50 EMA Bounce Forex Trading Strategy

In order to successfully trade the forex markets, a trader has to master just two skills, buying at a discount then selling at a higher price and selling at a high price then buying back at a lower price. Its that simple, or is it? I hope it was that simple. But if it were, then every trader should at least be a millionaire by now.

Although it is true that buying low and selling high or doing it in reverse is how a trader makes money, there are many things that a trader considers before even attempting to do just that. First, the question of trade direction. Where is price going? Up or down? That brings your chances to 50-50. Then there is the question of timing. At what price or when is it going up or down?

Moving Averages as a Trend Direction and Entry Point

Moving averages are simply an average of a trading instrument’s price based on a predetermined number of periods. It is a simple concept but is very useful.

Moving averages are one of the best tools a trader could have. This is because moving averages could objectively answer the two questions above, direction and timing. It is not perfect, but it does work.

First, the question of direction. Moving averages have a very simplistic way of determining trend bias. It is based on where the current price is or is generally at for the past few candles in relation to the moving average. If price is above the moving average, then the market is said to have bullish bias. If below it, then it is a bearish bias. That simple. Just by identifying where price is in relation to the moving average, we get to answer direction. Caveat though is if the market is still not reversing.

Onto the second question, timing. Amazingly, moving averages also do tend to cause price to bounce off it. No one really knows why. But if you’d think about it, you’d always want to buy at a discount or sell at a slightly higher price. If prices are generally going up, seeing price go back to its average would already be a discount. The inverse applies if prices are going down. Because of this, moving averages tend to become dynamic supports and resistances. There will be many instances when as soon as price touches a widely used moving average, price would bounce off it.

Trading Strategy Concept

The 50-period Exponential Moving Average (EMA) is one of the most widely used moving average. It is a moving average which traders often use to determine the intermediate trend. Longer-term traders use it, short-term traders also use it. As such, many of the characteristics of a moving average applies to the 50 EMA, such as determining trend direction and acting as a dynamic support and resistance.

We will be using the 50 EMA as a dynamic support or resistance. As soon as price touches the 50 EMA, we will be observing if price would show signs of bouncing off it. We will also be using the zigzagarrows indicator as an entry signal, confirming that price is showing signs of bouncing off of a 50 EMA.

We will also be aligning our entries with the long-term trend direction using the 200 EMA. To qualify as a valid buy trade, price and the 50 EMA should be above the 200 EMA. The reverse applies if we are looking for a sell trade.

Indicators:

Timeframe: 5-minute chart and above

Trading Session: any

Buy (Long) Trade Setup Rules

Entry

Sell (Short) Trade Setup Rules

Entry

Conclusion

Using moving averages as a dynamic support or resistance is a common strategy that many traders use. Often, traders combine this with candlestick patterns to signify an entry signal. However, not all traders have the skill to determine an entry based purely on candlestick patterns. This is where the zigzagarrows indicator could help us. However, it would still be better if we combine the indicator-based entry signal with some knowledge of basic price action and candlestick patterns.

Not all seemingly perfect entry signals would work though. This is because, as an intermediate trend moving average, the market’s bias could be divided at this point. Although price could bounce off the 50 EMA, a break through it could also act as a breakout of a support or resistance.

Also, moving average retracement strategies are great only during trending market conditions. It wouldn’t work on a ranging or reversing market. So, you would have to identify if the market is in a trending condition before using this strategy.

In order to successfully trade the forex markets, a trader has to master just two skills, buying at a discount then selling at a higher price and selling at a high price then buying back at a lower price. Its that simple, or is it? I hope it was that simple. But if it were, then every trader should at least be a millionaire by now.

Although it is true that buying low and selling high or doing it in reverse is how a trader makes money, there are many things that a trader considers before even attempting to do just that. First, the question of trade direction. Where is price going? Up or down? That brings your chances to 50-50. Then there is the question of timing. At what price or when is it going up or down?

Moving Averages as a Trend Direction and Entry Point

Moving averages are simply an average of a trading instrument’s price based on a predetermined number of periods. It is a simple concept but is very useful.

Moving averages are one of the best tools a trader could have. This is because moving averages could objectively answer the two questions above, direction and timing. It is not perfect, but it does work.

First, the question of direction. Moving averages have a very simplistic way of determining trend bias. It is based on where the current price is or is generally at for the past few candles in relation to the moving average. If price is above the moving average, then the market is said to have bullish bias. If below it, then it is a bearish bias. That simple. Just by identifying where price is in relation to the moving average, we get to answer direction. Caveat though is if the market is still not reversing.

Onto the second question, timing. Amazingly, moving averages also do tend to cause price to bounce off it. No one really knows why. But if you’d think about it, you’d always want to buy at a discount or sell at a slightly higher price. If prices are generally going up, seeing price go back to its average would already be a discount. The inverse applies if prices are going down. Because of this, moving averages tend to become dynamic supports and resistances. There will be many instances when as soon as price touches a widely used moving average, price would bounce off it.

