US President Trump re-introduced yesterday (11th) that the Federal Reserve should lower interest rates even lower interest rates, and the United States should start refinancing debt, and interest costs can be significantly reduced while extending the maturity. He believes that doing so can alleviate the burden of government debt.

For a long time, Trump has been bombarding the interest rate policy of the Federal Reserve (Fed) chairman Powell, but this time the rate of interest rate cuts far exceeds the required percentage point and even thinks it can be reduced to negative interest rates. However, the interest rate policy is independent and will not be affected by outside speech.

Looking back at the end of July this year, the Federal Reserve (Fed) announced a one-digit (0.25%) rate cut, the interest rate target range is 2% to 2.25%, so the market is expected next week. The interest rate decision meeting is expected to drop more than 90% of the opportunity by more than 90%.

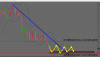

forex - Technical Analysis (Gold XAUUSD):

Today's foreign exchange - gold (September 12) early in the morning at 1497.1 US dollars/ounce, from the technical analysis, the 1-hour level observation trend fell deep after the stable bottoming, so there is a chance to finish the rebound after the market.

At present, the pressure range above the short-term line is located at 1504~1504.5 US dollars/ounce. In the downward direction, the initial support range is 1487~1487.5 US dollars/ounce. The operation mentality is mainly short. The investors who want to enter the market for a short time can consider the price of 1490.5 US dollars.

To the 1492.5 US dollars/ounce range of light warehouse buy, MT4 operation stop loss point can be considered to set below 1487.5 US dollars/ounce.

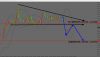

forex - Technical Analysis (EUR/USD EURUSD):

Today's foreign exchange - EUR / USD (September 12) Early in the vicinity of 1.00881, cut from the technical analysis, 1 hour level observation trend yesterday (11th) fell below the neckline after the plunge, deep rebound, so there is a chance After the end of the rebound, the policy of interest rate cuts fell again.

At present, the pressure range above the short-term line is located at 1.10250~1.10300, the downward direction, the initial support interval is 1.09700~1.09750, and the operational mentality is mainly short-term.

Investors who want to enter the short-term market may consider buying in the 1.10150 to 1.10180 range. The MT4 operation stop loss point can be considered to be set above 1.10250.

forex - Technical Analysis (Pound Sterling / USD GBPUSD):

Today's foreign exchange - GBP / USD (September 12) Early in the vicinity of 1.23260, cut from the technical analysis, 1-hour line-level observations must pay attention to the high head after the emergence of large head chips, so there is a chance to rebound after the decline.

At present, the pressure range above the short-term line is located at 1.23850~1.23900, the downward direction, the initial support range is 1.22850~1.22900, and the operational mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the 1.23250 to 1.23300 range.

The MT4 operation stop loss point can be considered to be set above 1.23401.

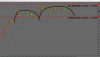

forex - Technical Analysis (NZD/USD NZDUSD):

Today's foreign exchange - New Zealand dollar / US dollar (September 12) Early in the vicinity of 0.64115, cut from the technical analysis, 1-hour line-level observation trend high point shock, pull back correction to make a breakthrough, so have the opportunity to break through the upper-pressure range.

At present, the pressure range above the short-term line is located at 0.64400~0.64450, the downward direction, the initial support interval is 0.64050~0.64100, and the operation mentality is mainly short. The investors who want to enter the market for a short time can consider buying in the 0.64340 to 0.64380 range. The MT4 operation stop loss point can be considered to be set below 0.64220.

Today's key data:

1.Germany August CPI monthly rate final value

2.France August CPI monthly rate

3.Eurozone July industrial output monthly rate

4.ECB's main refinancing rate from September to September 12

5.The number of people claiming unemployment benefits in the United States until the 7th of September (10,000 people)

6.US August quarterly adjusted CPI monthly rate

More information forex and MT4

For a long time, Trump has been bombarding the interest rate policy of the Federal Reserve (Fed) chairman Powell, but this time the rate of interest rate cuts far exceeds the required percentage point and even thinks it can be reduced to negative interest rates. However, the interest rate policy is independent and will not be affected by outside speech.

Looking back at the end of July this year, the Federal Reserve (Fed) announced a one-digit (0.25%) rate cut, the interest rate target range is 2% to 2.25%, so the market is expected next week. The interest rate decision meeting is expected to drop more than 90% of the opportunity by more than 90%.

forex - Technical Analysis (Gold XAUUSD):

Today's foreign exchange - gold (September 12) early in the morning at 1497.1 US dollars/ounce, from the technical analysis, the 1-hour level observation trend fell deep after the stable bottoming, so there is a chance to finish the rebound after the market.

At present, the pressure range above the short-term line is located at 1504~1504.5 US dollars/ounce. In the downward direction, the initial support range is 1487~1487.5 US dollars/ounce. The operation mentality is mainly short. The investors who want to enter the market for a short time can consider the price of 1490.5 US dollars.

To the 1492.5 US dollars/ounce range of light warehouse buy, MT4 operation stop loss point can be considered to set below 1487.5 US dollars/ounce.

forex - Technical Analysis (EUR/USD EURUSD):

Today's foreign exchange - EUR / USD (September 12) Early in the vicinity of 1.00881, cut from the technical analysis, 1 hour level observation trend yesterday (11th) fell below the neckline after the plunge, deep rebound, so there is a chance After the end of the rebound, the policy of interest rate cuts fell again.

At present, the pressure range above the short-term line is located at 1.10250~1.10300, the downward direction, the initial support interval is 1.09700~1.09750, and the operational mentality is mainly short-term.

Investors who want to enter the short-term market may consider buying in the 1.10150 to 1.10180 range. The MT4 operation stop loss point can be considered to be set above 1.10250.

forex - Technical Analysis (Pound Sterling / USD GBPUSD):

Today's foreign exchange - GBP / USD (September 12) Early in the vicinity of 1.23260, cut from the technical analysis, 1-hour line-level observations must pay attention to the high head after the emergence of large head chips, so there is a chance to rebound after the decline.

At present, the pressure range above the short-term line is located at 1.23850~1.23900, the downward direction, the initial support range is 1.22850~1.22900, and the operational mentality is mainly short-term. Investors who want to enter the short-term market may consider buying in the 1.23250 to 1.23300 range.

The MT4 operation stop loss point can be considered to be set above 1.23401.

forex - Technical Analysis (NZD/USD NZDUSD):

Today's foreign exchange - New Zealand dollar / US dollar (September 12) Early in the vicinity of 0.64115, cut from the technical analysis, 1-hour line-level observation trend high point shock, pull back correction to make a breakthrough, so have the opportunity to break through the upper-pressure range.

At present, the pressure range above the short-term line is located at 0.64400~0.64450, the downward direction, the initial support interval is 0.64050~0.64100, and the operation mentality is mainly short. The investors who want to enter the market for a short time can consider buying in the 0.64340 to 0.64380 range. The MT4 operation stop loss point can be considered to be set below 0.64220.

Today's key data:

1.Germany August CPI monthly rate final value

2.France August CPI monthly rate

3.Eurozone July industrial output monthly rate

4.ECB's main refinancing rate from September to September 12

5.The number of people claiming unemployment benefits in the United States until the 7th of September (10,000 people)

6.US August quarterly adjusted CPI monthly rate

More information forex and MT4

Last edited by a moderator: