RSI Mean Reversion Forex Scalping Strategy

Many traders are drawn to scalping. This is probably due to the allure of the excitement of a quick trade. Many try to dip their feet into it, do it wrong, and swear that scalping never works. Well, scalping does work. No one would be scalping if it doesn’t. You just have to find a system that gives you a high probability of success.

There are many approaches to trading. Some may forgo a high win rate but aim for a higher reward-risk ratio. But I feel that scalping should be more of a high win rate with just a good enough reward-risk ratio. You see a setup, get in, get out, quick money.

Mean reversion strategies are mostly like this. You see a choppy market. Market becomes overextended, you get in on the reversal, get out when price goes back to the short-term average. Compared to trend following strategies, mean reversion tend to be more of a quicker trade. The type I would use when scalping.

The RSI as a Mean Reversion Trigger

The Relative Strength Index (RSI) is one of the more widely used oscillating indicator. It is a bounded oscillator, which means it oscillates within a fixed range, from 0 – 100. This particular feature allows traders to identify extremes or overextended market conditions. Although the RSI rarely reaches 0 or 100, there will be instances when the RSI goes to extremes, depending on the parameters used. These extremes are prime areas for market reversals.

Think of price like a rubber band. If the rubber band is pulled far enough, it would often snap back when the pulling force is stopped. Same thing happens to price. Whenever the RSI is on an overextended condition, price would often snap back to the mean. This overextended condition allows us as traders to get in on the trade, prior to the actual snapping back of price towards the mean.