Trading Strategy Concept

The 50-period Exponential Moving Average (EMA) is one of the most widely used moving average. It is a moving average which traders often use to determine the intermediate trend. Longer-term traders use it, short-term traders also use it. As such, many of the characteristics of a moving average applies to the 50 EMA, such as determining trend direction and acting as a dynamic support and resistance.

We will be using the 50 EMA as a dynamic support or resistance. As soon as price touches the 50 EMA, we will be observing if price would show signs of bouncing off it. We will also be using the zigzagarrows indicator as an entry signal, confirming that price is showing signs of bouncing off of a 50 EMA.

We will also be aligning our entries with the long-term trend direction using the 200 EMA. To qualify as a valid buy trade, price and the 50 EMA should be above the 200 EMA. The reverse applies if we are looking for a sell trade.

Indicators:

- 50-period EMA (green)

- 200-period EMA (brown)

- Zigzagarrows

Timeframe: 5-minute chart and above

Trading Session: any

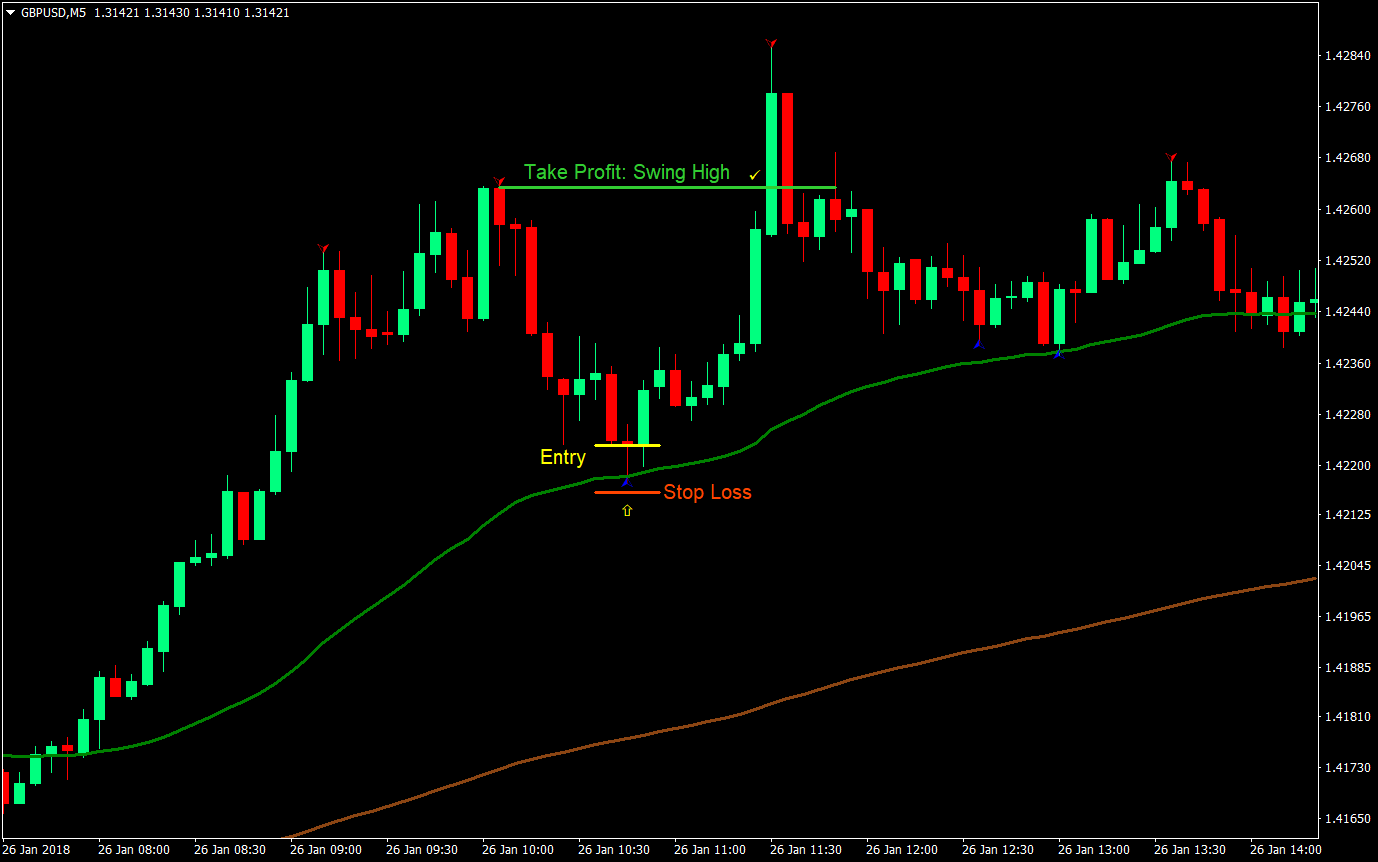

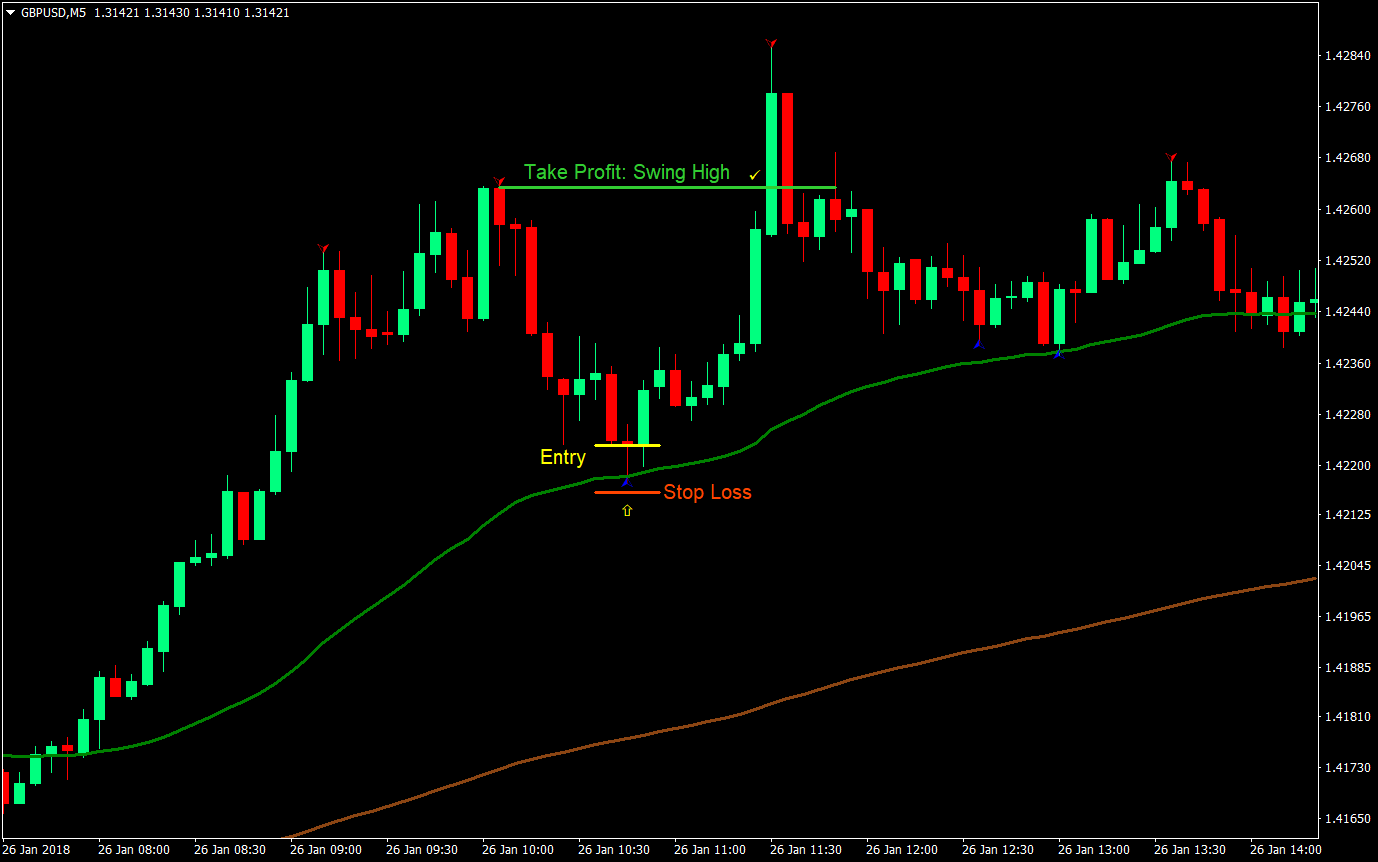

Buy (Long) Trade Setup Rules

Entry

- The 50 EMA should be above the 200 EMA

- Price should come from above the 50 EMA

- Wait for price to retrace and touch the 50 EMA

- The zigzagarrows indicator should print a blue arrow pointing up

- Enter a buy market order on the confluence of the above rules

- Set the stop loss below the entry candle

- Set the take profit target at the swing high based on the preceding red zigzagarrow

Sell (Short) Trade Setup Rules

Entry

- The 50 EMA should be below the 200 EMA

- Price should come from below the 50 EMA

- Wait for price to retrace and touch the 50 EMA

- The zigzagarrows indicator should print a red arrow pointing down

- Enter a sell market order on the confluence of the above rules

- Set the stop loss above the entry candle

- Set the take profit target at the swing low based on the preceding blue zigzagarrow

Conclusion

Using moving averages as a dynamic support or resistance is a common strategy that many traders use. Often, traders combine this with candlestick patterns to signify an entry signal. However, not all traders have the skill to determine an entry based purely on candlestick patterns. This is where the zigzagarrows indicator could help us. However, it would still be better if we combine the indicator-based entry signal with some knowledge of basic price action and candlestick patterns.

Not all seemingly perfect entry signals would work though. This is because, as an intermediate trend moving average, the market’s bias could be divided at this point. Although price could bounce off the 50 EMA, a break through it could also act as a breakout of a support or resistance.

Also, moving average retracement strategies are great only during trending market conditions. It wouldn’t work on a ranging or reversing market. So, you would have to identify if the market is in a trending condition before using this strategy.