Volume Flag and Pennants Trading Forex Trading Strategy

Pattern based trading strategies are one of the most popular types of trading strategies out there. Newbies are especially drawn towards these types of strategies. Imagine, seeing trading gurus show how it is done and it seemed to work. So, you learned a new pattern, a head and shoulders or a triangle pattern for example. You go back to your charts, then you find that you are at a loss when trying to identify these patterns. How was it that it was too easy for some traders to identify these patterns while you can’t even see one?

There are ways to simplify the way you look for trading patterns. It is in knowing where to look for them. For example, I usually find that ascending and descending triangles are usually unbroken and supports or resistances with a contracting range when you go to the lower timeframes. So, if you see an unbroken support or resistance, you may zoom out and notice a pattern on the higher timeframes. Reversal patterns such as double tops and bottoms or head and shoulders are usually also found on previous supports and resistances. But this may still be complicated to some new traders. So, let’s try to look at a technique in identifying continuation patterns by knowing which area to look at.

VWAPs as Pattern Hunting Grounds

Using moving averages are one of the best tools to use when trying to identify areas where price could retrace to. You could either use a single moving average and weight for price to retrace to the area around that particular moving average or use multiple moving averages and use the area between those moving averages as an area where price could retrace to. This is because even on a strongly trending market, price would still come back to the mean or the average. This is what retracement is all about.

These retracements are also often some form of a continuation pattern. A couple of patterns in particular commonly recur in these areas and with a high degree of success, the flag and pennant patterns. This is because flags and pennants are a basic structure of an expansion phase, which is the pole, a contraction, which is the body of the flag or pennant, and another expansion, which is the breakout from the flag or pennant. It is a basic retracement pattern, expansion-contraction-expansion.

However, even though moving averages are great all in itself, another type of average pricing could also be used, the Volume Weighted Average Price (VWAP). The difference is that VWAPs take into volume into account when drawing its lines. Price movements is not two dimensional, with only time and distance (price movement) as the only measurements. It is three dimensional, adding the third element of time. Volume could tell us if the movement of price in such a short time, which is typical in an expansion phase, is accompanied with volume. If so, then the expansion phase is a shift in sentiment of a big portion of the market.

Using the area in between a couple of VWAPs is very effective in marking the area where flags and pennants could occur.

Trading Strategy Concept

To help us identify flags and pennants, we will be using two VWAPs, a 20-period and a 50-period VWAP. During a thrust, the 20-period VWAP should start to tilt strongly towards the direction of the thrust. This would signify that the expansion phase does have volume behind it. Then, we wait for price to retrace between the two VWAPs. As price retraces between the two, we then try to identify if a flag or pennant pattern is recognizable. If so, then we wait for our trade setup to complete. If not, then we move on to another currency pair.

We will also be using the 200 Exponential Moving Average (EMA) to align our trades with the longer-term trend.

Indicators:

Timeframe: any

Trading Session: any

Buy (Long) Trade Setup Rules

Entry

Sell (Short) Trade Setup Rules

Entry

Conclusion

VWAP retracement strategies are commonly used in stock trading. Some traders would trade in the same manner, waiting for price to retrace to a VWAP during a strongly trending market. Although the use of VWAP is not that common in forex trading, there is no one that stops us from doing so. This is just one of the ways to trade VWAP retracements. Couple it with the very reliable flag and pennant pattern and you get to have winning trade setups coming your way.

Pattern based trading strategies are one of the most popular types of trading strategies out there. Newbies are especially drawn towards these types of strategies. Imagine, seeing trading gurus show how it is done and it seemed to work. So, you learned a new pattern, a head and shoulders or a triangle pattern for example. You go back to your charts, then you find that you are at a loss when trying to identify these patterns. How was it that it was too easy for some traders to identify these patterns while you can’t even see one?

There are ways to simplify the way you look for trading patterns. It is in knowing where to look for them. For example, I usually find that ascending and descending triangles are usually unbroken and supports or resistances with a contracting range when you go to the lower timeframes. So, if you see an unbroken support or resistance, you may zoom out and notice a pattern on the higher timeframes. Reversal patterns such as double tops and bottoms or head and shoulders are usually also found on previous supports and resistances. But this may still be complicated to some new traders. So, let’s try to look at a technique in identifying continuation patterns by knowing which area to look at.

VWAPs as Pattern Hunting Grounds

Using moving averages are one of the best tools to use when trying to identify areas where price could retrace to. You could either use a single moving average and weight for price to retrace to the area around that particular moving average or use multiple moving averages and use the area between those moving averages as an area where price could retrace to. This is because even on a strongly trending market, price would still come back to the mean or the average. This is what retracement is all about.

These retracements are also often some form of a continuation pattern. A couple of patterns in particular commonly recur in these areas and with a high degree of success, the flag and pennant patterns. This is because flags and pennants are a basic structure of an expansion phase, which is the pole, a contraction, which is the body of the flag or pennant, and another expansion, which is the breakout from the flag or pennant. It is a basic retracement pattern, expansion-contraction-expansion.

