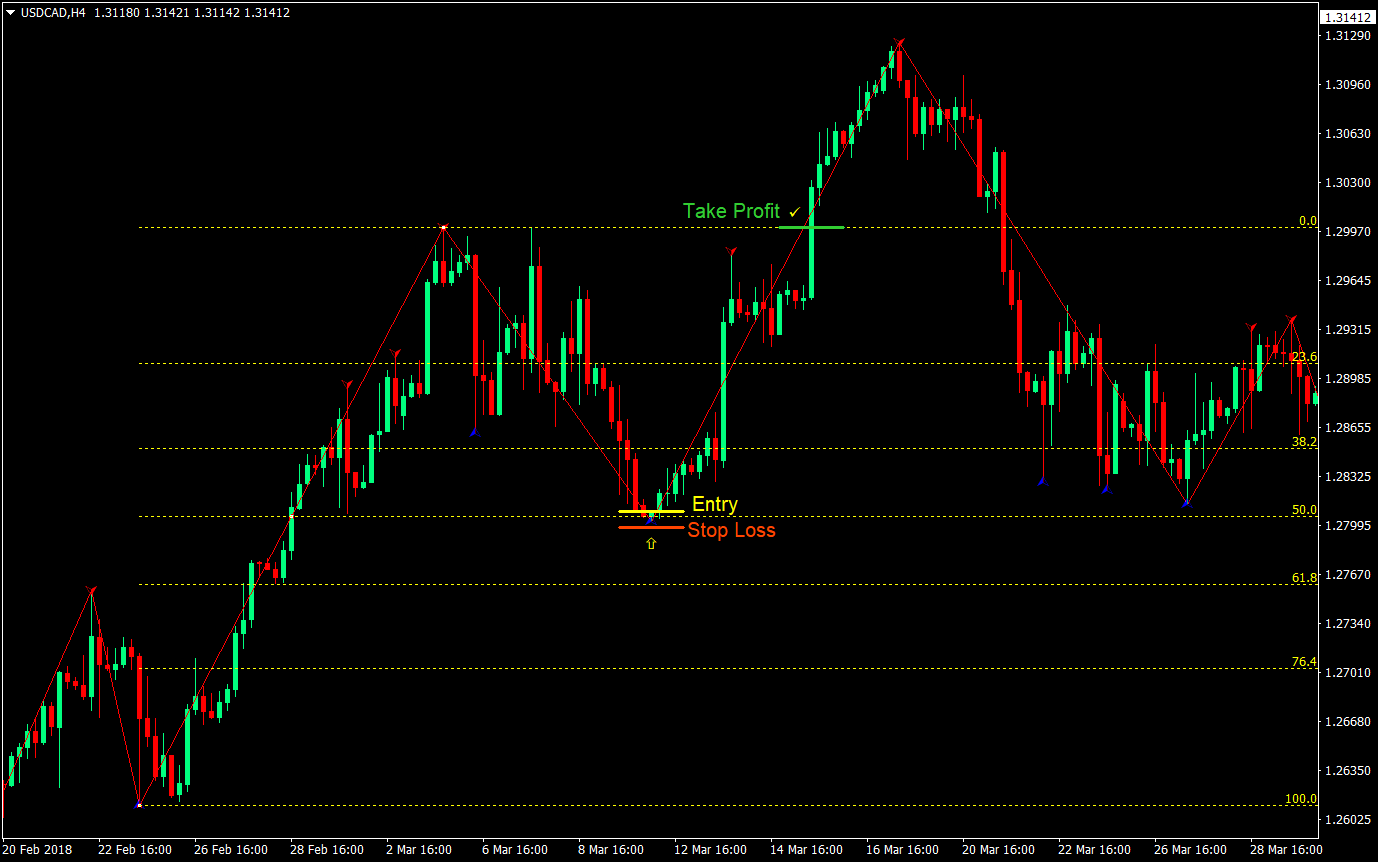

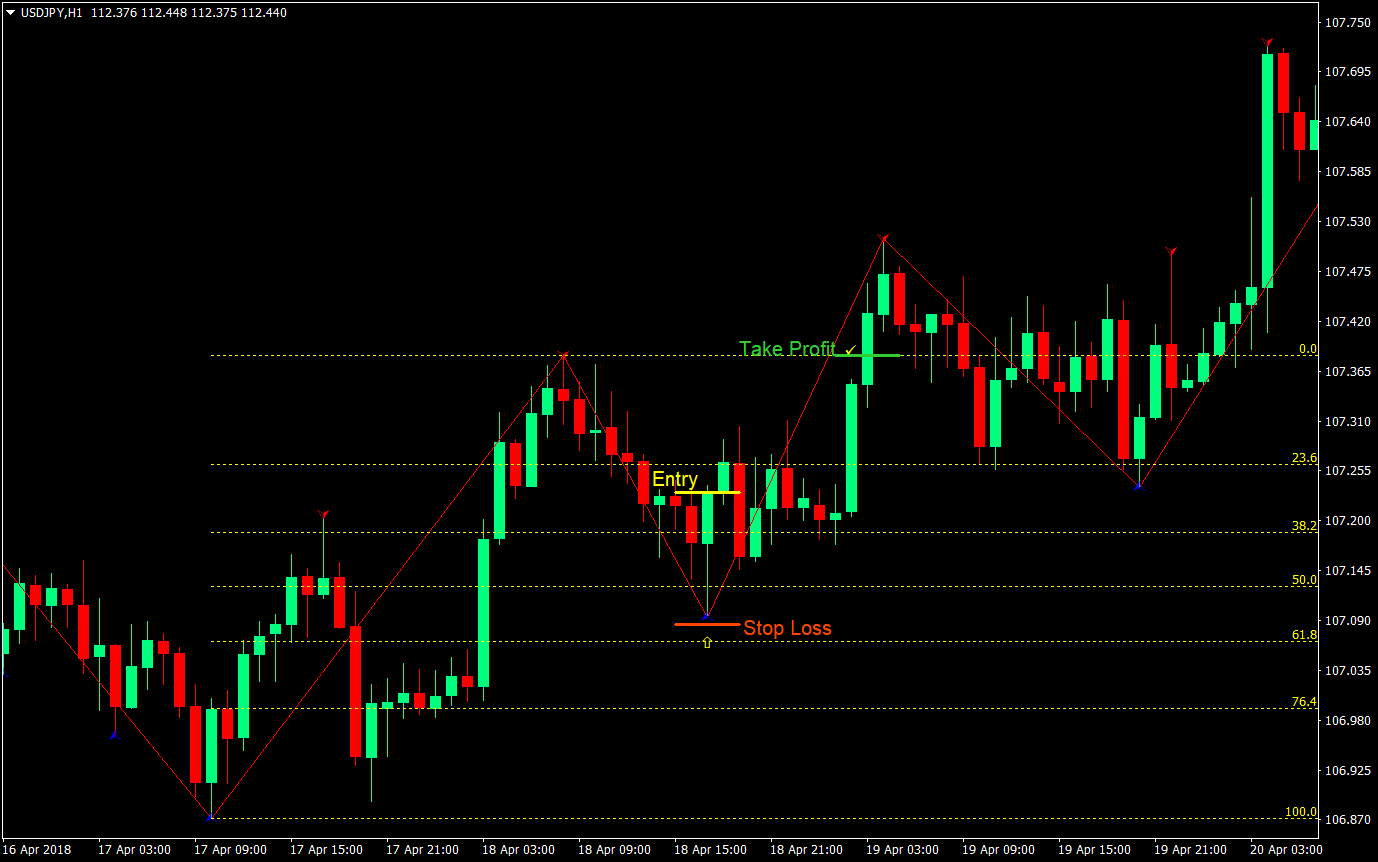

Buy (Long) Trade Setup Rules

Entry

- The last line drawn by the ZigZag indicator should be going up

- Use the Fibonacci retracement tool to measure the swing points from the low to the high

- Wait for price to come back at around the 50% level

- Wait for a the zigzagarrows indicator to print a blue arrow pointing up

- Enter a buy market order at the close of the candle

- Set the stop loss below the blue arrow

- Set the take profit at the swing high based on the ZigZag indicator

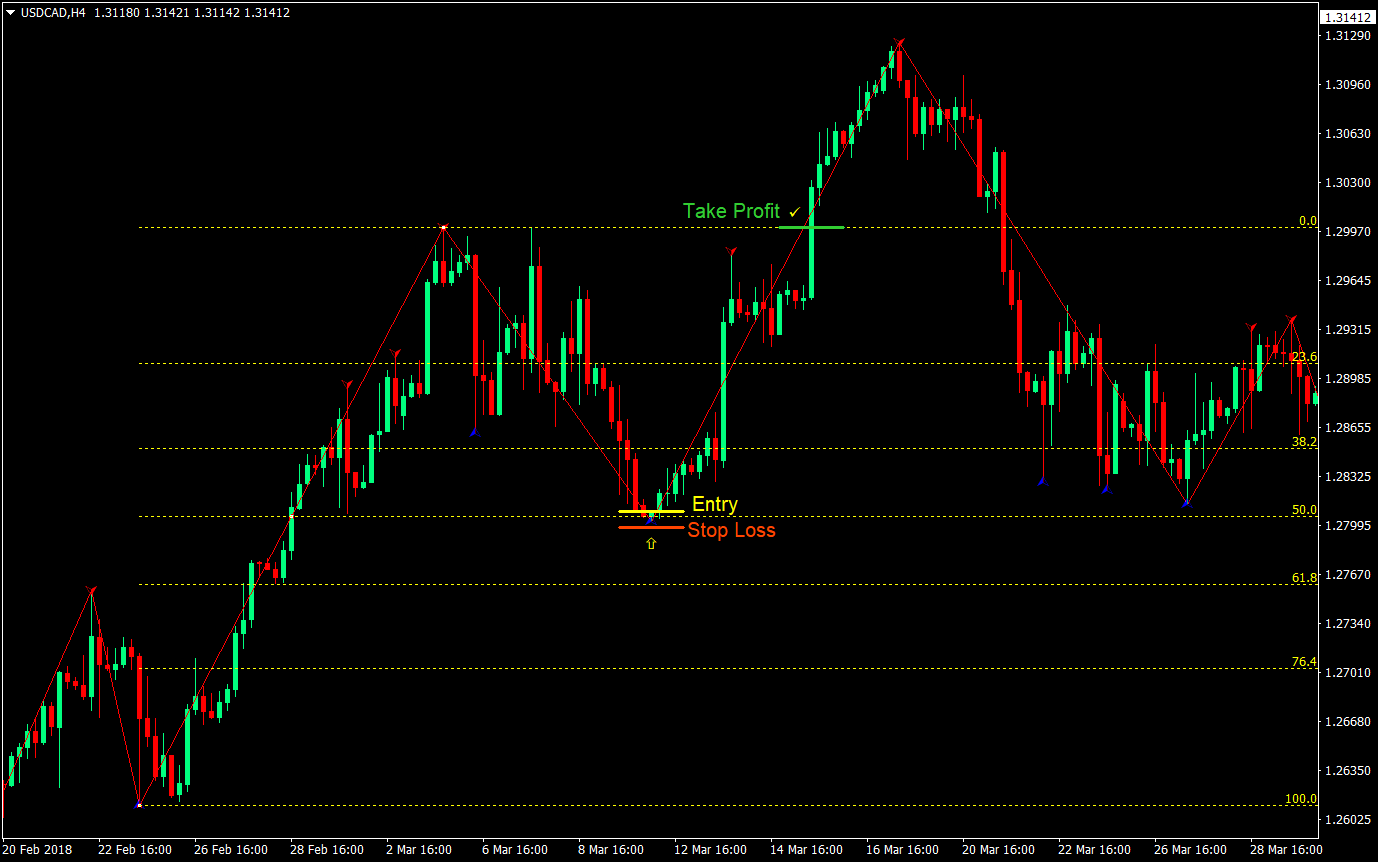

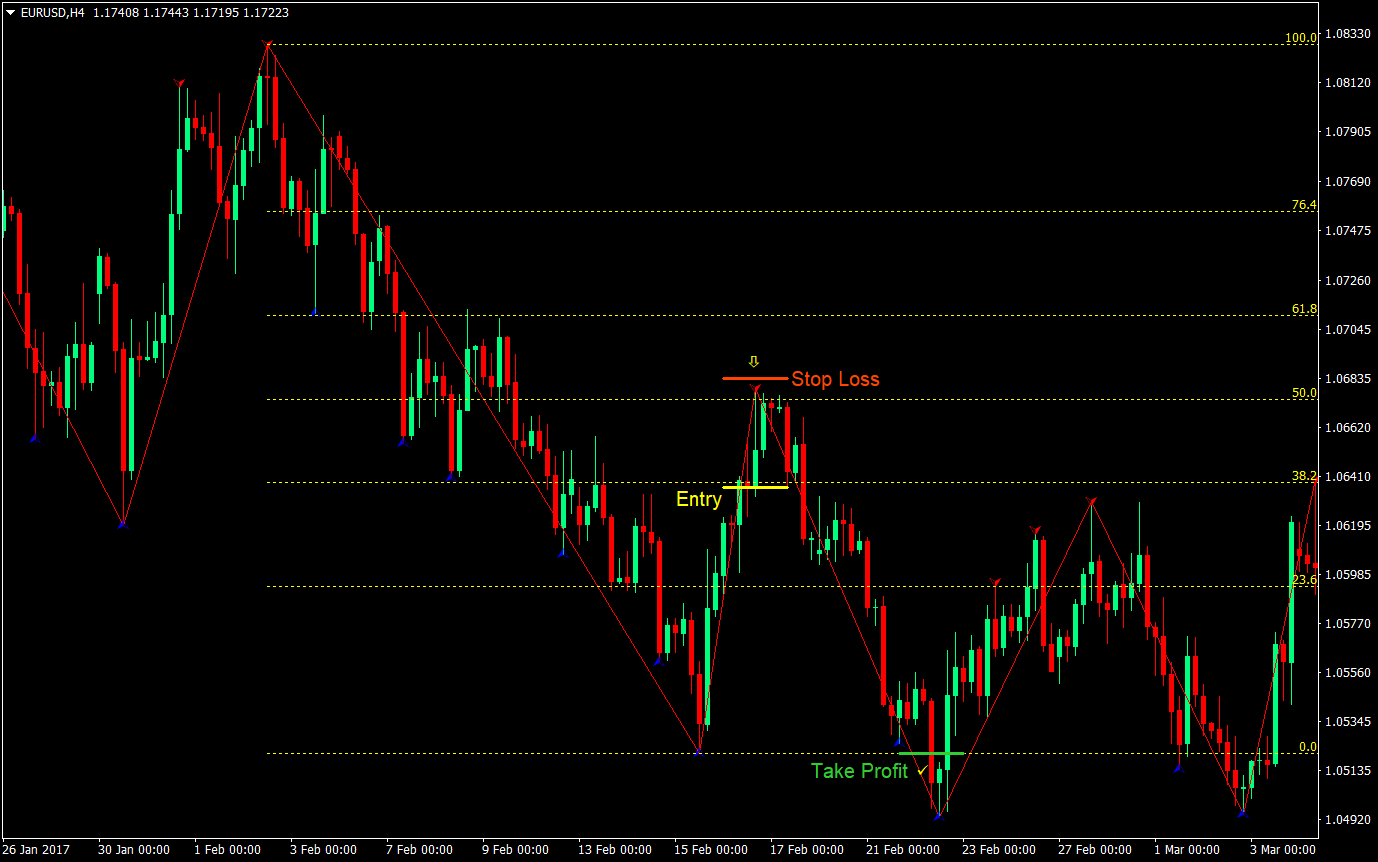

Sell (Short) Trade Setup Rules

Entry

- The last line drawn by the ZigZag indicator should be going down

- Use the Fibonacci retracement tool to measure the swing points from the high to the low

- Wait for price to come back at around the 50% level

- Wait for a the zigzagarrows indicator to print a red arrow pointing down

- Enter a sell market order at the close of the candle

- Set the stop loss above the red arrow

- Set the take profit at the swing low based on the ZigZag indicator

Conclusion

The use of the Fibonacci ratios is common among traders and many who have mastered it have made fortunes using it. It seems like magic. I don’t know the reason behind why the Fibonacci ratios work. Probably it is that seeing it recurring in everyday life primes traders to see these levels as a good discount price for their trade setup. It could also be just a self-fulfilling prophecy because of the number of traders who are using it. Whatever it is, it works.

This strategy isn’t trying to re-invent the wheel. All it does is simplify the task of identifying swing points, which is important when trading the Fibonacci levels. By doing this, you could be joining the ranks of those who are profiting from the market using Fibonacci levels.