Arman77

New Member

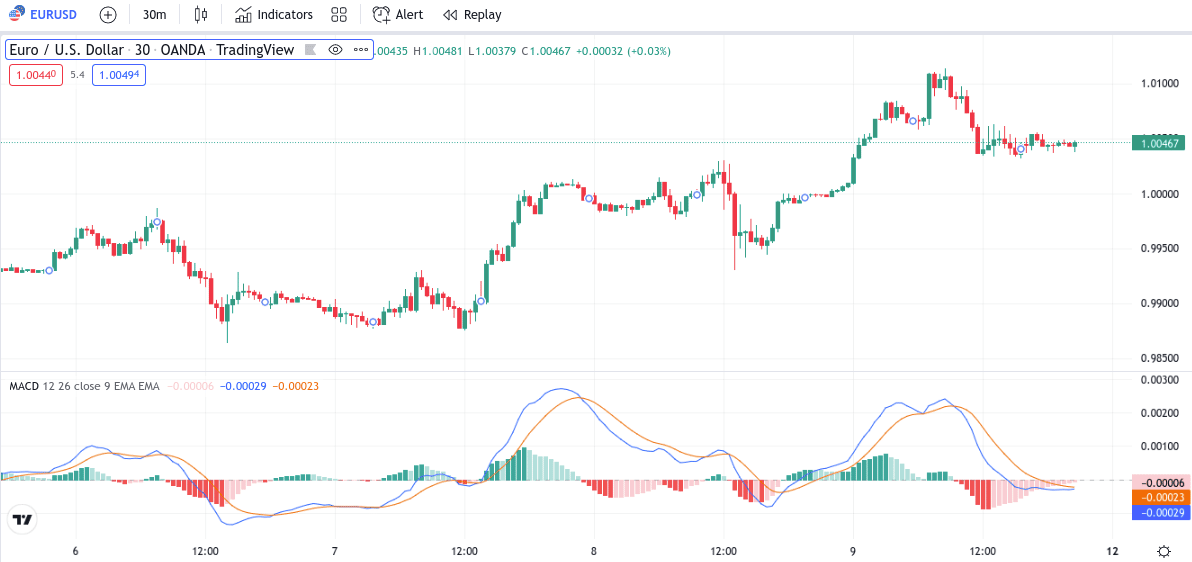

MACD – Pinpoint New and Ending Trends

The MACD is an indicator that follows trends. This falls into the category of a momentum indicator. A signal line consisting of a 9-day exponential moving average is added to the chart of the forex pair to validate momentum changes.A buy order is generally considered when the MACD line crosses above the signal level. On the other hand, when the MACD line crosses below the signal line this could indicate that selling pressure is in order. Some of the most commonly used moving averages for intraday traders are 12, 26, and 9.

In contrast, some of the commonly used moving averages for swing traders are thought to be 5, 13, and 1. Meanwhile, scalpers might opt for hourly or 4-hour charts. Of course, the period chosen is up to the individual and respective strategy.

Nonetheless, many traders utilize this strategy alongside the exponential moving average (EMA) to identify entry points. Put simply, traders use an EMA, along with the MACD, to determine market volatility and identify uptrends and downtrends. This is one of the best forex trading strategies for identifying bullish and bearish momentum.