Trading Strategy Concept

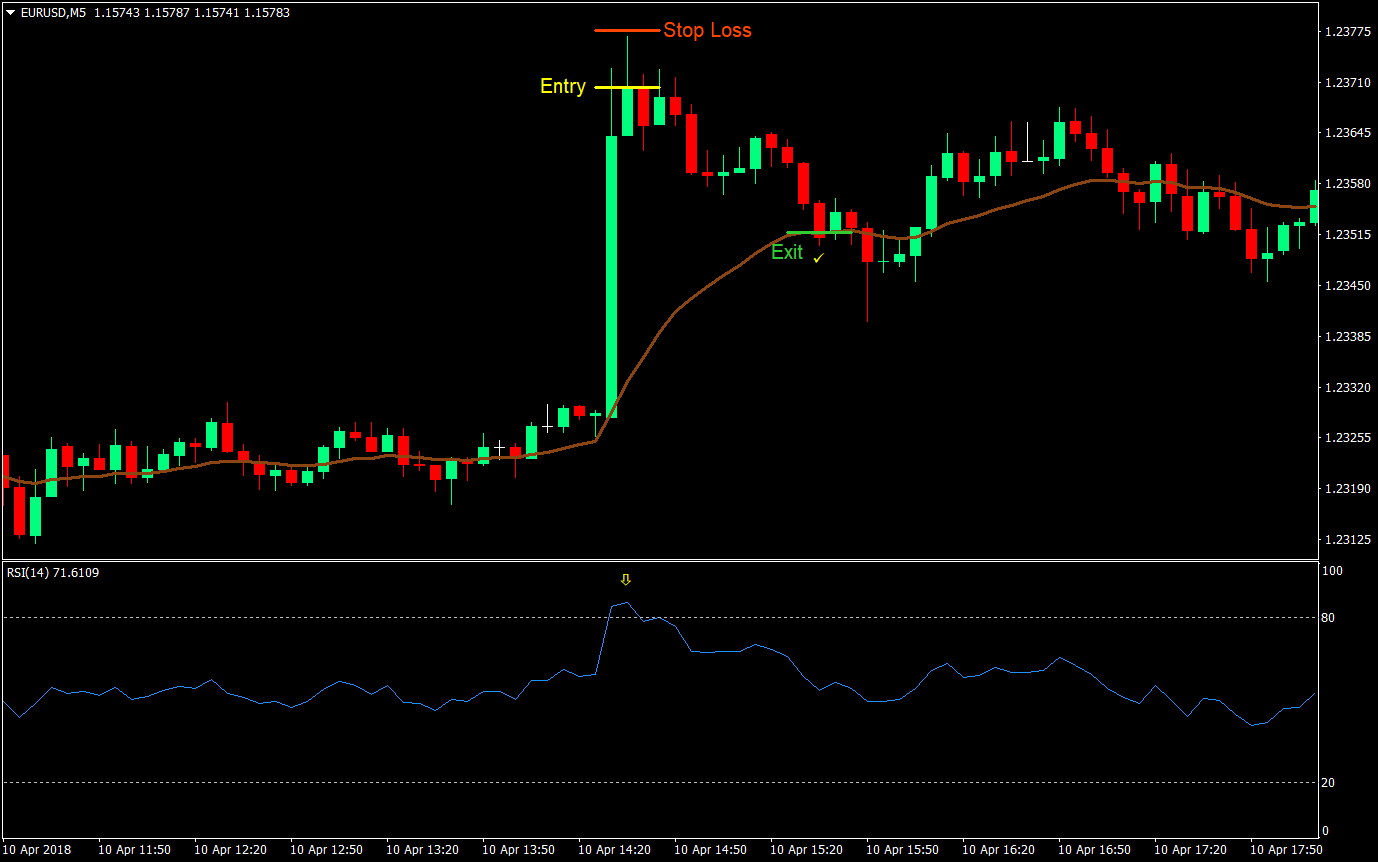

This strategy is a mean reversion strategy based on the RSI. The idea is to enter the market whenever the RSI is on an overextended condition and price action is also showing signs of price rejection or reversal.

So, how do we determine if the RSI is on an overextended condition? The usual parameters used is on the 30 and 70 level. Traders would often consider price to be oversold if the RSI is below 30 and overbought if it is above 70. However, for this strategy, we will take things a little further, to improve our odds. We will be using the 20-80 level. Price would be considered oversold if the RSI is below 20 and overbought if above 80. This would filter out lower probability conditions.

But we don’t stop here. Even if price is overextended, it is still not a guarantee that it will reverse. So, we will also be looking for signs of reversals on price itself. We will be looking for candles with relatively longer wicks. Candles that have longer wicks compared to its body, candles with unusually longer wicks, successive candles with wicks on one side, etc. Note that we are looking for wicks most of the time. This is because wicks are signs of price rejection, meaning the market just don’t think that the price on one side of the candle is acceptable, and therefore price moves away from it. These are telltale signs of reversal.

Now that we have determined how we will enter the market, the next question is where do we expect price to go. Mean reversion basically means that price would revert to its average. Given this definition, we will be using the most basic averaging indicator, a moving average. In particular, we will be using the 20-period Exponential Moving Average (EMA). This an average which price would usually revert to when retracing, and it still allows for a reasonable reward-risk ratio. As soon as price reaches the 20 EMA, we then close our trade, or we could constantly move our take profit target as the 20 EMA moves.

Indicators:

- RSI

- 20 EMA

Timeframe: 5-minute chart

Trading Session: London and New York Session

Buy (Long) Trade Setup Rules

Entry

- The RSI should be below 20

- The RSI is curling back up

- Candles should be having wicks at the bottom

- Enter a buy market order when the above rules are met

- Set the stop loss below the entry candle

- Option 1: Close the trade when price hits the 20 EMA

- Option 2: Constantly move the take profit to where the 20 EMA is until it is hit

Sell (Short) Trade Setup Rules

Entry

- The RSI should be below 80

- The RSI is curling back down

- Candles should be having wicks above

- Enter a sell market order when the above rules are met

- Set the stop loss above the entry candle

- Option 1: Close the trade when price hits the 20 EMA

- Option 2: Constantly move the take profit to where the 20 EMA is until it is hit

Conclusion

This strategy is a high probability, low reward-risk type of strategy. This is because the targets are not too far from the entry. The 20 EMA still hugs price a bit closely. On an overextended scenario however, price pulls away from the 20 EMA causing a gap between price and the moving average. This allows us to have a reasonable trade as price would try to fill the gap between it and the 20 EMA.

Avoid taking trades that are too close to the 20 EMA. This is because, although the probability of a successful trade would be higher, the reward relative to the risk would be too low. Avoid taking trades that have reward-risk ratios that are lesser than 1:1.

Also, try to practice getting a feel on whether price is about to rollover or not. As said earlier, wicks are signs that price is about to rollover. But this is not the only sign. Even how the bids and offers move, and the ticks move within the candle would give hints of whether price is about to reverse. This aspect requires some practice though.

Practice this strategy and make it yours.