However, even though moving averages are great all in itself, another type of average pricing could also be used, the Volume Weighted Average Price (VWAP). The difference is that VWAPs take into volume into account when drawing its lines. Price movements is not two dimensional, with only time and distance (price movement) as the only measurements. It is three dimensional, adding the third element of time. Volume could tell us if the movement of price in such a short time, which is typical in an expansion phase, is accompanied with volume. If so, then the expansion phase is a shift in sentiment of a big portion of the market.

Using the area in between a couple of VWAPs is very effective in marking the area where flags and pennants could occur.

Trading Strategy Concept

To help us identify flags and pennants, we will be using two VWAPs, a 20-period and a 50-period VWAP. During a thrust, the 20-period VWAP should start to tilt strongly towards the direction of the thrust. This would signify that the expansion phase does have volume behind it. Then, we wait for price to retrace between the two VWAPs. As price retraces between the two, we then try to identify if a flag or pennant pattern is recognizable. If so, then we wait for our trade setup to complete. If not, then we move on to another currency pair.

We will also be using the 200 Exponential Moving Average (EMA) to align our trades with the longer-term trend.

Indicators:

- Volume_Weighted_MA: 20-period (green)

- Volume_Weighted_MA: 50-period (deep pink)

- 200 EMA (brown)

Timeframe: any

Trading Session: any

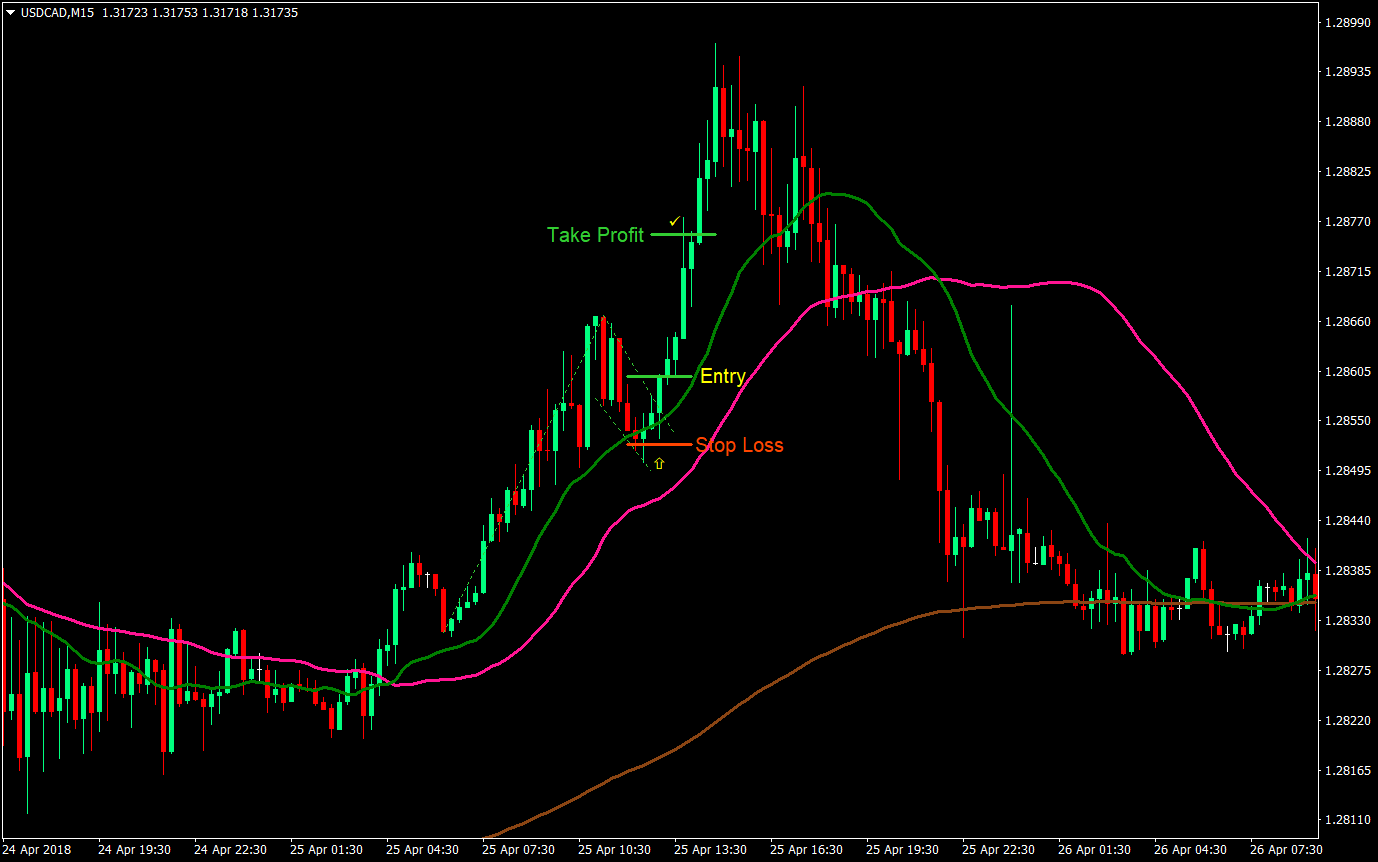

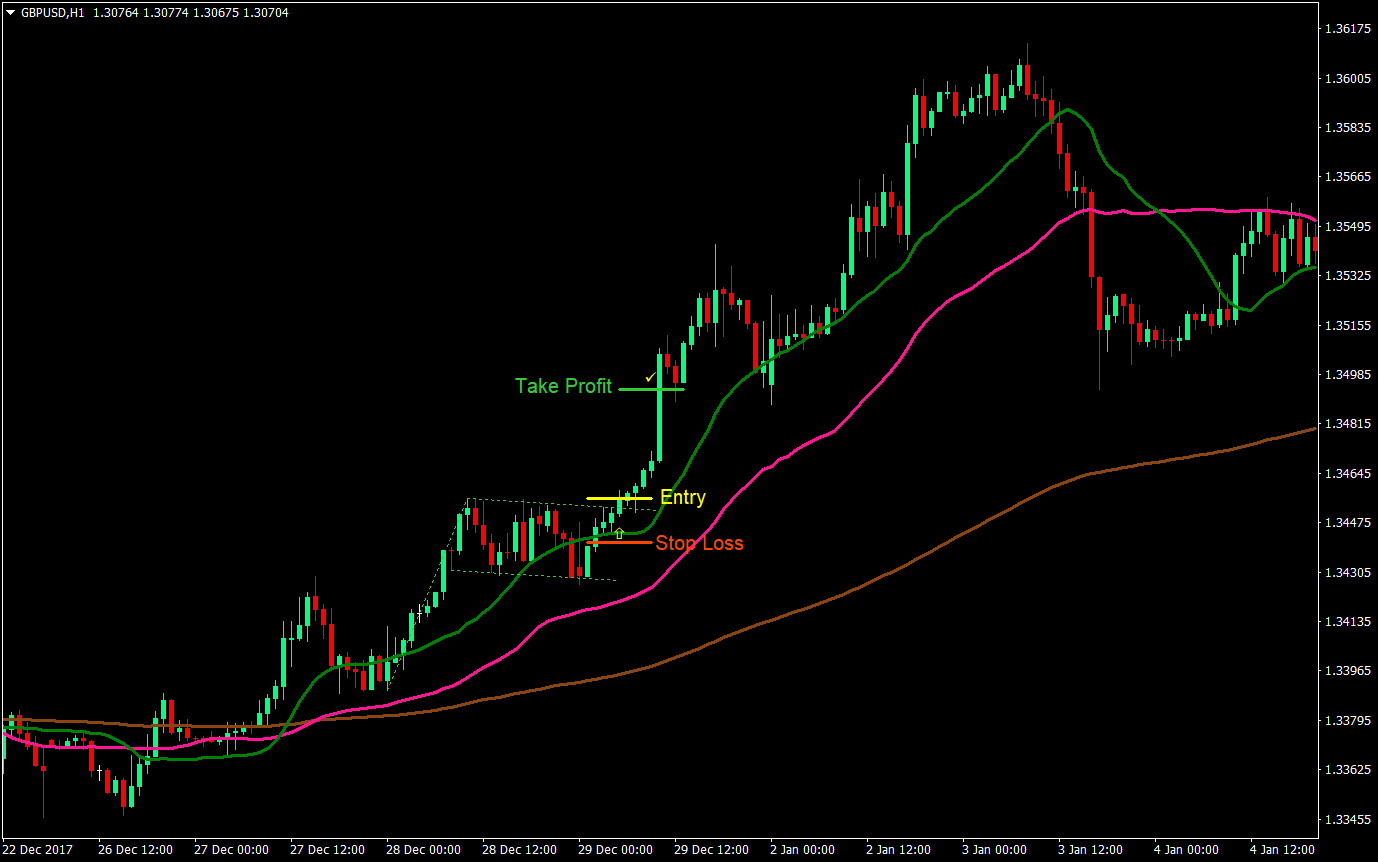

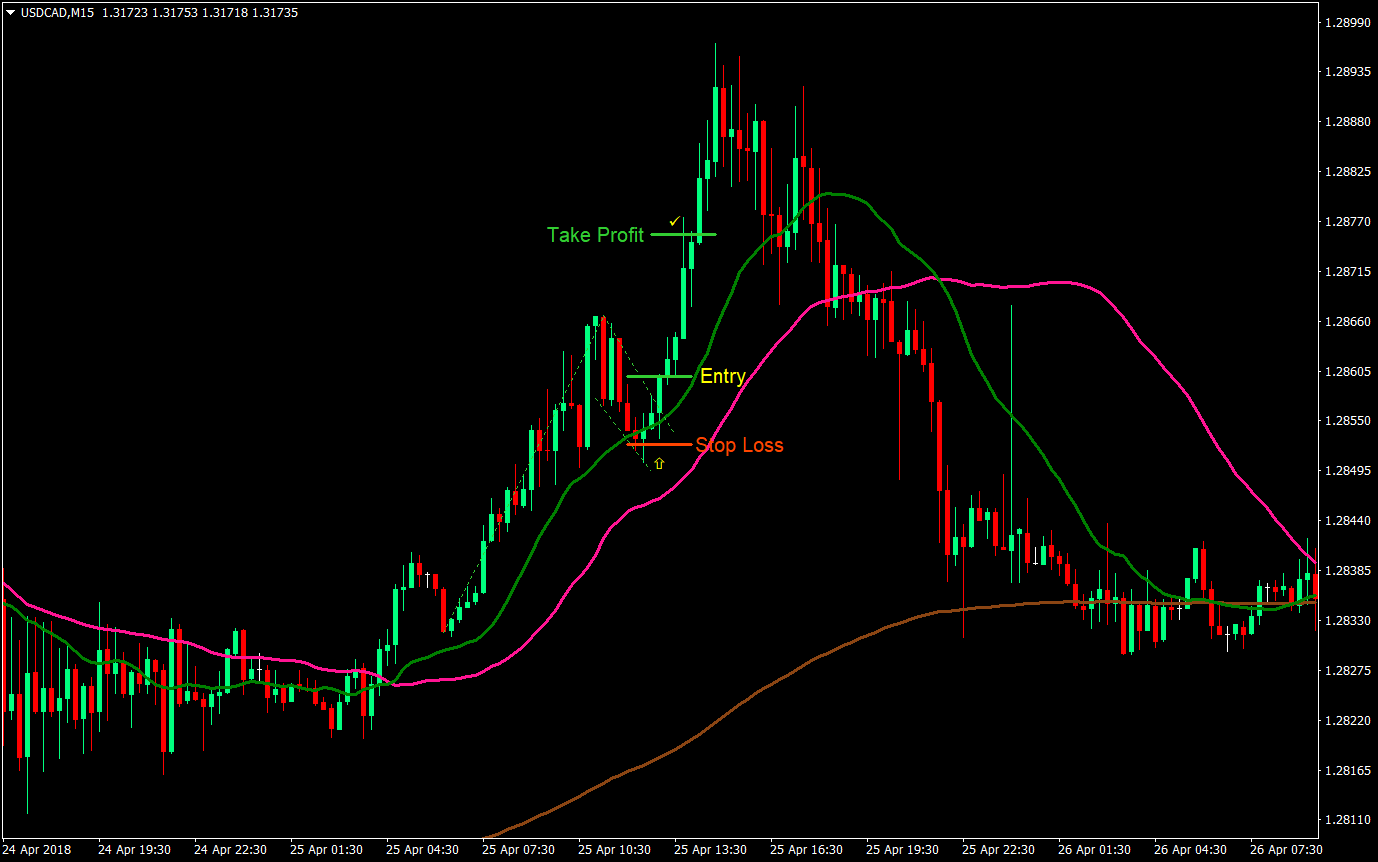

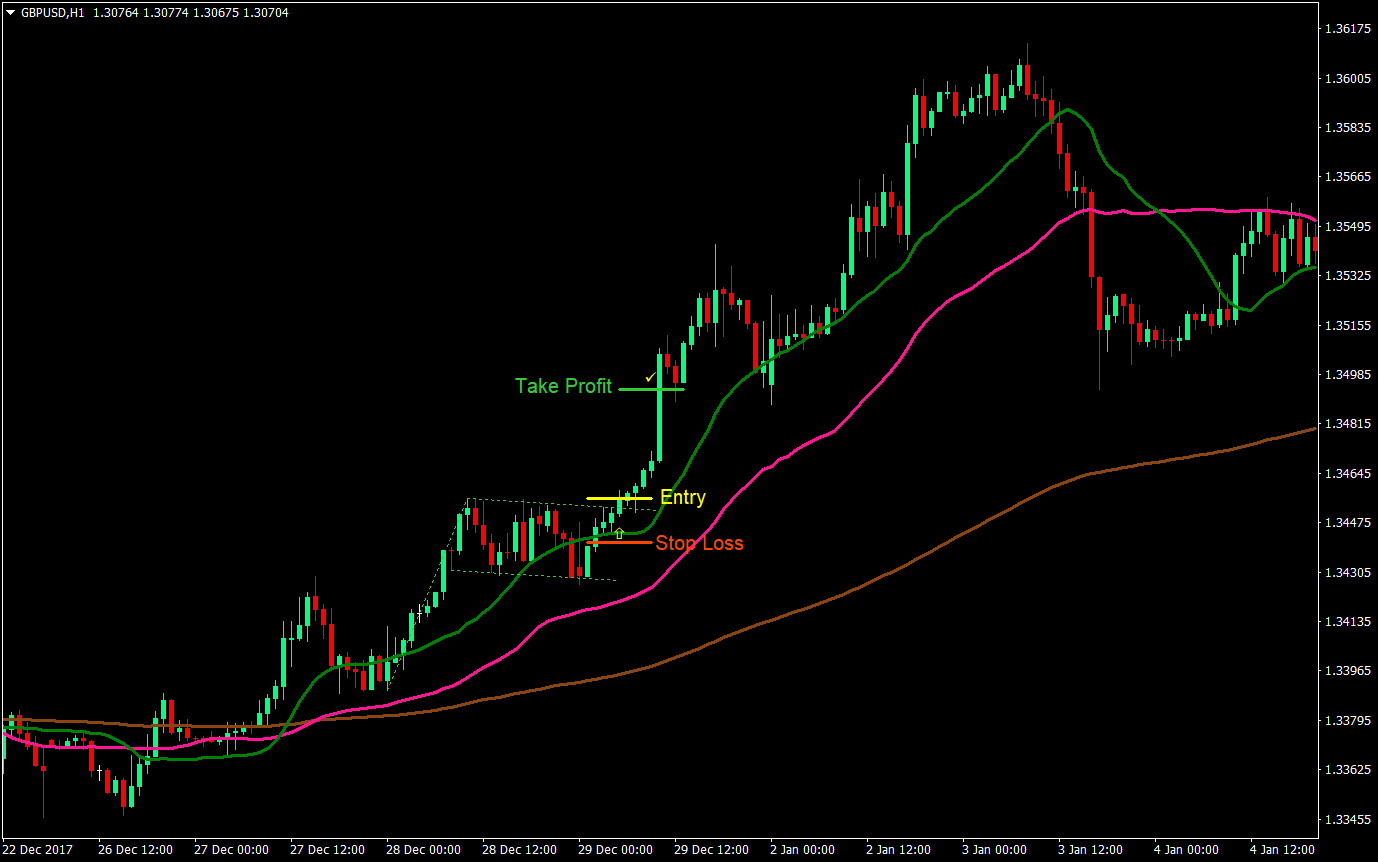

Buy (Long) Trade Setup Rules

Entry

- The two Volume_Weighted_MAs should be above the 200 EMA

- The 20-period Volume_Weighted_MA should be above the 50-period Volume_Weighted_MA

- Price should expand upwards forming the pole

- The 20-period Volume_Weighted_MA should tilt upwards

- Wait for price to retrace between the green and pink lines

- Identify a bullish flag or pennant

- Wait for a candle to breakout of the flag or pennant

- Enter a buy market order at the close of the breakout candle

- Set the stop loss inside the body of the flag or pennant pattern

- Set the take profit target at 2x the risk

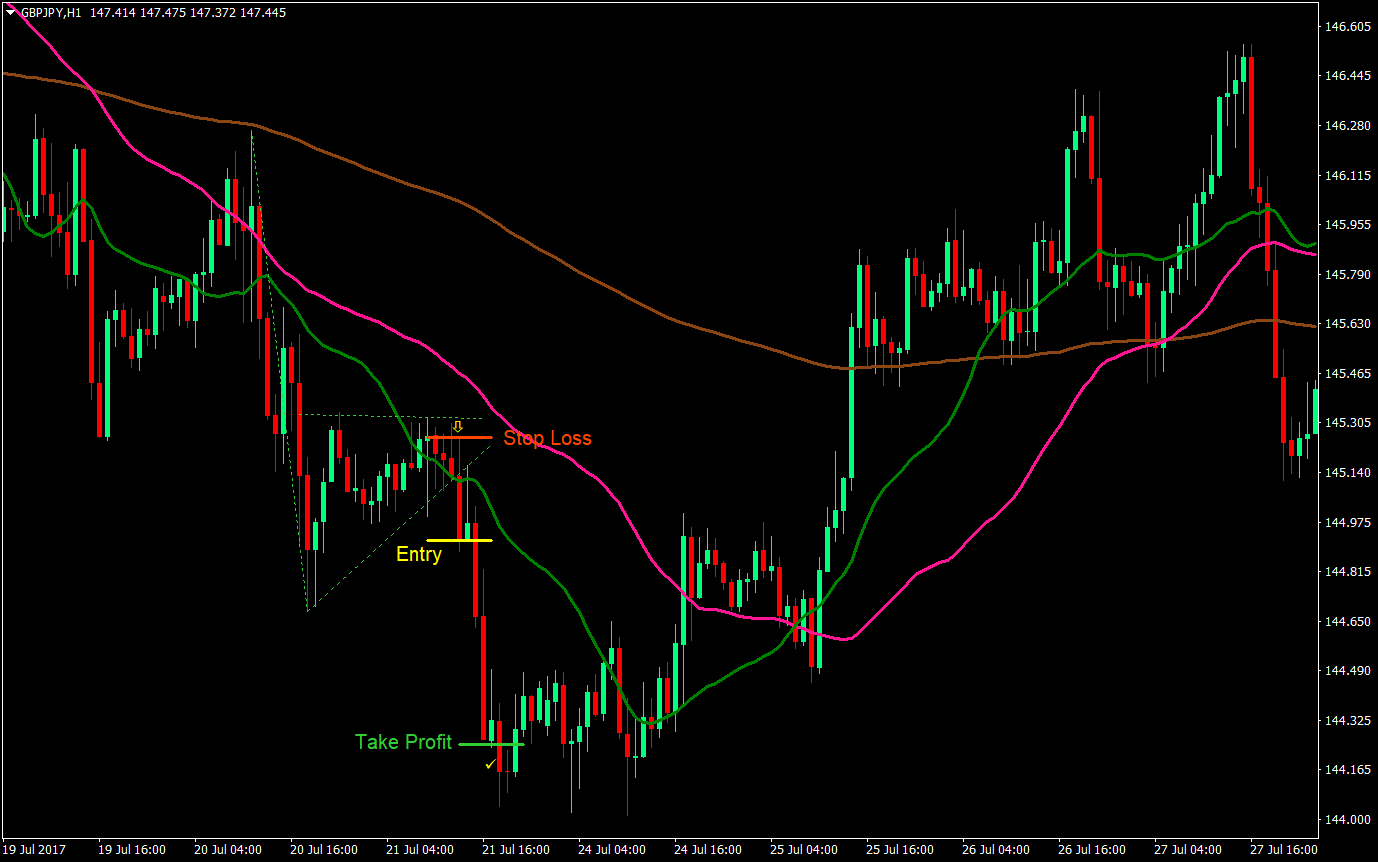

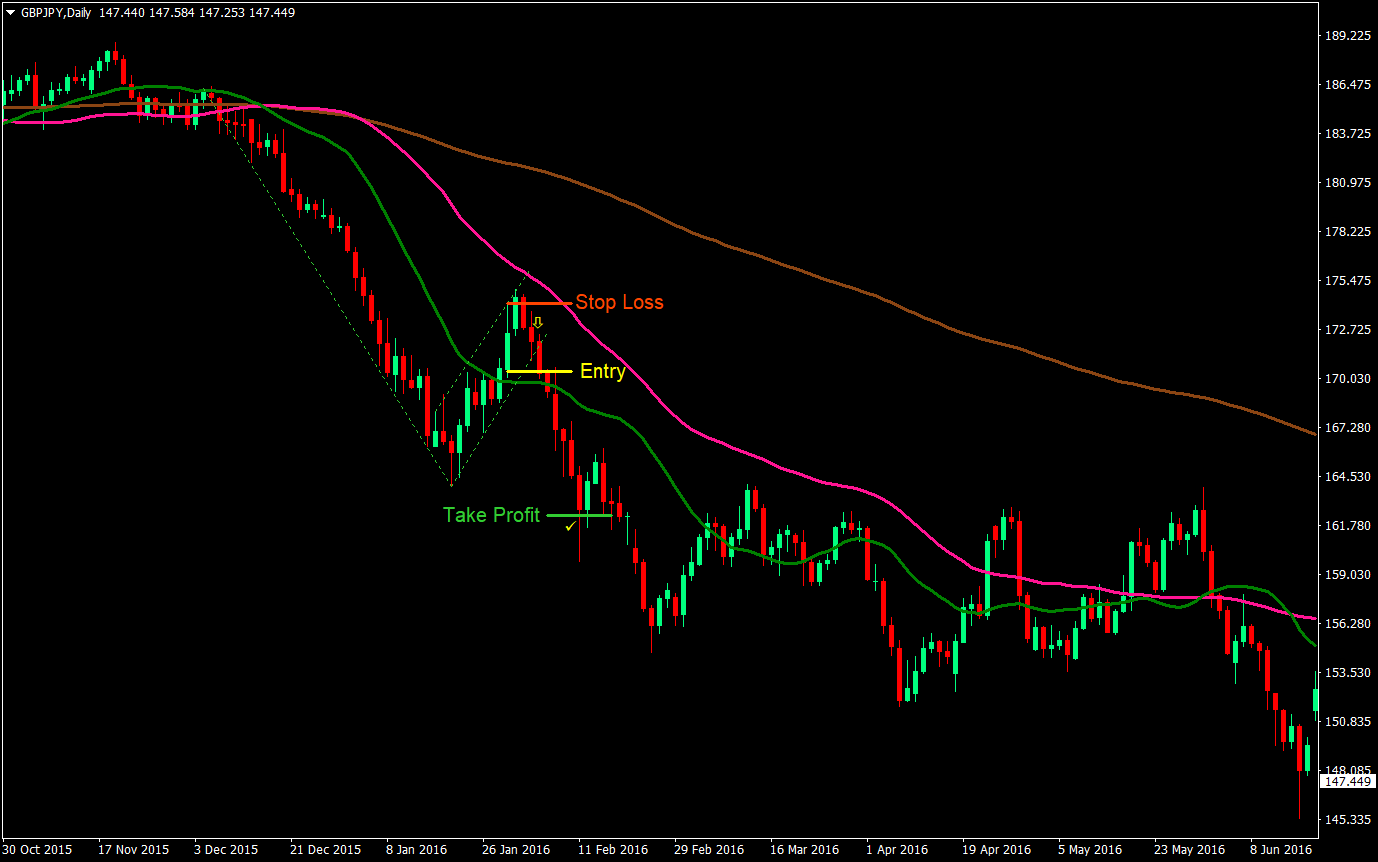

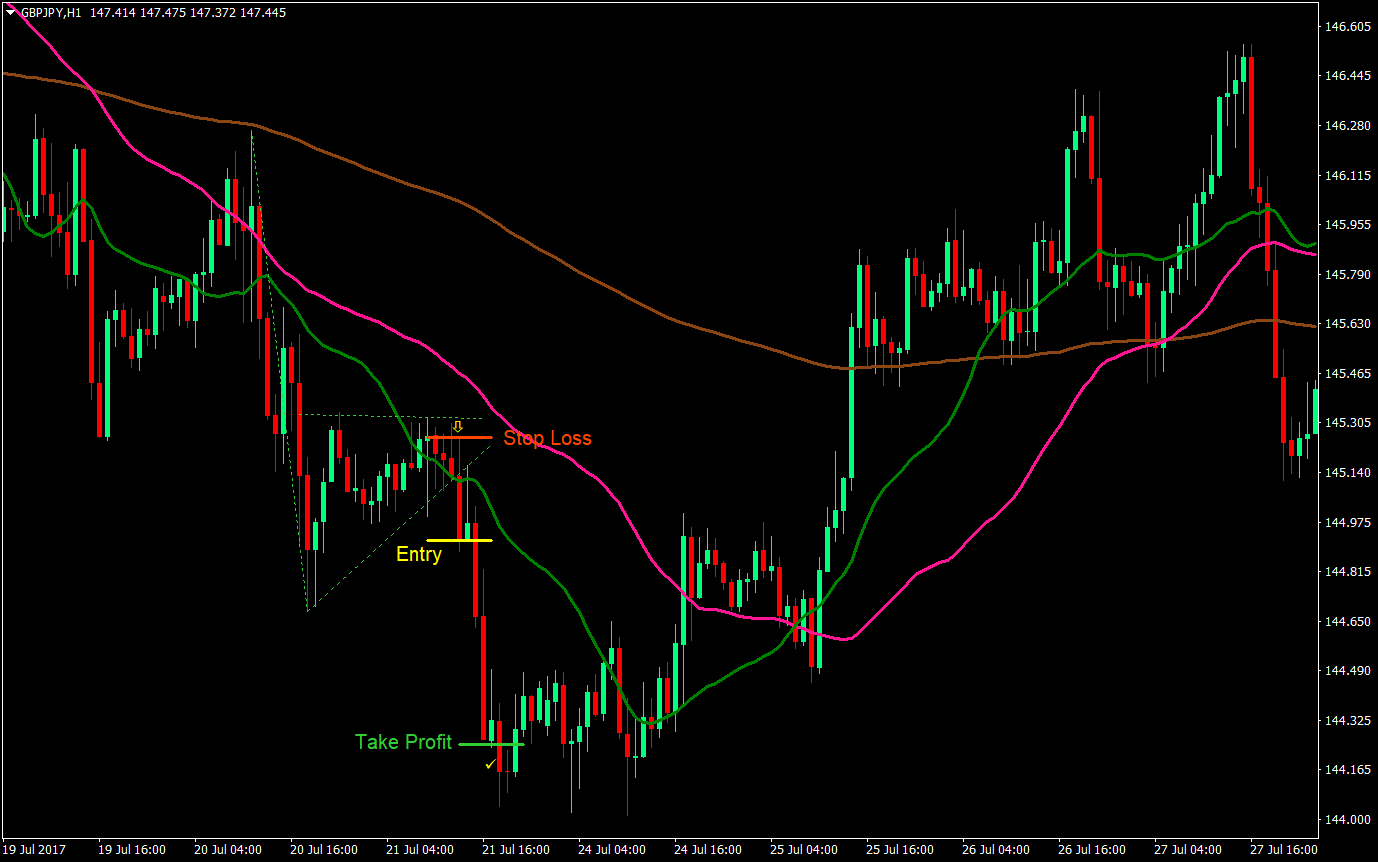

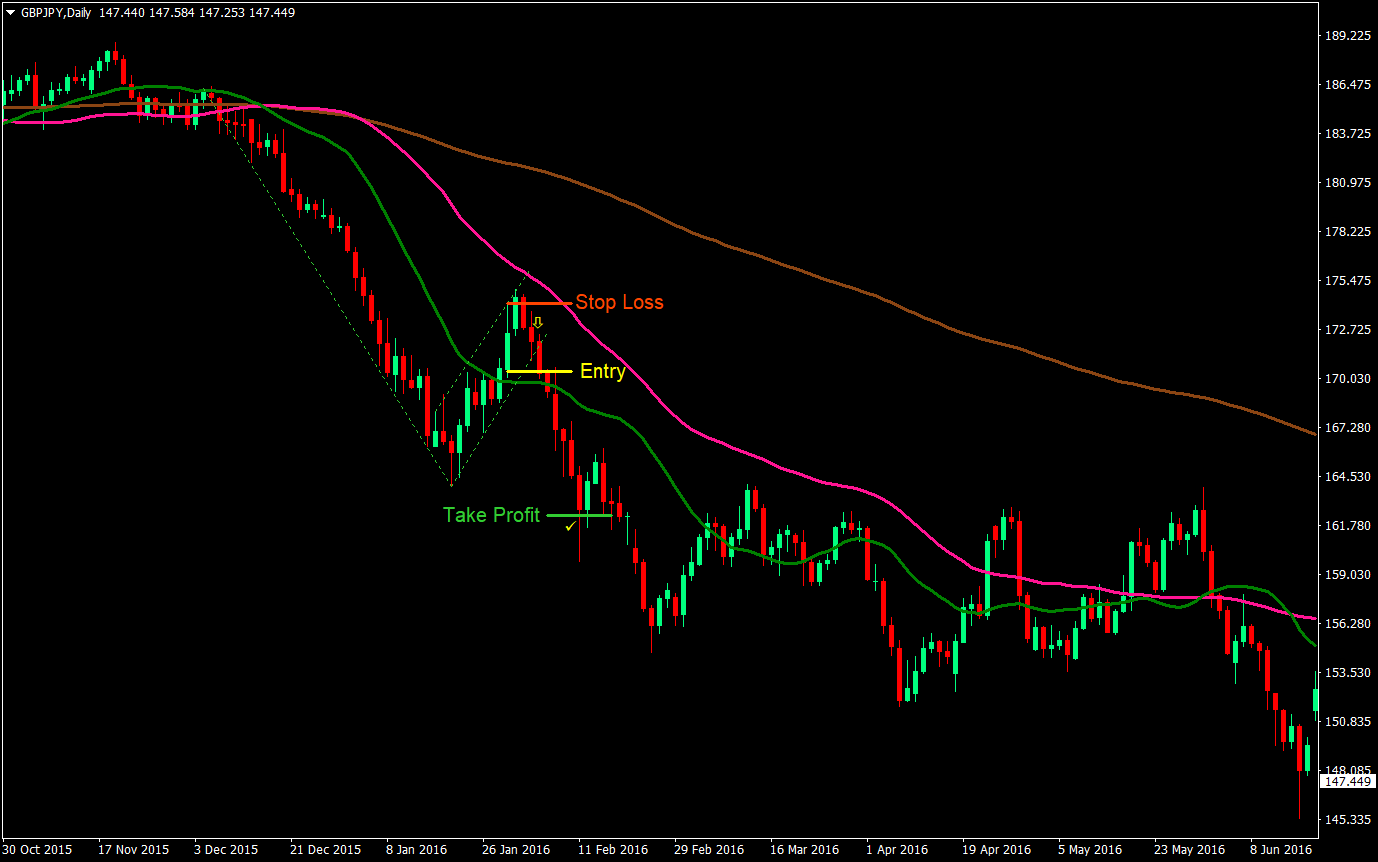

Sell (Short) Trade Setup Rules

Entry

- The two Volume_Weighted_MAs should be below the 200 EMA

- The 20-period Volume_Weighted_MA should be below the 50-period Volume_Weighted_MA

- Price should expand downwards forming the pole

- The 20-period Volume_Weighted_MA should tilt downwards

- Wait for price to retrace between the green and pink lines

- Identify a bearish flag or pennant

- Wait for a candle to breakout of the flag or pennant

- Enter a sell market order at the close of the breakout candle

- Set the stop loss inside the body of the flag or pennant pattern

- Set the take profit target at 2x the risk

Conclusion

VWAP retracement strategies are commonly used in stock trading. Some traders would trade in the same manner, waiting for price to retrace to a VWAP during a strongly trending market. Although the use of VWAP is not that common in forex trading, there is no one that stops us from doing so. This is just one of the ways to trade VWAP retracements. Couple it with the very reliable flag and pennant pattern and you get to have winning trade setups coming your way.